"It's not the death of U.S. Offshore Wind" says Intelatus

The offshore wind sector is bracing for transformative changes as it navigates shifting political landscapes and evolving market demands. To shed light on the current state of the industry, Maritime Reporter TV interviewed Phil Lewis, Director of Research at Intelatus, an international offshore energy markets expert, to discuss the trends shaping the Service Operation Vessel (SOV) and Construction Service Operation Vessel (CSOV) markets and the future of U.S. offshore wind under the Trump administration.

- SOV/CSOV Market: Speculation Drives Growth

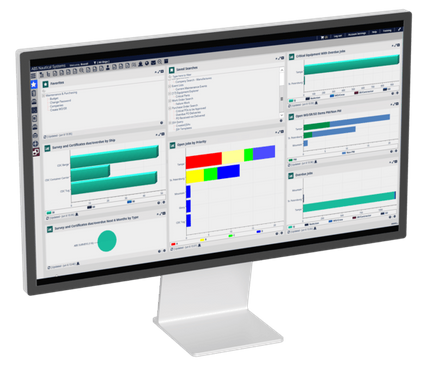

Interest in purpose-built SOVs and CSOVs has surged in recent years, driven by the rapid expansion of offshore wind farms, particularly in Europe. Lewis explains that the current fleet of approximately 60 vessels is expected to double to around 125 vessels by 2028. This growth reflects the increasing need for specialized vessels to support larger, more remote offshore wind projects.

“SOVs are generally built against long-term charters, ensuring a stable supply-demand balance,” says Lewis. “In contrast, CSOVs often enter the market speculatively, catering to shorter construction and commissioning projects, which introduces more risk but also the potential for higher day rates when vessel demand outpaces supply.”

However, the speculative boom in CSOV construction is leading to potential oversupply.

Lewis notes that while demand for these vessels remains strong, the influx of new CSOVs could result in lower day rates and underutilization by 2029. The interplay between offshore wind and traditional oil and gas markets also influences vessel utilization, with some CSOVs and subsea ves-sels crossing over to support oil and gas operations.

“It’s not the death of U.S. offshore wind,” said Lewis in discussing the new Trump administration and its impact on the U.S. Offshore Wind market. “While some projects may face delays and investment slowdowns, the market's reliance on established European supply chains and its growth potential support a resilient future.”

“It’s not the death of U.S. offshore wind,” said Lewis in discussing the new Trump administration and its impact on the U.S. Offshore Wind market. “While some projects may face delays and investment slowdowns, the market's reliance on established European supply chains and its growth potential support a resilient future.”

- U.S. Offshore Wind: Down, Not Out

The recent shift in U.S. political leadership has introduced uncertainties for the offshore wind sector. President Donald Trump administration’s renewed focus on hydrocarbons over renewables has led to policy reviews and slowed progress on several projects. Despite these challenges, Lewis remains cautiously optimistic.

“It’s not the death of U.S. offshore wind,” he asserts. “While some projects may face delays and investment slowdowns, the market's reliance on established European supply chains and its growth potential support a resilient future.”

Lewis emphasizes that while the pace of development may slow, the fundamental trajectory toward renewable energy remains intact, driven by global demand and international collaboration. The U.S. market, although impacted by political shifts, still holds significant potential as part of the broader offshore wind ecosystem.

- Industry Consolidation, Financial Outlook

The financial landscape for SOV/CSOV operators is marked by both opportunities and challenges. Companies focused on SOVs benefit from stable, long-term contracts, while CSOV operators face fluctuating day rates tied to market conditions. High capital investments and debt levels are common, making the sector ripe for mergers and acquisitions.

“We anticipate significant M&A activity as companies seek financial stability,” Lewis predicts. “Strategic consolidation will be key to navigating the evolving offshore wind landscape.”

As the offshore wind industry adjusts to political and market dynamics, the strategic deployment of SOVs and CSOVs will be critical. Despite current uncertainties, the long-term outlook for offshore wind remains promising.

- Watch the full interview with Phil Lewis on Maritime Reporter TV: