US Dirty Tanker Export Demand Jumps

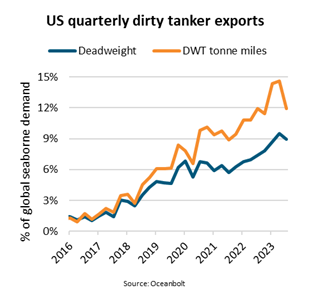

During the first eight months of 2023, US dirty tanker export demand increased 33% year-on-year while the global dirty tanker exports increased only 5%. Measured in deadweight tonne miles, US exports now account for 14% of global dirty tanker demand, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

US oil production has increased since 2013 while US refinery runs peaked before the COVID pandemic. This has allowed dirty tanker exports to increase from 0.4 million barrels per day (mbpd) in 2016 to 3.5 mbpd during the first eight months of 2023. During the same period export deadweight tonne miles have grown at an average annual pace of 46% and increased from 1% to 14% of global dirty tanker demand.

Exports into East Asia have grown particularly fast in recent years, making the region the largest destination area since 2019, now accounting for 20% of the dirty tanker ship capacity departing the US.

“The shift in exports towards East Asia has further added to ship demand growth by increasing average sailing distances by one third since 2016,” says Rasmussen.

The increased trade with East Asia has resulted in a rise in shipments on very large crude carriers (VLCCs). Year-to-date 2023 they have accounted for 69% of all US export deadweight tonne miles, a 10% increase compared to 2022.

Due to the EU’s sanction on Russian oil exports, US dirty tanker exports have grown the fastest into the EU since 2021. In 2023, average monthly deadweight tonne miles from the US to the EU have more than doubled compared with 2021. This has further added to the growth in demand for VLCCs which in 2023 account for 43% of deadweight tonne miles into the EU, up from just 2% in 2021.

All in all, the increase in US oil production and the shifts in trade patterns have made the US the second largest contributor to dirty tanker export demand, only exceeded by Saudi Arabia. In the future the US will contribute even more.

“The International Energy Agency estimates that that the US will contribute one third of the increase in global oil production between 2023 and 2028. However, US refinery runs are expected to decline during that period. US seaborne exports and their share of global dirty tanker demand are therefore expected to increase further,” says Rasmussen.