Offshore Service Vessels: What’s in Store in 2025

After what we would argue has been an incredibly eventful 2024 with massive deals, tremendous dayrate developments, further charterer backlog build, and the first series of newbuild orders in years, now comes the time when we turn our gaze towards 2025. What are some of the main trends we expect for next year, and how do we see the continuation of today's developments impact the year to come. Overall, we find continued strides for the better in the offshore support market although we foresee an industry that will not fire on all cylinders…

Car Carrier Vessel Market Outlook for '25 is Bearish

Political winds blowing a raft of new tariffs and incoming supply uptick suggests a volatile 2025 Bearish sentiment crept into the car carrier market in June after the European Union (EU) announced increased import tariffs for Chinese-made electric vehicles (EVs) up to as much as 45.3%. The EU tariffs, which came into play in November for a period of five years and were increased following an investigation into Chinese state subsidies to domestic car manufacturers, are weighing…

Betting on Dry Bulk: Newbuild Market Stands Strong in Q3

In its Q3 Dry Bulk report, Maritime Strategies International (MSI) estimates dry bulk newbuilding orders in the first eight months of the year above 25m dwt, with the potential for further upside on the back of late-reported deals. Despite a slight August lull, second-hand bulker values remain firm.MSI expects more than 30m dwt of dry bulk capacity to be delivered in 2024, with the orderbook forecast to rise still further by the end of the year, driven by strong contracting activity seen so far…

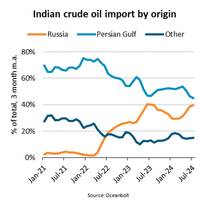

India Tightens Ties to Russian Oil

“During the past three months, India has relied on Russia for 40% of its seaborne crude oil import. Year-to-date, volumes have reached an average of 1.6 million barrels per day (mbpd), an increase of 1000% compared to 2021, before Russia invaded Ukraine,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The increased import of Russian oil has contributed to a higher average sailing distance for crude oil tankers discharging in India. Year-to-date, the average sailing distance has risen by 10%, resulting in an 8% increase in total tonne miles despite a 2% fall in volumes.

Floating Production – A Growing Segment in Transition

The specialized deepwater oil & gas and floating offshore wind segments will share many of the same stakeholders and supply chains, competing for increasingly scarce resources.To receive a full version of Inteletus analysis, click hereThe established floating production segment is forecast to experience continued growth through this decade, driving demand for, among other things, moorings, subsea systems, umbilicals, risers, flowlines and the large anchor handlers and subsea support vessels that will install and maintain the elements.At the same time…

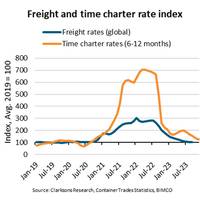

Market Watch: Container Freight Rates Fall, Costs Soar

"So far this year, container volumes have fallen nearly 2% year-on-year while average freight rates have declined, reaching 2019 levels in September. Since then, they have continued to fall. However, the cost to charter a ship remains 25% higher than in 2019,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Liner operators continue to struggle with a worsening supply/demand balance, affecting freight rates. On average, the fleet has year-to-date grown 5% and 19% compared with 2022 and 2019 respectively.

“Friendshoring” Impacts Container Shipping Trade Patterns

As geopolitical upheaval continues, Peter Sand, Chief Analyst, Xeneta, explores how global trade patterns have (and will) evolve.Geopolitical unrest could have dramatic and long-term impacts on global trade patterns for all goods and commodities, as political alliances are essentially being ripped up and rewritten. Spurred by Russia’s invasion of Ukraine in 2022, changing trade patterns are emerging in the container shipping sector, said Xeneta’s Peter Sand, as the term of the day is “friendshoring”…

Video: Container Carrier Capacity Adjustment - Too Little, Too Late?

While drama in the container shipping sector has calmed a bit, container carriers still wrestle with unexpected drops in demand. Peter Sand, Xeneta, discusses vessel capacity moves and their likely impact on rates, as well as the first containership sent to the ship scrap yard in more than 18 months.Q: Peter, the last time that we spoke, you were succinct in saying that this market is a mess, with spot rates plunging in what traditionally is the busiest shipping season in the US. Has that picture changed in the last few weeks?Peter Sand, XenetaHas it changed from being a mess? Not really.

Xeneta says Long-term Container Shipping Rates to Rise Again

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June. Following on the heels of a record 30.1% hike in May, this now means rates stand 169.8% higher than this time last year, with just two months of declines in the last 18 months. Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up, with some corridors showing significant gains.Xeneta has released the figures…

U.S. Natgas up 2% on Higher Demand, Soaring Global Prices

U.S. natural gas futures edged up about 2% on Tuesday on record power demand in Texas, forecasts for more gas demand over the next two weeks than previously expected, a reduction in gas output, low wind power and much higher global gas prices.Power demand in Texas failed to hit a new all-time high on Monday due to less hot weather, but will likely break peak use records on Tuesday and later this week as homes and businesses keep air conditioners cranked up to escape a lingering heatwave.

Containershipping's Long-term Reefer Rates Soar to All-time Highs, says Xeneta

According to the latest crowd-sourced data from Xeneta, long-term rates for reefer containers on the key US West Coast to Far East route soared almost 60% in April.In its report Xeneta notes a surge in rates of around $2000 per 40-ft. unit after the latest 12-month contracts came to a close. The average contracted rate recorded on 15 May stood at $5850 per container, while the average for new agreements running from Q2 2022 to the end of Q1 2023 was even higher, at $5945 per 40-ft. reefer.“This is an almighty increase, pushing prices to an all-time high” said Patrik Berglund, Xeneta CEO.

