Washington State Ferries Goes Out to Bid for New Hybrid-electric Vessels

Deliveries will begin in 2028 if all goes well. Delays and escalating costs have bedeviled the procurement process up until now.

Washington State Ferries on Thursday published an invitation to bid on building five new hybrid-electric ferries, an overdue achievement that promises to eventually bring more reliability to cross-Sound ferry service.

It’s the first time in more than 50 years that the state will accept bids from shipyards nationwide to construct its vessels. Going out to bid on this contract also represents a major step toward electrification of the WSF fleet. But it’s been choppy getting to this point with a years-long delay and rising costs. And the difficulties procuring the new boats have gubernatorial candidates in both parties suggesting it could make more sense to stick with diesel power in the near term.

“This is a great milestone for Washington State Ferries as well as the national shipbuilding industry that has shown strong interest in this program,” said Matt von Ruden, the ferry system’s electrification program manager. “These new vessels are urgently needed as WSF works to restore full service and reduce our environmental impacts.”

For frustrated riders, dealing with delays and cancellations, relief for the ferry system’s boat shortage can’t come soon enough.

WSF has long stated that it needs 26 ferries to provide reliable service on every route, with allowances for maintenance tie-ups and a vessel in reserve.

Entering this summer’s busy season, the beleaguered ferry system has 21 car ferries in its fleet, of which 15 are presently in service on a reduced schedule. Five aging boats are undergoing maintenance or breakdown repairs. Last but not least, the Wenatchee is in drydock in Seattle for conversion to hybrid-electric propulsion. The Wenatchee will be WSF’s first plug-in ferry when it re-launches sometime in the fall.

Bids from shipbuilders on the brand new hybrid ferries will be due in January and the contract awarded in February 2025. WSF declared a preference to split the contract between two low bidders so that two shipyards could go to work simultaneously to deliver new boats faster.

“Under this approach, WSF could achieve delivery of two vessels in 2028, two in 2029, and the final one in 2030 (subject to final bid prices and available funding). These ferries will serve the Clinton/Mukilteo and Seattle/Bremerton routes,” WSF spokesperson Suanne Pelley said in an email Thursday.

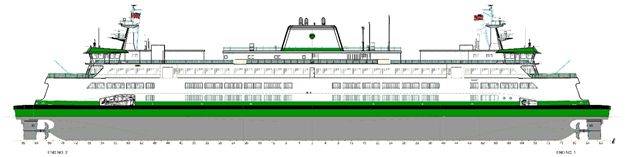

(Image: WSF)

(Image: WSF)

‘Responsibility to reduce our emissions’

The bid request published by WSF included the high-level design for a plug-in ferry capable of carrying up to 160 cars and 1,500 passengers. Drawings showed boats that resemble a slightly elongated version of the diesel-powered Olympic class ferries delivered between 2014 and 2018. The latest design has just one passenger deck stacked on top of the two auto decks though. The center of the ship’s hold will be packed with racks of water-cooled rechargeable batteries so the ferry can sail fully on electric power most of the time. The engine room will also feature twin diesel generators as a backup source of propulsion power.

Using green electricity to charge, the nation’s largest ferry system may achieve a 76% reduction in fuel consumption and emissions when it fully transitions its fleet to hybrid-electric vessels, said von Ruden.

“We have a unique responsibility to reduce our emissions,” von Ruden said during a webinar for potential bidders. “We are the largest contributor of greenhouse gas emissions in state government. Before COVID, we were burning 19 million gallons of diesel fuel per year.”

Over the last two legislative sessions, state budget writers set aside close to $1.3 billion to pay for new ferries over the next six to eight years. That works out to roughly $250 million per new ferry.

If bids come in high, ferry system managers may end up having to pick a poison. They might only be able to acquire four new boats in this round. Or they could plead to the Legislature for even more money. Or try to pare back the design to reduce costs.

The four leading candidates to replace outgoing Gov. Jay Inslee have all expressed willingness to revert to diesel power for at least the first couple of new ferries to get them built faster and cheaper.

