Floating Production – A Growing Segment in Transition

The specialized deepwater oil & gas and floating offshore wind segments will share many of the same stakeholders and supply chains, competing for increasingly scarce resources.

To receive a full version of Inteletus analysis, click here

The established floating production segment is forecast to experience continued growth through this decade, driving demand for, among other things, moorings, subsea systems, umbilicals, risers, flowlines and the large anchor handlers and subsea support vessels that will install and maintain the elements.

At the same time, the floating wind segment will move from demonstration and pilot scale projects to pre-commercial and commercial scale arrays and will consume large amounts of mooring components and dynamic electrical cables as well as the large anchor handler and subsea support vessel capacity that will install and maintain the elements.

Much of the new floating wind supply chain will leverage the existing floating oil & gas supply chains. Players experienced in deepwater oil & gas operations, whether developers, EPCI contractors or component and service suppliers, will find a growing opportunity to leverage their skills in the emerging floating wind segment.

These are the findings of a new whitepaper produced by Intelatus Global partners entitled “Floating Production and Floating Wind – increasingly close segments”.

A Growing Floating Production Segment

According to the latest Intelatus deepwater floating production forecast, floating production activity in the oil & gas sector is set to grow at an average 25 floaters per year through 2030, and the foundations are in place for continued activity through the next decade.

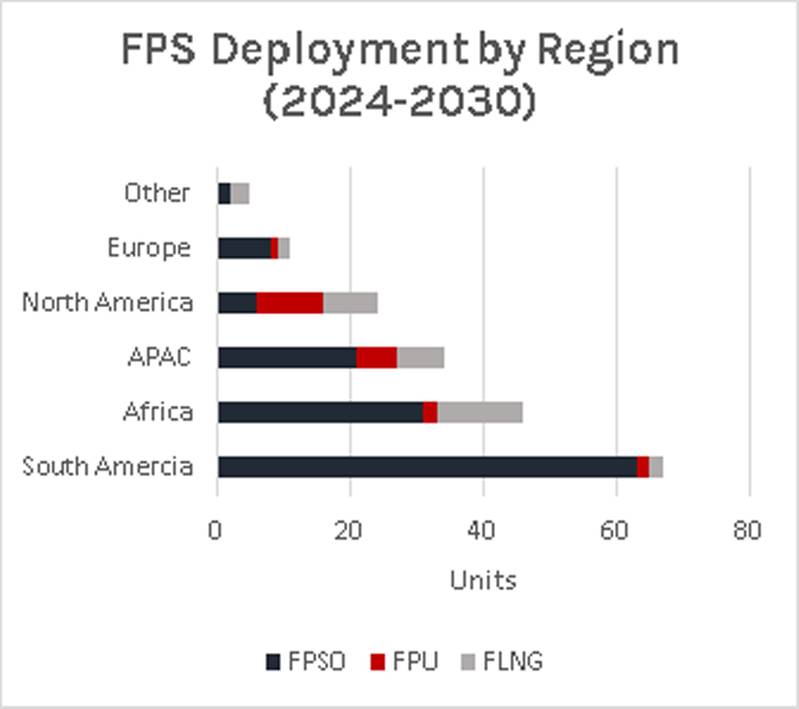

There will be over 260 floating production systems installed globally by the end of 2023. Over 185 new floaters will be installed by the end of 2030, of which 70% will be FPSOs, close to 20% FLNGs and floating production units without storage (semi-subs, TLPs and spars) over 10%. Source: Intelatus

Source: Intelatus

We forecast that more than two thirds of new floating production units installed between 2024 and 2030 will be located in South and Central American countries, of which Brazil and Guyana will account for around 90% of the share of units. FPSO technology dominates the region’s FPS demand.

In all, 18 countries in West and East Africa are expected to receive new FPSOs, FLNGs and FPUs between 2024 and 2030. Africa is forecast to be home to the largest number of FLNGs in our forecast, accounting for over 35% of global installations.

