Xeneta Data Points to "Brutal" 2024 for Ocean Freight Carriers

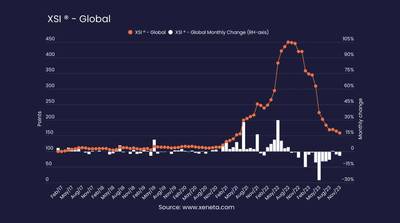

Latest data from Xeneta suggests 2024 could be even more brutal than expected for carriers in the ocean freight shipping market, as the Xeneta Shipping Index (XSI), which tracks real-time developments in global long-term contracted rates, today stands at 158.5 points, which is 62.3% lower than November 2022.

“The XSI is an average of all long term contracts on the market – so in essence the global index is currently being propped up by those older contracts which were signed back in 2022 when rates were much higher," said Emily Stausbøll, Market Analyst, Xeneta. “These older contracts with higher rates should have afforded some financial insulation throughout 2023, however we have still seen four of the major carriers post big financial losses in Q3.”

“We can be absolutely certain the new contracts will be signed at much lower rates than those signed at this time last year, so if carriers are already reporting losses, what are they going to be next year? We could be talking about extremely big numbers.”

Stausbøll pointed to Maersk’s loss of EBIT $27m in Q3 as a particularly significant development in light of the latest XSI figures. “Maersk relies heavily on the long term market so they should have been less impacted by the collapse in spot rates during 2023. The fact they still posted a loss in Q3 suggests there could be serious problems down the line when the XSI drops further next year. We always knew there was a storm coming in Q1 2024 when the older contracts expired, but it seems as though it has arrived earlier than expected.”