Car Carrier Vessel Market Outlook for '25 is Bearish

Political winds blowing a raft of new tariffs and incoming supply uptick suggests a volatile 2025

Bearish sentiment crept into the car carrier market in June after the European Union (EU) announced increased import tariffs for Chinese-made electric vehicles (EVs) up to as much as 45.3%. The EU tariffs, which came into play in November for a period of five years and were increased following an investigation into Chinese state subsidies to domestic car manufacturers, are weighing on confidence and this has created significant headwinds for car carrier operators.

The stock price for leading owner-operator Wallenius Wilhelmsen took a hit in late October after Q3 re-sults were released, falling by just under 20% within two weeks before partially recovering, after equity analysts highlighted weaker global car sales forecasts going forward. While recent guidance from Wallenius Wilhelmsen points to another solid year in 2025 based on adjusted EBITDA growth of 7-12% YoY suggesting a softer landing.

Source: VesselsValue, a Veson Nautical Solution

Source: VesselsValue, a Veson Nautical Solution

The bears are beginning to roar, but we think there is enough demand for deep-sea roll-on/roll-off (RORO) transportation from China to suggest rates and asset values won’t crash in the short and medium term in this sector.

VesselsValue also has identified around 1 million ‘cars in containers’ out of China that are likely to switch back to RORO modalities in 2025/26, providing an unexpected boost for demand on car carriers. However, light vehicle freight rates have started to soften from China to Europe as China’s export volumes are projecting slower growth rates, and large newbuilds are being delivered in greater numbers.

These include the Hoegh Aurora a 9,100 car equivalent unit (CEU) pure car and truck carrier (PCTC) delivered in August to Norway’s Höegh Autoliners by China Merchant Heavy Industries as well as China COSCO Shipping Corporation’s (COSCO) armada of 30 PCTC that are due to be delivered by 2026.

While the economic headwinds do seem to be blowing harder than the tailwinds, we don’t expect charter rates to collapse back down to long term averages based on a stable demand outlook from Asia driven by China.

- China Needs Europe

China’s car market gulfs that of Japan and South Korea based on car sales of around 26 million per annum, meaning almost one in three cars sold globally are in China. Therefore, the potential for China to keep on exporting is huge.

However, we estimate that EV tariff hikes set by the EU that target China could remove around 10% of China to global demand which cannot be easily replaced elsewhere, equating to a c.2% cut for global demand. And if the EU is to achieve 55% lower CO2 emissions by 2030 and zero CO2 emissions by 2035, it must work with China and therefore a solution will be needed very soon. The same cannot be said for the US, where EV tariffs are already at 100%, and may even climb higher under the President Trump’s administration.

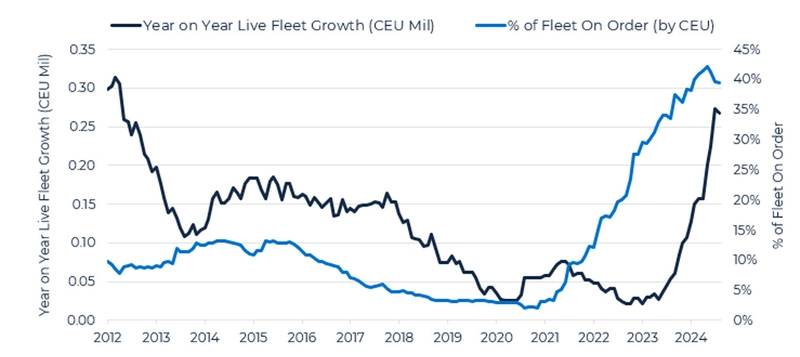

This all adds up to a volatile 2025 for the car carrier sector. A bulging 39% orderbook to live fleet ratio will inject a whopping 11% net supply uptick in 2025 which will have a deep impact.

Additionally, an earlier than expected resolution to the Red Sea crisis could see that figure rise by a further 6% to 17% based on shorter and more frequent transits returning to the Suez after an initial period of congestion. Although this scenario is unlikely, it would comfortably tilt the car carrier market into oversupply territory creating a perfect storm for rates and asset values, enticing the next major round of scrapping.