Trade War All About the Eastbound Transpacific -BIMCO

When two of the world’s top trading partners get entangled in a stand-off, where the outbreak of a trade war could become the extended tool of intense negotiations, BIMCO says we’d better prepare for what may come while hoping that it will never take place.

The U.S. is China’s largest trading partner measured by value – and China is the largest one-country trading partner that the U.S. has.

“The global shipping industry naturally gets concerned when two nations of huge importance to most shipping sectors get in the ring to fight a trade war – gloves off,” says Anastasios Papagiannopoulos, BIMCO President and Principal of dry bulk shipping company Common Progress.

“I am still hopeful that world trade will not implode and encourage the involved parties to avoid a brutal and harmful escalation that will affect the shipping industry badly.”

What matters the most?

There may be a lot of talk concerning Chinese plans for tariffs on U.S. pork, fruit and wine, and while bound to hurt the U.S. exporters of these products, the potentially lost TEUs containing these goods doesn’t really matter to the transpacific shipments on containers.

What matters to the container shipping industry is volumes that may be lost on the essential leg of a transpacific voyage from China into the U.S.

In container shipping, the fronthaul of any trade dictates the amount of shipping capacity deployed on that trade lane. The fronthaul leg of a trade lane, being that which holds the higher container volume transported as compared to the return leg (backhaul).

BIMCO’s Chief Shipping Analyst Peter Sand comments, “The shipping industry is concerned with a lower level of U.S. containerized imports which may become a result of a trade war between the U.S. and China.

“If fronthaul volumes go down, oversupply of ships develops causing utilization to drop alongside freight rates and earnings on the transpacific networks.”

In many aspects, backhaul shipments only serve to cover a part of the repositioning costs of a ship to the next fronthaul voyage – they don’t generate profits.

Why is it all about the cargo moving into the U.S.?

When container alliances and individual carriers optimize their global networks, which they constantly do, they try to match shipping capacity with that of shipping demand. As more containers move from China to the U.S., than the other way around, that part of the trade is the constraining element in the optimizing matrix.

Only when we have growing cargo movements on the fronthaul leg, is more shipping capacity required – meaning there is an increasing demand for ships. Compare this to cargo movements growing on the backhaul leg, where you are nowhere near the limit of using the deployed shipping capacity at full extent. That demand growth will not result in a need for more ships – it will only deliver a higher utilization of ships where available space is amble.

Which cargoes matter?

1.8 million TEU of Chinese imports from the U.S. and up to 3 million TEU exported from China into the U.S. will be subject to these higher tariffs, according to Drewry’s senior manager for container research, Simon Heaney. Nearly 2.5 percent of total global containerized trade can be affected.

Admittedly the tariff lists are long on both sides, and single products with a huge impact on shipping demand, besides soya bean are difficult to find. Nevertheless, we do know that U.S. whiskey exports may come to a complete stop without global shipping ever knowing about it. That commodity is on the list due to political reason, as we have highlighted previously in our focus series of the potential trade war.

Which cargo groups are relevant to pay closer attention to?

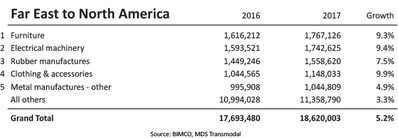

Top 5 Commodities (SITC at a two-digit level) on Far East to North America trade lane:

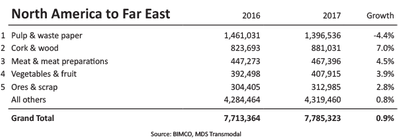

Top 5 Commodities (SITC at a two-digit level) on North America to Far East trade lane:

“For the shipping industry, importers and exporters in either country involved in transpacific shipments of containers this uncertainty is a huge burden to handle.

As the countdown continues we get ever closer to disruptions – not just of container shipping but also dry bulk shipping in the case of steel, aluminium and soya beans”, Peter Sand ends.