BIMCO: Dry Bulk Market Supply and Demand Balance Will Weaken in Coming Years

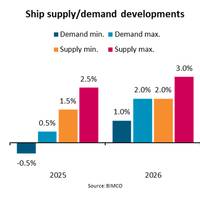

The tariff increases by the US and China in effect as of April 25 are estimated to directly affect 4% of dry bulk ton mile demand. They are expected to impact the growth of minor bulk cargo volumes, as shipments to the US may stagnate or decrease. On the other hand, China is expected to increase purchases of dry bulk cargoes from other countries, leading the US to seek alternative markets.“We expect that the dry bulk market’s supply/demand balance will weaken in both 2025 and 2026.

Golden Ocean Group Appoints New Director

Dry bulk shipping company Golden Ocean Group has appointed Tonesan Amissah as Director of the company.Amissah is a Barrister and Attorney-at-Law with over 30 years of experience in international corporate law.She is currently a Client Director at Ocorian Services (Bermuda), a global fiduciary and corporate services company where she oversees all aspects of client service. Amissah is a former partner of Appleby (Bermuda) where she led the funds and investment services team and was a senior member of the firm’s corporate department, having joined Appleby in 1989.

Baltic Index Falls Again as Capesize, Supramax disappoint

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, extended losses for the thirteenth straight session on Thursday, pressured by a dip in rates across capesize and supramax segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, dropped 11 points to 715 points, hitting its lowest in 23 months.The capesize index slipped 35 points to 841 points, dropping to its lowest level since February 2023.

Capesize Segment Buoys Baltic Index

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, rose on Thursday, supported by higher capesize rates.The index, which factors in rates for capesize, panamax and supramax shipping vessels, edged up 3 points to 969 points.The capesize index was up 64 points at 1,164 points. Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, increased by $530 to $9,653.Dalian iron ore futures prices snapped a four-day losing streak…

BIMCO's Shipping Number of the Week

Dry bulk contracting falls 70% below average amid low rates.“Over the past three months, dry bulk newbuilding contracting has been 70% below the yearly average. Declining freight rates in recent months, a cloudy outlook and high newbuilding prices contributed to the slowdown, and contracting in 2024 will likely fall short of 2023 levels,” says Filipe Gouveia, Shipping Analyst at BIMCO.Driven by healthy demand, the dry bulk market was strong throughout most of the first three quarters of 2024. However, in recent months, weaker Chinese import demand paired with a recovery in Panama Canal transits has impacted freight rates negatively.

Baltic Index Snaps Losing Streak on Larger Vessel Rate Rise

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, snapped a seven-session losing streak on Friday, supported by gains in larger vessels.The index .BADI, which factors in rates for capesize, panamax and supramax shipping vessels, gained 7 points to 1,167 points, but the index was down over 13% for the week.The capesize index .BACI edged up 5 points to 1,535 points. The contract posted about 28% decline for the week. Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, increased by $37 to $12,727.Iron ore futures prices slid and headed for a weekly loss on Friday…

Bulk Shipping: Corn surges on technical buying, solid exports

U.S. corn futures climbed to a two-week high on Friday on technical buying and support from strong U.S. export sales, putting the market on pace for its strongest weekly advance in a month.Soybeans followed corn higher, although forecasts for a record-breaking Brazilian harvest limited gains, while wheat futures were mixed.Row crop futures have largely held within narrow trading ranges since mid-November as traders assessed crop weather in South America, Russia and other key production zones and gauged possible shifts to global trade following the U.S. presidential election."Corn is trying to lead the way higher. We had an outside reversal higher day yesterday…

Brazil Grain Barges Return as Amazon Drought Eases

Transportation of soybeans and corn on barges along the Brazilian Amazon's Tapajos River, which had been suspended in early October due to dry weather, resumed at 50% capacity this week, operators said on Wednesday.Shipping began again on that waterway, which receives grain cargos from Brazil's biggest farm state Mato Grosso and nearby areas, as rain raised river levels, said Amport, an association representing port terminals and cargo transshipment operators of the Amazon basin.Barge shipping on the Madeira River, another Amazon waterway, returned to normal this week, Amport said. Grain transportation on the Madeira had been halted in September…

