TOTE Goes Gas

Historic Shipbuilding Contract for World’s First LNG-Powered Containership to be MAN-Powered, NASSCO-Built

Last month U.S. ship owner Tote Inc. shocked the maritime community in ordering the world’s first LNG-powered containerships; in one fell swoop energizing the U.S. shipbuilding sector. On the occasion of this historic contract, top executives from TOTE, NASSCO and MAN spoke to Maritime Reporter & Engineering News to weigh in on the deal’s significance.

In recent decades, particularly in the large commercial ship niche, it is fair to say that the U.S. has not been a world force. As the majority of commercial shipbuilding continues its migration to Far East, specifically South Korea and China, developed countries with much higher labor costs and prohibitively expensive environmental regulations have seen new shipbuilding business dwindle. So when last month it was announced that an order had been placed (two firm, three options) for the world’s first LNG-powered containerships, the Vegas odds of the order emanating from a U.S. ship owner would have been high; the odds of the order emanating from a U.S. ship owner for construction in a U.S. shipyard would have been mind-boggling. Welcome to mind boggling.

The Owner

Tote Inc. (www.toteinc.com) created a palpable buzz last month when it ordered the world’s first LNG-powered containerships from San Diego-based NASSCO (www.nassco.com), a General Dynamics company which is much better known in military shipbuilding circles, but which has amassed arguably the country’s most diverse and deep repertoire in the commercial sector, particularly among the large shipyards.

TOTE, Inc. announced its commitment to build two state-of-the-art, 3100-TEU containerships for the Puerto Rico trade, with options for three more vessels for domestic service. The debate over the advance of LNG as fuel for ships – particularly on ships that are not LNG carriers with their own built-in source or fuel – has raged for years. There is a fair balance of pros and cons on the issue, including:

Pros

- An abundance of cheap natural gas being developed in the U.S.

- The overwhelming environmental emission advantages without after treatment versus diesel.

Cons

- The higher cost of the ship (generally 10 to 20% higher than a comparable diesel)

- The uncertainty of future natural gas prices

- The massive tankage (in comparison to diesel) needed onboard vessels to accommodate the LNG fuel tanks

- The dearth of LNG bunkering stations

Though many questions remain, an increasing number of bold leaders are stepping to the plate and taking the LNG-plunge.

According to Anthony Chiarello, President and CEO of TOTE Inc., the decision to build the ships with the LNG option was a no brainer given the environmental advantages and the startling emissions numbers, particularly in light of ever tightening emission regulations in the ECA zones.

“Last August we announced the conversion of our Alaska Ships … our ORCA class vessels … to LNG,” said Chiarello. “So we had already spent a lot of time looking at LNG as an alternate fuel source; and we already had a good amount of due diligence completed relative to LNG. So when we started talking to the yards about the newbuilds, there was no doubt that the ships were going to be dual fuel and that LNG was going to be the primary fuel source. That was never a question.”

While the cost comparison between diesel and gas is currently overwhelmingly in favor of gas, Chiarello maintains that environment, not economics, was the project’s driver. “For us, this decision was purely made on the back of the enviromental impact and how the ECA guidelines are driving the shipping business. Within the Saltchuk group of companies (TOTE Inc.’s owner) there are two things first and foremost: Safety and Environmental Stewardship.

In the last week I have been asked a lot if this was it a financial decision and not an environmental one … and the answer is ‘absolutely not.’ I don’t know what LNG is going to cost three years from now when the ships come out; but I absolutely know what the impact will be in terms of emissions: that’s not going to change. If there’s an advantage from a fuel cost perspective, that will be wonderful, but that’s not what this decision was based upon: it was purely an environmental consideration.”

And in a word, the environmental impact is staggering.

