ZF Geared up for a Commerical Maritime Push

A walk through the ZF Friedrichshafen AG marine propulsion system manufacturing plant in southern Germany does nothing but confirm the commonly held perceptions of German engineering prowess: the facility is clean to a fault; the equipment is modern and well-maintained; the employees are orderly and efficient. While the ZF marine propulsion systems business – which generated a turnover of $336 million in 2013 – is but a sliver of the company’s overall 2013 sales of $22.4 billion, make no mistake that this unit is of keen interest for the company as it continues to increase its penetration in the global commercial marine sector. On the eve of the company’s 100th anniversary celebration in 2015, Andre Körner, Head of Production Commercial & Fast Craft, ZF Friedrichshafen AG, shared insights on the path ahead.

As the head of ZF marine propulsion commercial and fast craft business, he overseas both the “bread-and-butter” business – ZF’s dominance of the global yacht market, an approximate three-quarters market share which commands about one-third of the company’s transmission production; as well as the high growth ends of the business in the commercial workboat sector, including the production of heavy duty workboat transmissions in Padua, Italy, and the production of Z-Drives in Krimpen, The Netherlands, the latter a feature focus in the August 2014 edition of Maritime Reporter & Engineering News which chronicled the company’s strong push in the North American towboat sector.

Körner joined ZF just more than a year ago, and a part of the draw was the fact that it is a large, private company, which he said delivers a certain degree of freedom in mid- and long-term product line planning that a similarly sized public company, driven by shareholder demands, may not be able to stomach.

“We are living in an environment where we have more mid- and long-term vision on the business than on shareholder value driven companies because they have to show performance year after year,” Körner said. “Don’t get me wrong: we are not living in some kind of a paradise where nobody is questioning us on performance and operating result. But I believe we (as a privately held company) have more medium and long-term vision which, especially in the marine environment, is key to long-term success.”

Digging into the Workboat Sector

Generally stated, the current marine market perception is that ZF is well known for fast craft and yacht transmissions. Körner said that ZF today has only a small share in the workboat transmission sector, meaning that it has plenty of room to grow. It recently introduced the “Tough Gear” brand name, which is simply the surface manifestation of its drive to further penetrate the global workboat markets. But the Tough Gear name is much more than skin deep. ZF’s drive into the workboat sector is backed by finance, focus, leadership will and engineering firepower to drive this growth.

The latest member of the Tough Gear brand was unveiled at SMM when ZF introduced the new workboat transmission family – ZF W 10000. The new family is designed specifically for the commercial craft segment. “We spent a lot of time talking to the market, but more importantly, listening to the market,” said Körner. “And the W10000 is the direct result of market feedback.”

The W10000 is rated to 2,610 kW (3,500 hp) at 2,100 rpm, and its compact design increases power density compared to the current offerings. The W10000 represents a transmission family of a new generation based on a standardized platform for component sharing, which aims to reduce the complexity while increasing service parts availability across product families.

The new transmission is available at launch with ratios from 2.0:1 up to 7.9:1. “Our customers are requesting deeper ratios and the W10000 delivers,” Körner said.

The transmission can be ordered in reversing, non-reversing and hybrid-ready (PTI) versions. W10000 transmissions also incorporate an integrated shaft brake, a 1,000kW (1,340hp) Top PTO, and has many accessories including ZF Autotroll available for various applications and vessels with dynamic positioning requirements.

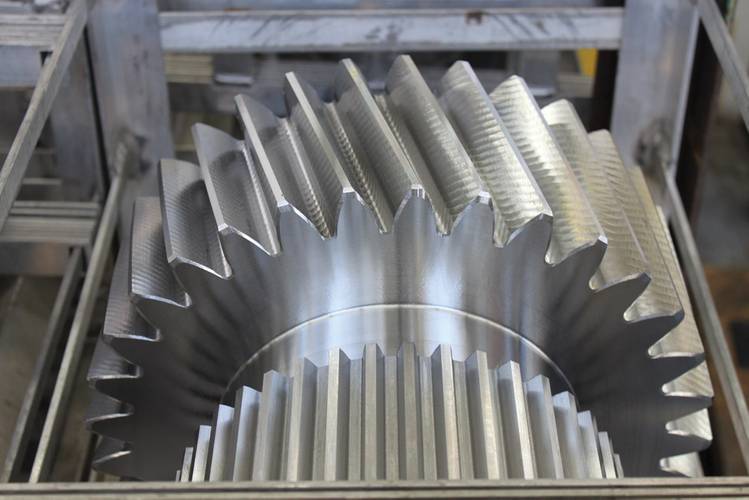

“We know how to build gears, and these (Tough Gears) are really on the highest standard in terms of material, production processes and design. Today we have a wide, modern portfolio in this (workboat) area,” said Körner. “This should be a signal into the market: We are here; we have this portfolio, and it’s a good product. In fact it is a really good product.”

