Evaluating Marine License Insurance Providers

For professional mariners, safeguarding their USCG credentials with marine license insurance is vital. Yet, not all insurers offer the same caliber of service and expertise.

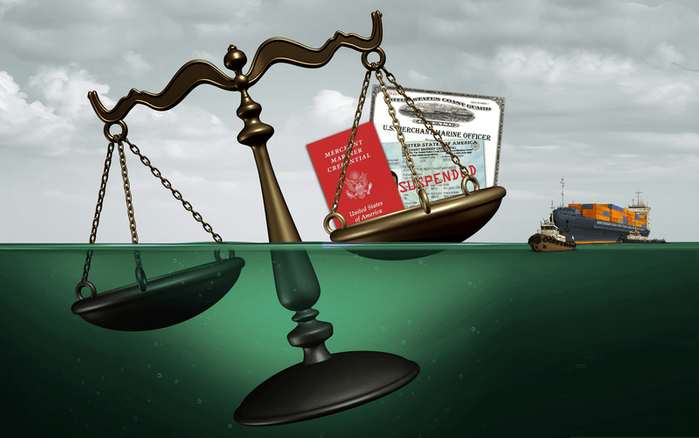

For professional mariners navigating the perilous sea, safeguarding their USCG license is paramount. Even minor mishaps can trigger Suspension & Revocation (S&R) proceedings by the U.S. Coast Guard, jeopardizing the seafarer’s credentials and livelihood. Legal representation costs for an S&R hearing can escalate rapidly, underscoring the indispensable need for marine license insurance.

Marine license insurance serves as a crucial safety net, providing fully paid legal representation and defense by a maritime attorney in the event of incidents leading to actions against a mariner's USCG license. However, not all insurance providers offer the same caliber of service and expertise.

Swift Responsiveness

In the chaotic aftermath of a marine casualty, where time is of the essence, seafarers require an insurer that provides more than just financial coverage. They need personalized attention from a committed team familiar with their operations and prepared to act quickly, any hour of the day or night.

Such promptness could mean the difference between the mariner speaking with a seasoned maritime attorney moments after an incident and being stuck in a tedious claim reporting process, waiting hours or days for assistance.

Appointing the RIGHT Legal Expertise

Given that not all maritime attorneys are equipped to navigate USCG proceedings, it is imperative that insurers appoint specialized legal support tailored to the complexities of marine license defense and each specific case. This entails pairing mariners with admiralty lawyers proficient in the workings of the U.S. Coast Guard and state pilotage authorities and experienced in formulating effective defense strategies.

To ensure mariners receive suitable legal representation, a strong bond between the insurer and its network of attorneys is crucial. This collaborative approach not only increases the chances of a favorable outcome in an S&R hearing, but also alleviates the stress often associated with maritime legal proceedings.

Choosing the right marine license insurance company demands careful consideration. It not only involves evaluating financial coverage offerings, but also ensuring seamless access to experienced professionals who understand the unique risks and challenges of the maritime industry.

Setting the Standard

With a legacy spanning over 85 years and a track record of defending over 10,000 USCG licenses, MOPS Marine License Insurance stands out as the preeminent choice for mariners. MOPS' adept team is available 24/7/365, diligently and promptly connecting seafarers with experienced maritime attorneys specialized in license defense. For professional mariners confronting the rigors of the sea, MOPS is the trusted beacon of reliability and support.

To learn more and get a free, no-obligation quote, call MOPS today at 516-431-9191, then press 3, or visit mopsmarinelicenseinsurance.com.