The vessels are already being touted as the most environmentally friendly containerships in the world with CO2 emissions-per-container that are 71% less than the vessels now in the Puerto Rican trade. In addition, Particulate Matter will be reduced by 99%; Sulfur oxides will be reduced by 98%; and Nitrogen oxides will be reduced by 91%. The 3100 TEU vessels are expected to be the largest ships of any kind in the world powered primarily by liquefied natural gas (LNG). Both ships will be powered by dual-fuel LNG engines that surpass the requirements of the U.S. Environmental Protection Agency’s clean air regulations.

The new ships will operate in TOTE’s Puerto Rican trade, a route that currently has three TOTE ships in the region, two active, one in lay-up. Because of the North American ECA regulations, the ships currently serving the trade cannot be run past 2019.

Universally, the lack of LNG bunking facilities has been acknowledged as one of the chief detriments to the immediate uptake of LNG as a primary fuel in the marine market.

According to Ole Grøne, Vice President Low-Speed Sales and Promotions, MAN Diesel & Turbo, LNG fuel for ships appears to be a harbinger for things to come and expects the take-up by shipowners to increase accordingly, but he said the limiting factor at the moment is the availability and lack of infrastructure on the LNG bunkering side of the equation.

But Chiarello believes this will soon be changing.

“The only remaining piece of the puzzle? Locking in our fuel source in both the Pacific NW as well as in the PR service,” he said. “But in the last week, immediately following our announcement, I’ve had no less than a dozen contacts to us from parties who are already providing LNG in other locations that would like to provide it to us, or a bunkering service or direct line. We have little concern that there will be adequate choice of fuel source.”

The Builder

General Dynamics NASSCO in San Diego, California will build the vessels, with the first two scheduled to be delivered and enter service between Jacksonville, FL and San Juan, PR in 2015 and 2016.

Fred Harris is the ubiquitous and long tenured president of General Dynamics NASSCO, and he summarizes the job succinctly: “This project breaks new ground in green ship technology. It adds to our design and production capabilities and validates our reputation as one of the nation’s leading shipyards for commercial and government new-construction shipbuilding.”

As U.S. shipbuilding has undergone considerable consolidation in the past decade, NASSCO has emerged as the one that seems most able to balance commercial and navy shipbuilding loads, leveraging its partnership with a leading South Korean shipbuilding yard as well as its own investment in facilities, equipment and people.

“NASSCO has three primary segments of business: Government New Construction, Commercial New Construction, and Government Repair. These three segments provide us the ability to level load our workforce during times when one segment is down, but another segment is up, which historically is often the case. As a result, NASSCO has one of the most experienced workforces in the country – our journeyman-to-trainee ratio is better than 60:1,” said Harris. “Another key ingredient for success is that we put significant effort into leveraging world-class commercial design and construction standards from our design and procurement partner, Daewoo Ship Engineering Company (DSEC). DSEC is a subsidiary of Daewoo Shipbuilding & Marine Engineering (DSME), the second largest shipyard in the world, that focuses on international collaboration projects. DSME and DSEC stay on the cutting edge of design and shipbuilding technologies.

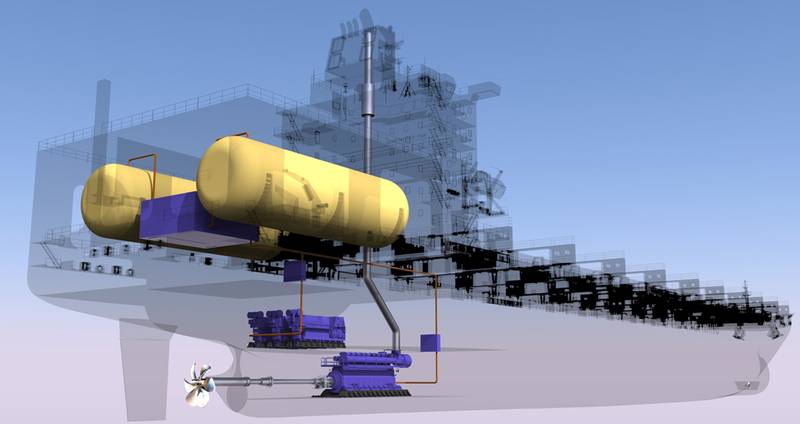

When completed, the 764-ft.-long, 3,100 TEU LNG-powered containerships are expected to be the largest ships of any type in the world primarily powered by liquefied natural gas (LNG). The ships will be designed by DSEC, and the design will be based on proven containership-design standards and will include DSME’s patented LNG fuel-gas system and a MAN ME-GI dual fuel slow speed engine.