Industry Insights

While ZF leans heavily on its pedigree and manufacturing process, it does not create its products and systems and a vacuum, rather it relies on close ties with both the end user, the boat builders and the engine manufacturers to help it analyze future market trends.

“We conducted intensive market studies as we looked to define our future strategy,” said Martin Meissner, Marketing and Communications Manager for North America, Industrial Technology division, ZF Group. “We ask questions: ‘Where’s the market going … but more specifically, where is the market going with relation to power? And how do we make sure that the products that we have meet those future needs? So, if we’re talking about engine manufacturers for example, it is crucial to know where they are going with their next versions of product, so that we can make sure that the transmissions that we build are application-ready for them.”

To its very core, the engineering process is an ever-evolving entity, and in ZF Marine’s world this means balancing the benefits of delivering a “gear family” with its standardized manufacturing and common parts, while incorporating individual customer wants and needs.

“We have a lot of discussions with potential customers on a deep technical base,” Körner said. “And those discussion lead to custom requests, such as the placement of the cooler, the addition of a sensor, and so on. We really discuss with people what they want, and what we can do to make their lives easier. But at the same time without spoiling our family concept and our modularity.”

“And we can really play on our global service network,” said Meissner. “This is one of our true strengths; when we are in a market, we are there to support you. So as we roll out our new products and really push the new Tough Gear brand, we will emphasize that ‘we are where you are.”

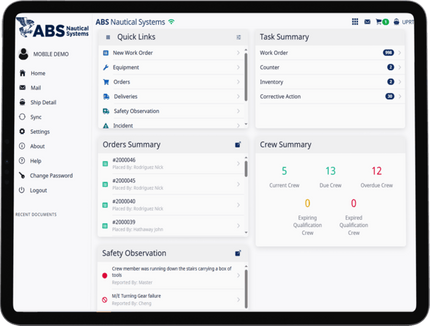

Run until Fail vs. Preventative Maintenance

Key to the success of the gear product of course extends far beyond the manufacturing floor, and Körner stressed the importance of service after sales as an important plank in the platform to increase market share in the world’s demand workboat and government markets. Common parts across different types of transmissions is a good example, as it not only makes the production process more reliable and efficient, it also makes the ability to stock and deliver parts globally, when and where needed, more efficient.

“Up-time (in the commercial market) is most important, because it is money,” said Körner. “It is money every time, every hour, every day the boat is out of operation. And the economic pressure on owners has grown over the years. So there’s pressure for us too, because if you have problem with the transmission and you can’t run your boat, we have to serve these customers as fast as possible to provide spares, to provide technicians and to get this boat back into service.”

In tandem with an increased focus on maintenance is an increased focus on individual parts of the system such as the transmission. “Maybe 10 or 20 ago, when and owner of a vessel thought maintenance, they were mainly thinking of the engines,” Körner said. “But I believe most companies today realize that it’s not only engines. You have to look at all of the systems, including the transmissions, to keep your boat running and to keep it operational.”

According to Körner the change in attitudes on maintenance is palpable, and the days of running until failure is becoming the exception rather than the rule. Managed maintenance is the trend, particularly with the big operators, as they seek the path of regular investment in the name of operational continuity.

“So today they are really looking and saying, ‘Okay, the recommendation of the manufacturer is to change the bearing after 40,000 hours; so they change the bearing, even if it still looks OK, because they want to be sure that they have the next 40,000 hours operation without problems.”

Meissner contends that preventative maintenance versus ‘run until fail’ is an effective means to positively impact the bottom line. “When you have a failure, that boat could be 700 miles from your facility; Now it’s broken 700 miles away,” Meissner said.

“But if you schedule your preventative maintenance overhaul, you can bring the boat in during a down time in your business, do the maintenance at your facility where all of the parts, or maybe a swing gear is on-hand, and this helps to make it a more manageable and cost efficient operation” rather than waiting for an emergency repair.