The third most active floating production region from 2024-2030 is forecast to be Asia Pacific. Over 60% of the activity in the region is anticipated to come from FPSOs, with FLNGs and FPUs each accounting for around 20% of the units.

Over 80% of the activity forecast for North America will be located in the U.S and Mexican Gulf of Mexico. The region will be home to the largest number of FPUs, accounting for close to half of our global forecast.

A Segment in Transition

We are noting a transition in the business models of many floating production system owners. Changes include deploying the latest technologies to decarbonize floating production operations and transition floating production activity into a wider floating energy business that leverages the skills and lessons learnt from deepwater oil & gas projects into the emerging floating wind segment, with measures including:

- The use gas and reduction in routine flaring, whether through liquefaction or pipeline export.

- The increased deployment of carbon capture technologies coupled with the reinjection of carbon dioxide into wells (e.g. Petrobras plans to inject CO2 into pre-salt storage).

- The wider scale adoption of combined cycle power generation and topside electrification by several leading FPSO owners. Sources of power investigated by some developers for floating production systems include renewable energy, such as offshore wind.

- Leveraging Industry 4.0 technologies to improve production unit operations and maintenance performance, including IoT connectivity, digital twins and autonomous operations.

- An emerging floating production segment – the production and storage of low and zero emission energy carriers, such as methanol and ammonia. One exciting development leverages Generation IV small modular nuclear reactors to provide the power and heat required to desalinate seawater, power electrolyzers and other production, storage and offloading systems. Concepts are being developed in South Korea and Europe.

- Finally, we are seeing a trend of certain key players in the floating production segment to leverage their expertise for executing challenging and large projects in deep water into the floating wind space, including Petrobras, Shell, TotalEnergies, Equinor, CNOOC, SBM Offshore, MODEC and BW Offshore.

Competing for the Same Supply Chains

The growth in activity in both the floating production and the floating wind segments will drive increased demand for engineering services, shipyard and port capacity, mooring system supply, dynamic subsea cables and specialist installation vessels. We are forecasting some potential supply chain bottlenecks as a result of the increased activity.

To show how floating production and floating wind projects will compete for similar resources, we will use a high-level simple example comparing a “typical” FPSO with a “typical” floating wind project deploying conventional moorings. As the traditional oil and gas floating production segment grows, the floating wind segment will move from demonstration and pilot scale projects to pre-commercial and commercial scale arrays and will consume large amounts of mooring components and dynamic electrical cables as well as the large anchor handler and subsea support vessel capacity that will install and maintain the elements.

As the traditional oil and gas floating production segment grows, the floating wind segment will move from demonstration and pilot scale projects to pre-commercial and commercial scale arrays and will consume large amounts of mooring components and dynamic electrical cables as well as the large anchor handler and subsea support vessel capacity that will install and maintain the elements.

Image courtesy Gazelle Wind PowerIf we apply this simple “rule of thumb” approach to our floating production and floating wind mooring pre-lay forecast through 2030, floating wind accounts for around 30% of the total mooring line quantity required and nearly 50% of the anchor volume. This will be a challenge for the existing higher spec vessel supply side to accommodate, given its current high utilization. The Intelatus Floating Wind Installation Vessel Forecast analyses the commercial and technical potential vessel capacity and capability gaps in detail as well as why the commercial conditions don’t yet really exist for sustained new building activity.

Floating wind is a new technology where engineers continue to search for innovative ways to deliver commercial scale projects. However, at least in the short- to mid-term, developers will need to rely on existing technologies and supply chain capabilities to deliver commercial scale wind farms, technologies that have been developed over years in the deepwater floating production segment.

Players experienced in deepwater oil & gas operations, whether developers, EPCI contractors or component and service suppliers, will find a growing opportunity to leverage their skills in the emerging floating wind segment.

However, the stakeholders in both segments should be aware of a forecast shortage and therefore increased competition for supply chain resources.

To receive a full version of Inteletus analysis, click here