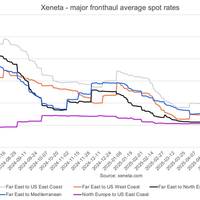

Xeneta Ocean Container Shipping Market Update

Market average spot rates – July 8, 2025:Far East to US West Coast: USD 2673 per FEU (40ft container)Far East to US East Coast: USD 5151 per FEUFar East to North Europe: USD 3393 per FEUFar East to Mediterranean: USD 4197 per FEUNorth Europe to US East Coast: USD 1992 per FEUMarket average on the Transpacific trade from Far East to US West Coast accelerated its decline in the early days of July, down 18% from end-June and falling below the level seen in second half of May. With carriers now deploying more capacity above the level required to meet shippers’ demand…

Car Carrier Vessel Market Outlook for '25 is Bearish

Political winds blowing a raft of new tariffs and incoming supply uptick suggests a volatile 2025 Bearish sentiment crept into the car carrier market in June after the European Union (EU) announced increased import tariffs for Chinese-made electric vehicles (EVs) up to as much as 45.3%. The EU tariffs, which came into play in November for a period of five years and were increased following an investigation into Chinese state subsidies to domestic car manufacturers, are weighing…

Demand Grows for OSVs in the Offshore Floating Production and Storage Energy Sector

Over the last year we have seen an upswing in floating production and storage systems ordering after many years of low activity. According to our colleagues at World Energy Reports, “The global oil and natural gas markets are contending with rebounding energy demand on top of supply disruptions from Russia’s invasion of Ukraine. As a result, activity and business sentiment in the floating production sector has seldom been stronger.” This increased activity in the floating production…

Tanker Markets Stay Bearish through '22, says McQuilling Report

Spot market earnings for VLCCs will average $2,500/day in 2022 on a non-eco, no scrubber basis (US $11,000/day for ECO-designs, without scrubbers), while the peak year for VLCC spot market earnings have been pushed out to 2025, amid substantial supply-side support. This was a key finding in McQuilling Services 25th Annual Tanker Market Outlook: 2022-2026 Tanker Market Outlook. While conditions are tight for the big ships, Suezmaxes and Aframaxes sectors are projected to return healthier levels in 2022…

2021 in Review: The Dry Bulk and Tanker Markets

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE.Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC…

MARKETS: Cruise Woes Continue, Full Recovery Unlikely before 2023 says MSI

MSI analysis finds ‘big three’ cruise companies could have less than 50% of capacity back in service by year end but a recovery to pre-pandemic levels is unlikely before 2023A new report from MSI says that a restart to full operations can’t come soon enough for cruise lines, whose financial position has become increasingly precarious given high debt levels incurred from fleet expansions and the fundraising required to survive the COVID crisis.The latest cruise market report from Maritime Strategies International (MSI) finds that net revenue losses for the ‘big three’ lines (Carnival…

If EURO2020 was Decided by Shipping-related Factors, Who Would Win?

The European Football Championship is on the verge –and kicking off on Friday June 11. Therefore, BIMCO’s shipping number of the week had to be football-infused today. Adding extra topping to this sporting feast is the fact that the 2021 Copa America starts at the same time.If the result was decided by COVID-19, anything can happenSeveral national football teams have already seen the supply of their top footballers disrupted by the pandemic, much like what has hit many shippers ordering containerised goods produced in the Far East for shipments to any destination…

BIMCO: Tanker Market Hangover Continues

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions.

Market Report: Global Heavy Lift Vessel Sector

The global heavy lift vessel market is a difficult place to be. Utilization for the fleet has remained depressingly low since the first oil and gas downturn in 2014, currently hovering around 33% for the global fleet with a lift capacity of over 800 tonnes, according to IHS Markit’s ConstructionVesselBase. Fixed platform installation work, the traditional market driver for the heavy-lift fleet in oil and gas, has seen demand fall significantly. According to global figures from IHS Markit’s FieldsBase, 190 fixed platforms were installed in both 2013 and 2014, rising to 219 in 2015.

Market Insights: Cruise Shipping ... Now What?

Heading into 2020 the cruise industry was booming. The number of passengers who went on cruises in 2019 was at an all time high, a trend mirrored by the exponential fleet growth since the 1950s. However, COVID-19 caused an industry wide shut down. Since the start of the year, ordering activity has fallen nearly 50%. This is a dramatic decrease and is unprecedented in the cruise industry, especially when compared to last year which during the same period, activity never dropped more than 10%.

COVID-19 Slams Vehicle Carrier Market

COVID-19 has hit the vehicle carrier market hard. The world vehicle demand has dropped by c.35%. Consequently, shipping these vehicles has fallen considerably.The only order to take place earlier this year is one from NYK line for a large LCTC for $95 million.No deals have taken place since the beginning of the year, this is a figure we have not seen historically. A break of five months on the S&P side of things in the Vehicle carrier market. One of the main reasons for this low period and a fall in the values is the drop in rates for the 6…

Market in Focus: Gas Ships

Liquefied natural gas (LNG) shipping hasn’t been able to avoid the negative impact of COVID-19 as gas demand fell during the first quarter of 2020.The residential sector recorded the largest drop in consumption this year compared to 2019 which wasn’t helped by the mild winter seen in the US. The shut-downs of major economies and more specifically shut-ins of cargoes due to the historically low gas prices means we have basically witnessed demand destruction.LNG rates have fallen since the beginning of the year with the one-year time charter dropping by 80%.

Market in Focus: Containershipping

The only orders to be placed since the beginning of the year are from OOCL and Great Horse China for a combination of 7 ULCV’s ranging in size. This is a drop of 86% compared to this time last year and can only be due to the Covid-19 outbreak.As the global lockdown intensified through March, rates and values across all sizes fell. We have seen the larger 8,500 TEU tonnage earnings fall by c.40% since the start of the year which has bought values down a considerable amount. Container traffic out of the East picked up from the end of March as the situation in Asia…

Bulk Carriers Orders Down 30%

The number of Bulker orders were down 30% for 2020 YTD compared to the same period last year. From the 1st of January 2020 when the Chinese market and shipyards closed due to the pandemic, until today, we have only seen USD 1,037 mil spend in the Bulker NB market, down 35% for the same period in 2019. The Chinese government have now started up the economy again and most of the orders placed are by companies like China Development bank and Bank of Communications all being built…

Market Report: Tankers

Total number of Tanker orders are down by 26% for 2020 YTD compared to the same period in 2019. By comparing to 2018 YTD, this year there have been half the number of orders placed. This comes as no surprise as Europe and the US entered the lockdown phase of the pandemic earlier this year, only a month or so after the Chinese industry shut down. However, towards the end of May 2020 orders were placed for both VLCC’s and Suezmaxes by the Greeks, Norwegians and Angolans accounting for USD c.780 mil.The S&P market has also taken a hit so far this year with sales down 25% compared to 2019 YTD.