“I think this contract symbolizes two significant points,” said Harris. “First, the United States can still take a leading position in the global maritime industry by smartly teaming and learning from world-class shipbuilders. In our case, DSME/DSEC represents the vehicle to help us achieve this ability. The United States will never be able to compete commercially against world shipbuilding powers primarily located in Korea, Japan, and China. However, we have demonstrated that a mutually beneficial partnership can be achieved. Second, this contract represents that the Jones Act is alive and well. While the Jones Act provides a means of economic, national, and homeland security, this contract demonstrates that there is also a market for U.S. Jones Act owners, operators, and shipbuilders.”

The vessels will operate on either fuel oil or gas derived from LNG, which will significantly decrease emissions while increasing fuel efficiency as compared to conventionally-powered ships. The LNG-powered containerships will also include a ballast water treatment system, making them the greenest ships of their size in the world.

“At the end of the day, these are containerships powered by a large, slow speed MAN diesel engine,” said Harris. “The unique challenges presented to us are directly associated with the LNG-propulsion system. First, NASSCO, DSEC, and TOTE will have to work closely with the classification society and the USCG to ensure that the design is approved in an efficient manner. Second, NASSCO will need to determine precisely how to supply and bunker the LNG before ship delivery. Last, NASSCO must safely and successfully test and operate the fuel gas system. While these are unique challenges, all of these challenges can and will be overcome over the course of the project.”

The Engine Maker

MAN Diesel & Turbo will supply the low-speed, dual-fuel ME-GI engine for the TOTE containership project, a high-profile win for the global power company. The vessels will each be powered by 8L70ME-GI dual-fuel gas-powered engines.

Unveiled at a major event at MAN Diesel & Turbo’s Copenhagen Diesel Research Center in May 2011, the ME-GI engine represents the culmination of many years’ work that began in the 1990s with the company’s prototype MC-GI dual-fuel engine that entered service at a power plant in Chiba, near Tokyo, Japan in 1994.

While the “LNG as ship’s fuel” concept has just started to pick up speed in the last few years with the emergence of ever-tightening emission regulations, Ole Grøne, MAN Diesel & Turbo’s long-tenured Senior Vice President Low-Speed Sales and Promotions, puts recent developments in perspective.

“It is important to realize that we have been advocating the GI concept for decades; but frankly, the market was not ready for it,” Grøne said. “In fact, the first presentation for a GI engine was at the CIMAC conference in 1983.”

In step with environmental regulation changes has been the discovery and recovery of abundant amounts of cheap natural gas, particularly in North America. “Now the gas price has changed significantly,” said Grøne. “In the U.S., you have found a lot of gas, and the price is low, plus you have looming sulfur level regulations.”

Depending on relative price and availability, as well as environmental considerations, the ME-GI engine gives shipowners and operators the option of using either HFO or gas – predominantly natural gas but also, eventually, LPG.

MAN Diesel & Turbo sees significant opportunities arising for gas-fuelled tonnage as fuel prices rise and modern exhaust-emission limits tighten. Indeed, previous research indicates that the ME-GI engine delivers significant reductions in CO2, NOx and SOx emissions. Furthermore, the ME-GI engine has no methane slip, and it is therefore the most environmental friendly technology available.

“Our experience with two-stroke, dual-fuel engines stretches back to the 1990s,” said Grøne. “With the current developments in fuel prices and multiple customer requests for a solution, the momentum towards the development of a commercial, low-speed dual-fuel engine became unstoppable. We see this order as a natural culmination, and see the ME-GI as the beginning of a significant new era.”

