Xeneta

Xeneta News

Video: Container Carrier Capacity Adjustment - Too Little, Too Late?

While drama in the container shipping sector has calmed a bit, container carriers still wrestle with unexpected drops in demand. Peter Sand, Xeneta, discusses vessel capacity moves and their likely impact on rates, as well as the first containership sent to the ship scrap yard in more than 18 months.Q: Peter, the last time that we spoke, you were succinct in saying that this market is a mess, with spot rates plunging in what traditionally is the busiest shipping season in the US.

Reefers Riding Out Spot Rate Storm Better Than Dry Containers -Xeneta

Reefer spot rates are proving more resilient than dry container prices on exports from North Europe, with slow declines as opposed to dramatic drops. According to the latest market analysis from Oslo-based Xeneta, all main trades from the region have experienced falls over the past three months. However, unlike the dry market, the routes are still commanding higher rates than this point last year,…

Container Rates: Slide Begins as Long-term Shipping Rates Fall -Xeneta

Long-term contracted rates fell by 1.1% in September, marking the first drop since January and one of only three declines in the past 21 months, recent data from the Xeneta Shipping Index (XSI) reveals. However, analysts at Oslo-based Xeneta, which aggregates data from leading global shippers and freight forwarders, expect “it won’t be the last”, with market fundamentals suggesting the “halcyon days”…

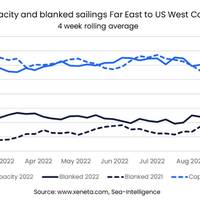

Collapsing Spot Rates, Falling Capacity define Far East to U.S. Container Trade

In its latest Container Freight Rate Update note, Xeneta covers the average capacity and blank sailings on the Far East to the US West Coast while we head into the not-so-traditional peak season.The average capacity offered from the Far East to the US West Coast has fallen to its lowest since February in the past four weeks. Over this period, an average of 275,000 TEU has left the Far East heading for the US West Coast…

Rollercoaster Containershipping Rates Continue, says Xeneta

South American spot rate gap set to narrow as shippers take advantage of lower Far East to West Coast ratesThe latest ocean freight rate data from Xeneta reveals that spot rates are currently $3,700 more expensive for shipping 40-ft. containers from the Far East to the South American East Coast, compared to the West Coast corridor. This huge gap – the norm is usually around a $55 East Coast premium – has opened up since 1 July.

Container Shipping Rates: Has the Peak Been Reached?

Despite another slew of rises in long-term contracted ocean freight rates across key global trade corridors, month-on-month growth is slowing - and spot rates continue to weaken – suggesting prices may have peaked. However, according to the latest Xeneta Shipping Index (XSI), which crowd-sources real-time data from the world’s leading shippers, today’s valid long-term agreements stand 112% higher than this time last year…

Container Shipping: "Fluctuating fortunes for Ocean and Air Freight out of Far East

While spot rates head in the right direction for ocean freight from the Far East to the South America East coast, short-term air freight rates are failing to take off on major intra-Asian and long haul trades, according to Xeneta.“Certainly, as far as ocean freight rates are concerned, the long-term market tends to play catch-up with the spot market, with around a three-month delay,” said Peter Sand, Chief Analyst, Xeneta.

Xeneta says Long-term Container Shipping Rates to Rise Again

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June. Following on the heels of a record 30.1% hike in May, this now means rates stand 169.8% higher than this time last year, with just two months of declines in the last 18 months. Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up…

Containershipping's Long-term Reefer Rates Soar to All-time Highs, says Xeneta

According to the latest crowd-sourced data from Xeneta, long-term rates for reefer containers on the key US West Coast to Far East route soared almost 60% in April.In its report Xeneta notes a surge in rates of around $2000 per 40-ft. unit after the latest 12-month contracts came to a close. The average contracted rate recorded on 15 May stood at $5850 per container, while the average for new agreements running from Q2 2022 to the end of Q1 2023 was even higher, at $5945 per 40-ft.

