Baltic Index Propelled Again by Capesize, Panamax Demand

The Baltic Exchange's main sea freight index rose on Wednesday, driven by demand for capesize and panamax vessels.

The Baltic index, which tracks rates for ships ferrying dry bulk commodities, rose 2.6%, or 53 points, to 2,064, its highest since January 2014. The index has surged about 60% this year. The index extended gains for a seventh straight session, mainly driven by strong demand for vessels that ship iron ore from Brazil.

A restart of Vale SA's Brucutu mine in Brazil that was shut in early February after a tailings dam burst, has prompted increased demand from the country.

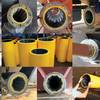

The capesize index rose 127 points, or 3.2%, to 4,095 points, its highest since December 2017. Average daily earnings for capesizes, which typically transport 170,000 tonne-180,000 tonne cargoes such as iron ore and coal, rose $916 to $31,073.

Iron ore shipments to China from Australia's Port Hedland terminal rose more than 11% in June from a month earlier, port data released on Wednesday showed.

The panamax index rose 33 points, or 1.6%, to 2,085 points, its highest since December 2013. Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 tonnes to 70,000 tonnes, rose $265 to $16,661.

Tight spot market for capesize vessels has driven iron ore shippers to book panamax vessels, driving rates higher, analysts said.

The supramax index edged 23 points higher to 928 points.

Reporting by Karthika Suresh Namboothir