Government Markets

In addition to the yacht, pleasure boat and workboat business, ZF has a large and vibrant government and navy business, with several cornerstone contracts including the U.S. Coast Guard’s FRC project, and the U.S. Navy’s JHSV project. Government and Navy work require a different level of solution, as Körner explains. “(On the government of the business) you have to of course meet the requirements from the navies and from the boat builders, specifically the military specifications in regards to shock and vibration, for example. But besides the product itself, you provide services such as manuals, spare parts list in a special forms, electronic repair instructions, and these kind of things. The service around the transmission itself is more demanding than you have today in a commercial business. So this is an ongoing investment, and one that we are happy to make.”

And today coast guard and navy business is booming, and not just in the U.S. In the Far East it is booming as tensions in the China Sea area have resulted in a huge number of boats being built for and in the region. Asia Pacific, India and the Middle East markets are all running strong. Demands to this market niche are similar to the yacht business in the demand for light, strong, quiet and reliable transmissions. Demand for service, training and spares has never been higher. The U.S. Coast Guard FRC boats are a great example, as the Coast Guard said “We don’t just want supply of a product, we want support from ZF with our crews that are being brought on each boat as part of the commissioning process,” said Körner. “So the crews come to the ZF facility in Miramar, FL for a weeklong training course on basics of transmission technology, theory and first level diagnostics.”

Lessons from Automotive Applied to Marine

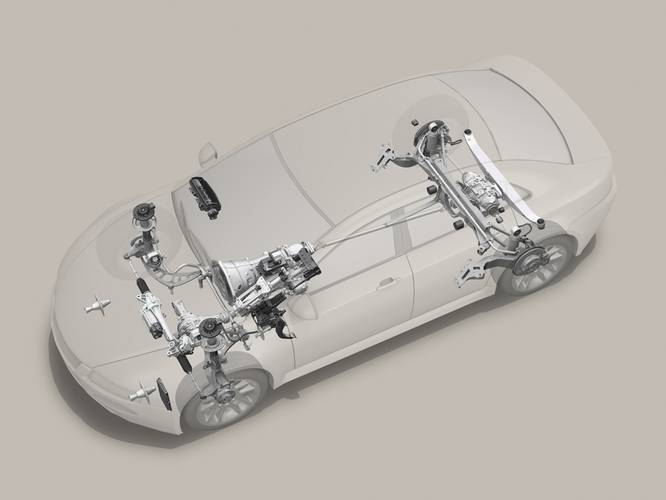

ZF Group’s expanse of operation includes a majority stake in automotive transmissions and driveline systems, which offer some cutting edge technologies that could someday, in some way, prove compelling in the marine market. For example, ZF now offers GPS based transmission technology. Martin Meissner, Marketing and Communications Manager for North America, Industrial Technology division, ZF Group, explains. “The car knows where it is in the world, what road it’s on, the gradient of the road and upcoming curves, for example. We offer products where if you are on a windy, hilly road with an automatic transmission from ZF, and you’re coming up to a corner for example, the transmission’s not going to change gears because it knows that you’re going to be off the gas through the corner, and then back on the gas. It is going to wait to shift until you’re through the corner. Or when you are coming up to a hill, it’s will drop a gear down in anticipation that you are going to be climbing the hill. So now you’ve got other divisions of ZF advancing that technology in the automotive, heavy truck and bus sector, and the door is open for technology share. So when we see examp=les of next generation technology solutions, we can go to these other divisions and say, ‘Show us this technology, because we think we have an opportunity to adapt it to the marine market.’”

And as conservative as the marine market has traditionally been, it is not averse to technology change if improved efficiency, reduced downtime and lower operating costs can be proven.

American Commercial Lines (ACL) has proven this, as it is becoming a leader on the inland waterways incorporating Z-Drives, starting earlier this year when it took delivery of The American Way in February 2014. “Two boats have been received (American Way and American Spirit), two are under construction and four are on order,” said an ACL company spokesperson. “All eight boats are 2,000 HP with ZF 5000 units.”

In making the decision to add Z-Drive boats to the ACL fleet, the company cited improved performance, reduced operating costs, replacement of older boats and the addition of boats for business growth as the primary factors. At the same time, the company weighed the drawbacks, which it says includes the initial cost for spare parts, limited service coverage due to the technology being new, and additional training needs. While the jury is still out on the long-term cost benefits of the Z-Drive boats, early results are promising. “Analysis shows a ~20% improvement in fuel burn or performance when ran hard,” said an ACL company spokesperson. “It remains unclear whether Z-drive boats are more cost efficient than conventional drive boats with regard to maintaining the Z drive unit vs. shafts, gearbox, wheels and rudders. Time will tell.”

(As published in the November 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)