Xeneta Appoints Finbow, Irvine to Exec Team

Xeneta, a leader in ocean and air freight rate benchmarking, market analytics platform and container shipping index, announced the appointment of two new sales executives. Scott Irvine joins Xeneta as VP of Freight Forwarding and Laura Finbow will serve as Director of Sales Enablement. Scott Irvine has worked in the logistics industry for over two decades holding senior leadership roles across both shippers and freight forwarders.

Most Containership Spot Rates Tower Above Long Term Contracts - Xeneta

The Far East to South American East Coast trade is the only front haul trade where the long term is lower than the average spot rate among Xeneta's top 13 trades. Long-term rates on this trade are still below their October highs, but they have been steadily rising since 2022. As of 15 March, long term contracts from the past three months were $800 per FEU above the spot market, at $10,400. In comparison…

Freight Rates from North Europe to US East Coast Increase Three-fold

Spread between short- and long-term container shipping freight rates from North Europe to U.S. East Coast narrow with both increasing around three-fold.Rates from North Europe to the U.S. East Coast have increased dramatically over the past year, similar to any other main trade lane. With disruptions hitting container shipping globally, the non-major trade lanes have also experienced reverse cascading - ships heading back to main trades…

Container Shipping: Rates Dip in January, Fundamentals Strong says Xeneta

Long-term contracted ocean freight rates fell 3.6% in January, according to the latest Xeneta Shipping Index (XSI) Public Indices, the second consecutive monthly rates decline following 14 straight months of increases. Despite the recent stumble, contracted rates stand 98.1% up year-on-year.“The logistics chain remains stressed,” said Patrik Berglund, CEO of Oslo-based Xeneta, “with demand outstripping supply…

Xeneta: Intra-Asian Spot Rates Contribute to Rising Manufacturing Costs in The Region

Among most global trades, intra-Asian rates have seen considerable increases in recent years, though the costs on the world’s busiest container trade have not risen as quickly as in other places, Xeneta, and ocean and air freight rate benchmarking and market analytics platform said Thursday.According to Xeneta, in the first half of January, spot rates from the main Chinese ports to the main Japanese and South Korean ports have risen back above USD 1 800 per FEU.

2022 & Beyond: Will the Container Carrier Debacle Ever End?

When the global supply chain runs smoothly, it’s like a well-choreographed dance. Everything comes together elegantly and effortlessly. But when someone misses a step, the show can quickly turn into a disaster. And that’s what’s currently unfolding before our eyes, headline after headline.Those of us in the supply chain industry know it takes a Herculean effort to keep the wheels of commerce turning without so much as a squeak or rattle.

Strong Demand, Supply Chain Strain Persist, says Xeneta

Ocean carriers remain in pole position in negotiations for long-term freight contracts, with high demand, port congestion, and supply chain disruption driving further rates increases. According to the Xeneta Shipping Index (XSI) Public Indices, long-term rates recorded their tenth consecutive month-on-month rise in October, climbing by 2.2%. The indices now stand at a colossal 93.1% up year-on-year…

Peter Sand Joins Xeneta as Chief Analyst

BIMCO's longtime chief shipping analyst Peter Sand is departing the trade organization to take up the chief analyst role at ocean and air freight rate benchmarking, market analytics platform and container shipping index Xeneta, the Olso-based company announced on Wednesday.Sand joins Xeneta after over a decade at BIMCO, where he was responsible for analyzing commercial markets based on the global economic situation and its influence on trade.

Contracted Rates to Fall Long-term Due to Conoravirus -Xeneta

The container shipping segment appears to have caught coronavirus, with the industry suffering its first monthly fall in long-term contracted ocean freight rates since October 2019. According to the latest XSI Public Indices report from Xeneta, March 2020 saw a small dip of 0.5% in rates after a sustained period of growth. Although these symptoms look mild, the future is characterized by growing uncertainty…

Container Contract Rates Rise in November

The ongoing trend of downward pressure on long-term contracted ocean freight rates appears to have been broken, or at least temporarily derailed, with marginal increases…

Xeneta Expects Further Disruption in Container Rates

Further disruption in ocean freight rates expected despite best efforts from leading carriers, according to Xeneta Container Rates Alert.Long-term contracted ocean…