What to Expect from the US Offshore Wind Market This Year

After many false starts, the U.S. offshore wind market is building strong roots for a solid future. But as the market develops from its current northeast and mid-Atlantic niche new opportunities and challenges arise.The U.S. offshore wind market has long been seen as not delivering on its significant potential. With an offshore wind technical potential of more than double that of the country’s total annual electricity sales, the U.S. has long been seen as having the potential to be a major player in the global offshore wind market.

Tanker Markets Stay Bearish through '22, says McQuilling Report

Spot market earnings for VLCCs will average $2,500/day in 2022 on a non-eco, no scrubber basis (US $11,000/day for ECO-designs, without scrubbers), while the peak year for VLCC spot market earnings have been pushed out to 2025, amid substantial supply-side support. This was a key finding in McQuilling Services 25th Annual Tanker Market Outlook: 2022-2026 Tanker Market Outlook. While conditions are tight for the big ships, Suezmaxes and Aframaxes sectors are projected to return healthier levels in 2022…

2021 in Review: The Dry Bulk and Tanker Markets

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE.Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC…

Oil Slides 4% on China Virus Curbs, Climate Warning

Oil prices fell by 4% on Monday, extending last week's steep losses on the back of a rising U.S. dollar and concerns that new coronavirus-related restrictions in Asia, especially China, could slow a global recovery in fuel demand.A United Nations panel's dire warning on climate change also added to the gloomy mood after fires in Greece have razed homes and forests and parts of Europe suffered deadly floods last month.Brent crude futures fell by $2.82, or 4.2%, to $67.88 a barrel by 0930 GMT after a 6% slump last week for their biggest weekly loss in four months.U.S.

Iron Ore Futures Fall as Chinese Demand Softens

Chinese iron ore futures fell below a key 1,000 yuan per tonne level on Thursday, falling more than 5% to their lowest in more than two months as domestic consumption remains sluggish on steel production controls.The most active iron ore futures on the Dalian Commodity Exchange, for September delivery, plunged as much as 5.6% to 999 yuan ($154.54) per tonne, their lowest since May 27. They were down 4.6% to 1,009 yuan a tonne as of 0322 GMT."Domestic consumption (for iron ore) is weakening significantly...

MARKETS: Cruise Woes Continue, Full Recovery Unlikely before 2023 says MSI

MSI analysis finds ‘big three’ cruise companies could have less than 50% of capacity back in service by year end but a recovery to pre-pandemic levels is unlikely before 2023A new report from MSI says that a restart to full operations can’t come soon enough for cruise lines, whose financial position has become increasingly precarious given high debt levels incurred from fleet expansions and the fundraising required to survive the COVID crisis.The latest cruise market report from Maritime Strategies International (MSI) finds that net revenue losses for the ‘big three’ lines (Carnival…

Shipbuilding Numbers Stay Suppressed; Containerships Remain a Bright Spot

The world fleet is projected to grow by 6.4% over the coming five years, down from 7.4% in previous five years, says shipping organization BIMCO.Global shipyards are under pressure and 2021 is turning out to bring the third lowest level of newbuilding orders in 12 years, despite new orders for containerships currently at a 14-year high.Also under pressure are seafarers who, during the pandemic, have in many cases faced the challenges of being stuck on board ships for many months after their contracts ended, despite their crucial role in helping world trade flow uninterrupted.

If EURO2020 was Decided by Shipping-related Factors, Who Would Win?

The European Football Championship is on the verge –and kicking off on Friday June 11. Therefore, BIMCO’s shipping number of the week had to be football-infused today. Adding extra topping to this sporting feast is the fact that the 2021 Copa America starts at the same time.If the result was decided by COVID-19, anything can happenSeveral national football teams have already seen the supply of their top footballers disrupted by the pandemic, much like what has hit many shippers ordering containerised goods produced in the Far East for shipments to any destination…

Tanker Shipping Facing a Tough Year Ahead, Says BIMCO

After a turbulent year, low demand looks set to plague the market in the coming months combined with too many ships fighting for too few cargoes in both the crude oil and oil product segments, says the oil tanker shipping overview and outlook released today by BIMCO.Demand drivers and freight ratesThe realities of the pandemic are setting in for the tanker market. The record-breaking Q2 2020 is a distant memory and, instead, the market faces a slow recovery with low demand, stock…

Container Shipping Looks Strong in 2021 - BIMCO

In the full year of 2020, global container shipping volumes fell by 1.2% compared with 2019, much less than feared even before the pandemic was first declared, and much recovered compared with the 6.8% drop recorded in the first six months of the year. Volumes in the second half of the year were up 4.2% from 2019. Much of this growth was concentrated on just a few trade lanes, with congestion and imbalances on these spilling out and causing disruption on other trades.BIMCO expects that 2021 will be even better for container shipping than 2020…

BIMCO: Tanker Market Hangover Continues

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions.

BIMCO: Agriculture Exports Make "Stunning Comeback"

BIMCO notes stunning comeback to Q2 agricultural exports nearly triple freight ratesAs agricultural dry bulk commodities exports took a dive in the first quarter of this year and painted a gloomy picture for Panamax and Handymax freight rates, a stunning second quarter comeback have nearly tripled freight rates.While total agricultural export volumes are now solidly up in the first half of the year, they are not mind-blowingly high, and export volumes in the first quarter of 2020 certainly offered little help.