Vanishing Volatility Signals Oil Market Shift

The oil market has rarely been so quiet. Benchmark Brent has traded in a narrow range of $5 either side of $110 per barrel since the summer of 2012.

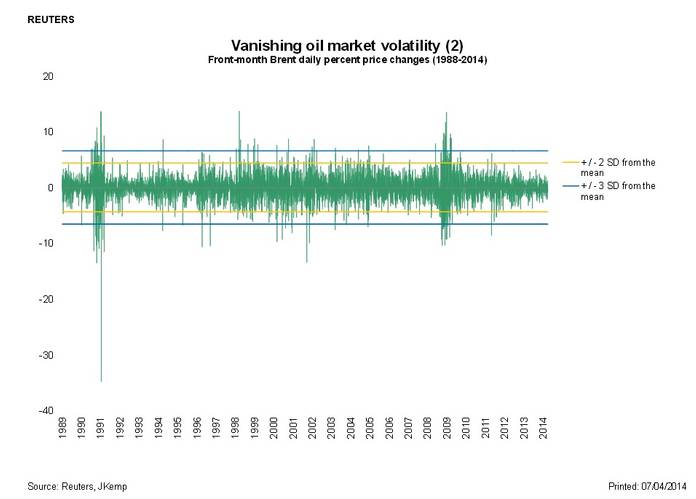

Price volatility has fallen to some of the lowest levels since crude futures markets were established in the early 1980s.

Oil prices have rarely been so stable for so long since the 1973 oil shock ended the long period of calm in the 1950s and 1960s and ushered in the era of OPEC dominance.

Measured volatility in front-month Brent futures prices has been below average continuously for almost two years.

For much of this time, volatility has actually been below the 25th and 10th percentiles of the 1988-2014 distribution (Chart 1).

Annualised volatility so far this year is running at 15 percent or less, compared with an average of 30 percent since 1988.

Large daily price moves have become increasingly infrequent (Chart 2). Even major supply disruptions from the North Sea and Libya have failed to move prices.

Crude has moved into a new era in which confidence about plentiful shale oil from the United States is more than enough to offset political risks emanating from the Middle East and production problems in other regions.

Endless Calm

French mathematician Benoit Mandelbrot, the leading expert on volatility, argued that commodity markets, like other financial assets, swing between a mild state and a wild one, alternating between periods of low and high volatility ("The misbehaviour of markets" 2004).

But the oil market has been stuck in its current calm state for such an abnormally long period that it seems safe to infer that something fundamental has changed in the way oil prices trade and behave.

It is not hard to find the explanation. The period of high and rapidly rising prices between 2004 and early 2012, briefly interrupted in 2008 and 2009, has produced a profound "regime change".

From the demand side, consumption of liquid transport fuels has peaked in the developed economies as automotive engines become more efficient and petroleum-derived gasoline and diesel are being partially replaced by biofuels.

On the supply side, high prices have spurred development of shale and reversed the previous trend towards growing dependence on conventional oil fields in the Middle East and OPEC member states.

It has decisively altered the medium-term outlook in the minds of many producers, consumers and traders and reshaped what they consider to be the normal range for oil prices, something Paul Stevens at Chatham House calls traders' "bands of belief".

OPEC Sidelined

One result is that there is now almost no discussion among market participants or in the media about oil and other fossil fuel reserves peaking or running out.

Controversy about speculation in the market has almost entirely disappeared as oil prices have stabilised.

Another result is that investors have largely lost interest in buy-and-hold commodity strategies that relied on oil and other fuels becoming progressively more scarce and expensive.

The number of hedge funds specialising in oil has begun to fall, and institutional investors are allocating a smaller share of their portfolios to commodity-based products.

Trading activity has shifted from banks, hedge funds and mutual funds specialising in trading outright prices to merchants and the trading desks of the major oil companies, which are expert at locational and quality arbitrage.

At a more global strategic level, the influence of traditional oil exporters around the Persian Gulf is declining as alternative supplies become more available, now and in future.

Political risk and other sources of supply-side risk are diminishing as oil supplies become more geographically diversified.

It is no coincidence that the oil market in 2014 is beginning to resemble the markets of the 1950s and 1960s, because that was the last time the United States, with its large, stable and non-monopolised oil industry, was the marginal producer in the global oil market.

Oil markets are inherently cyclical. The long-term behaviour of oil prices owes more to Hyman Minsky ("Stabilising an unstable economy" 1986) than Francis Fukuyama ("The end of history and the last man" 1992).

The current calm will eventually sow the seeds of its own destruction as complacency grows. But in the meantime, the market appears firmly settled into a new era that is transforming the role of everyone involved in the production, transportation, refining, risk management and consumption of oil.

Chart 1: http://link.reuters.com/myn38v

Chart 2: http://link.reuters.com/jyn38v

(John Kemp is a Reuters market analyst. The views expressed are his own)

(editing by Jane Baird)