Greece Joins Clean Energy Marine Hubs Project

The Clean Energy Marine Hubs (CEM Hubs) project has welcomed the government of Greece, a nation that represents 20% of global shipping.The initiative aims to accelerate and de-risk the production, transport and use of low-carbon fuels that will be transported by shipping for the world.Greece joins the governments of Brazil, UAE, Canada, Norway, Uruguay and Panama, as supporters of this first of its kind cross sectoral public-private platform.Other new partners include ABS, Lloyd’s Register Maritime Decarbonisation Hub…

Provaris and Norwegian Hydrogen Partner with Uniper for Regional Hydrogen Supply

Provaris Energy and Norwegian Hydrogen have signed an MoU with Uniper Global Commodities aimed at strengthening co-operation in developing hydrogen supply chains from Norway and other potential Nordic sites, to import locations in North-Western Europe.The parties will collaborate in exploring the potential for Uniper to off-take RFNBO1 compliant hydrogen, which will be produced by Norwegian Hydrogen and transported and stored using Provaris’ H2Neo carriers and H2Leo storage barges.In April 2024…

MOL Teams Up with Rio Tinto for Decarbonization of Maritime Transportation

Mitsui O.S.K. Lines, Ltd. (MOL) and Rio Tinto have signed the partnership agreement to enhance collaboration on both safety and crew welfare initiative and decarbonization of maritime transportation.MOL and Rio Tinto have agreed to further collaborate on shipping decarbonization in addition to the existing commitment to the DOO program through a deal signed on January 24, 2024.The DOO program is a Rio Tinto initiative aimed at enhancing safety and improving crew welfare in the…

BIMCO: Tanker Supply/Demand Balance will Tighten

The BIMCO Tanker Shipping Market Overview & Outlook February 2024 by Niels Rasmussen, BIMCO’s Chief Shipping Analyst, forecasts that the supply/demand balance will tighten further during both 2024 and 2025.Low fleet growth, along with increasing sailing distances, create the foundation for the improvement despite a slowing of growth in oil demand. The product tanker supply/demand balance is also expected to tighten in 2024 but weaken in 2025. Like the crude tanker market, longer sailing distances support demand growth despite slowing oil demand.

MOL Embarks on Liquid Hydrogen Transport Study

Mitsui O.S.K Lines (MOL) has signed non-binding memorandum of understanding (MoU) with Woodside Energy, HD Korea Shipbuilding and Offshore Engineering (HD KSOE), and Hyundai Glovis to jointly study the development of shipping solutions to enable bulk marine transportation of liquid hydrogen.Woodside Energy, HD KSOE and Hyundai Glovis have been studying liquid hydrogen transportation since 2022.In this project, the participating companies will study the technology, safety, construction…

Baltic Dry Bulk Index Doubles in November

The Baltic Exchange's dry bulk sea freight index .BADI gained for the sixth consecutive session on Thursday, more than doubling in November to hit an one-and-a-half year peak helped by mounting supply of tonnage and cargo demand.The overall index .BADI, which factors in rates for capesize, panamax, supramax shipping vessels, was up 241 points or 8.9% at 2,937.

Diana Shipping Announces Time Charter with K Line

Diana Shipping Inc. has announced that, through a separate wholly-owned subsidiary, it has entered into a time charter contract with Kawasaki Kisen Kaisha (K Line) for one of its Capesize dry bulk vessels, the New Orleans.The gross charter rate is US$20,000 per day, minus a 5% commission paid to third parties, for a period until minimum August 15, 2025 up to maximum October 31, 2025. The charter is expected to commence on December 7, 2023.The New Orleans is a 180,960dwt Capesize…

Committed Owners Supporting Green Financing Landscape

Hamburg-based ship finance platform oceanis’s Q4 State of Ship Finance Report comes with a thank-you to shipping companies that are committed to the green transition.Over the past decade, oceanis has seen large changes to the ship financing landscape towards greener projects. The most obvious green financiers are the Poseidon Principles banks, the initiative launched in 2019 whose signatories manage 70% of the world’s shipping loans. At the same time, many other banks and funds are moving away from financing ‘brown’ assets and trades.