“If that means that we have to extend our reliance on diesel-powered ferries in the short-term, then we should do that while taking advantage of new, cleaner, hybrid ferries downstream,” wrote GOP frontrunner Dave Reichert in an open letter that blasted Inslee for what Reichert called a “mismanaged nightmare” on the governor’s watch.

WSF and Inslee contend that going back to conventional diesel propulsion would only delay matters even more because the bid documents and ferry design would have to be reworked.

Another wrinkle is that legislators made nearly $200 million of the new boat and terminal electrification spending contingent on voter rejection of a ballot measure this November. The initiative measure, I-2117, seeks to repeal the state’s cap-and-trade program. The ferry money is among a raft of spending that is hanging in the balance depending on whether or not voters want to sustain the state’s carbon pollution permit auctions that bring in the dough.

Who might bid?

In previous procurements, the Washington Legislature required that new state ferries be built in-state to keep the jobs and money close to home. However, that approach backfired beginning five years ago when there was just one local shipyard in the mix to assemble large car ferries. The state and that shipbuilder – Vigor Marine – reached an impasse over pricing and liability issues.

WSF said at least 15 potential prime contractors and subcontractors from coast to coast registered formal expressions of interest in the new ferry procurement. Some of them allowed their names to be made public. Among the noteworthy names on the list are Fincantieri Marine Group, a major shipbuilder and defense contractor in Wisconsin, and Conrad Shipyard of Louisiana, which boasts an extensive portfolio of ferry construction, including for the states of Texas and North Carolina and the Martha’s Vineyard and Nantucket ferry authority. Shipbuilder Gunderson Marine, which operates a large shipyard in Portland, Oregon, also put its hand up.

Vigor delivered the last twelve new ferries to WSF from its Harbor Island shipyard, in some cases outsourcing large sections such as the superstructure to partners in Tacoma or Freeland, Washington. Despite the snafus that grounded its previous planned contract extension with WSF, Vigor put its name on the interested parties list too. A Vigor spokesperson said Thursday that company management needed more time to study the new ferry bid specs before offering reaction.

Another local shipyard group interested in bidding is the holding company for Nichols Brothers Boat Builders on Whidbey Island and its sister shipyard Everett Ship Repair. However, CEO Gavin Higgins expressed concern in an interview about the competitiveness on price of Washington state shipyards.

Higgins said Washington shipbuilders would be “hamstrung” in national competition because they have to follow a range of public works contracting laws that out-of-state shipyards might not face. These include apprentice utilization requirements, small business set-asides and union-level wage floors, aka prevailing wage rates.

“I’m not begrudging this, but just pointing out this is where the costs are,” Higgins said. “The prevailing wage jacks up the cost dramatically.”

The Legislature kept a finger on the scale to favor ferry construction locally by including a 13% bid credit for work performed in state. But Higgins estimated he would need a credit on the order of 25% to compete on price with a shipyard on the Gulf Coast, for example.

Foreign shipyards are ineligible to bid even though contracting with an overseas builder would likely save taxpayers large sums. The new state ferries have to be built in America because of a century-old federal maritime law.

In neighboring British Columbia, BC Ferries is also acquiring hybrid-electric ferries to meet emissions reduction goals. In January, the peer ferry system to Washington awarded a contract to European shipbuilder Damen to build four plug-in interisland ferries at a yard in Romania. No price was released, but the Office of the BC Ferries Commissioner indicated the cost was more than CA$50 million ($35.7 million U.S) per vessel. BC Ferries is now moving on to a new procurement to replace up to seven of its largest vessels, beginning in 2029, with 360-car boats that would run on biofuels and battery power.

The largest hybrid ferries in the world are being outfitted in China for France-based Brittany Ferries. The 460-car sister ships Saint-Malo and Guillaume de Normandie will enter service next year on English Channel routes using a combination of liquified natural gas and battery power.

(Source: Washington State Standard)