Greek Owners Top Global Cargo Carrying Capacity

BIMCO’s Chief Shipping Analyst, Niels Rasmussen, has revealed that Greek and Chinese shipping companies now own 34% of the global fleet’s cargo capacity, with Greek owners leading on cargo capacity.“The global fleet of cargo carrying ships consists of around 61,000 ships with a deadweight capacity of about 2,200 million tonnes. The ships owned by Greek and Chinese shipping companies contribute 34% of the total fleet’s deadweight tonne capacity,” says Rasmussen.Although consolidation has been significant within the container shipping segment…

Lauritzen Bulkers to Test Decision-Making Tool

Bulk shipping companies Torvald Klaveness and Lauritzen Bulkers are collaborating, with Lauritzen Bulkers testing Market Manager by Klaveness for better decision-making.The software-as-a-service (SaaS) platform developed by Klaveness Chartering enables customers to be better informed about shipping markets.Niels Josefsen, CEO at Lauritzen, said: “Over the past four years, Lauritzen Bulkers has transformed from a traditional shipowner and operator to a company with increasing focus on active portfolio management.

Torvald Klaveness and Marubeni Expand Partnership

After three successful years as joint partners of Baumarine by MaruKlav, the world's largest Panamax Pool, Marubeni will take a 25% stake of Klaveness Dry Bulk.The deal includes the operating arm Klaveness Chartering, the Baumarine Pool and Market Manager, a recently commercialized digital freight offering."The Torvald Klaveness group and Klaveness Dry Bulk have delivered significant results, not only for the Marubeni fleet, but also for Panamax owners in Baumarine by MaruKlav as a whole,” said Toru Okazaki, Chief Operating Officer, Aerospace & Ship Division of Marubeni Corporation.

Ship Grounded in Suez Canal

A ship has grounded in the Suez Canal, shipping agent Leth Agencies said early on Thursday.Suez Canal tugboats are trying to refloat the vessel, named Xin Hai Tong 23, the company said.There was no immediate comment from Canal authorities."M/V XIN HAI TONG 23 has grounded in the Suez Canal at KM 159/0400 hrs," Leth Agencies said in a tweet, adding it was "leaving behind 4 vessels from the early convoy in addition to the ordinary group which was planned to enter Suez Canal at about 0600 hrs."The Marine Traffic ship tracker and Refinitiv data showed the ship, which sails under the Hong Kong flag, as "not under command" near the southern end of the canal, positioned at an angle next to the canal's eastern side.(Reporting by Hatem Maher and Ahmed Tolba; writing by Nafisa Eltahir, Editing by Mu

Capesize Gains Lift Baltic Index to Over 2-month High

The Baltic Exchange's main sea freight index jumped to a more than two-month high on Tuesday, propelled by gains across vessel segments, particularly the larger capesizes.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels ferrying dry bulk commodities, rose 77 points or 4.3% to 1,865 points, its highest since Aug. 1.The capesize index gained 203 points, or about 10%, to also hit an over two-month high of 2,244 points.

Aquavita Charters Diana Shipping's M/V Boston Bulk Carrier

Diana Shipping has entered into a time charter contract with Aquavita International for one of its Capesize dry bulk vessels, the m/v Boston. The gross charter rate is US$20,500 per day, minus a 5% commission paid to third parties, for a period until a minimum of April 1, 2023, up to a maximum of May 31, 2023. The charter began on July 15, 2022. The m/v Boston was previously chartered to Richland Bulk Pte. Ltd., at a gross charter rate of US$13,000 per day, minus a 5% commission paid to third parties.The “Boston” is a 177,828 dwt Capesize dry bulk vessel built in 2007."The employment of “Boston” is anticipated to generate approximately US$5.25 million of gross revenue for the minimum scheduled period of the time charter…

Baltic Index Rises on Gains on Higher Rates for Capesize Vessels

The Baltic Exchange's main sea freight index rose on Monday as higher rates for larger capesizes overshadowed a fall in the panamax and supramax segments.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was up 12 points, or 0.56%, at 2,162 points.The capesize index .BACI rose 48 points, or 1.64%, to 2,967 points.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were up $394 at $24…