MAN Diesel & Turbo predicts a broad, potential market for its ME-GI engine, extending from LNG and LPG carriers to other oceangoing vessel segments such as containerships as well as ships plying a fixed trade. As such, the ME-GI engine represents a highly efficient, flexible, propulsion-plant solution.

Shipbuilding by Numbers … Easy as “1, 2, 3”

While it may come as a surprise to some that the world’s first LNG-powered containership will be built in a U.S. shipyard, it should come as a surprise to none that the U.S. shipyard selected is General Dynamics NASSCO in San Diego, Calif.

In the massive consolidation of big shipbuilding prowess which has swept the U.S. industry over the past decade, NASSCO has emerged as a clear leader in ship construction and repair for both the U.S. Navy as well as commercial customers. While part of the credit lies with the shipyard’s strategic alignment with leading commercial shipbuilders in South Korea, the lion’s share resides within the yard itself, which has followed a steady course facility and personnel investment and improvement to help reduce costs while increasing quality.

“As you are aware, General Dynamics NASSCO is the only full-service shipbuilding and repair yard on the West Coast of the U.S.,” said Fred Harris, President, NASSCO. “We aggressively pursue continuous process improvements to reduce product cost and cycle times on each of our shipbuilding and repair programs. NASSCO has taken a systematic approach to reduce the cost of producing new ships while still delivering a quality product. This approach addresses our production facilities, our design processes, and ultimately, those activities taking place at the deck plate level in the shipyard. Looking to the future, we are examining how to further improve total cost of ownership for our customer.

According to Harris, there are essentially three means the yard is working at to this end.

1. Modifying Facilities:

The systematic approach NASSCO has taken to continuous improvement began with a complete assessment of the shipyard facility in 2005-2006. The focus of this capital investment was to provide ample lay down space for the outfitting of large ship blocks and grand blocks, prior to their erection into a graving dock or building ways. The company invested approximately $150m in facility improvements between 2006 and 2009. The expenditures made on these capital investments came as a direct result of NASSCO’s relationship with world-class Korean shipbuilders and associated benchmarking of capabilities accomplished through GAP analysis. Major renovations to NASSCO’s facility during this time included the establishment of a fully-enclosed, onsite blast and paint facility, and the addition of a new intermediary stage of construction known as Stage of Construction 4 (SOC 4).

The integration of General Dynamics Marine Systems Group principles brought the thought process of moving the final State of Construction 6 (SOC 6) work to earlier stages of construction at NASSCO. In early stages of shipbuilding production, it is cheaper and easier to redesign the product so that it is more producible. Prior to bringing these producibility measures to production, all cost reduction measures resided in the engineering and planning phases at NASSCO. By bringing cost reduction measures to production, the number of man-hours required to build each ship was reduced by improving efficiencies in touch labor.

2. Lessons Learned, Lean Six Sigma, and Process Improvement Initiatives

The introduction of Lean Six Sigma (LSS) to the modernized shipbuilding processes now in place at NASSCO allowed for the modification of these processes for better efficiency. This effort looked at processes from supplier to end user, exposing hidden productivity gains in material handling and processes aimed at reducing rework. Similarly, the Process Improvement Initiative (PII) Program unleashed the capability of NASSCO’s workforce by having employees focus on and speak up about what they can do to improve their jobs on a daily basis. Individuals at the deck plate level who best know the intricacies of what their tasks entail can provide the best input. Today, we now have 3,000 employees now working to reduce cost at NASSCO. Of the 10,000 employee ideas submitted to the PII Program in 2010, 75% were implemented. This year, we expect to have more than 20,000 ideas submitted, with 90% of them incorporated into our processes. With the implementation of the PII program, NASSCO has multiplied the number of people thinking about cost saving in the shipyard by tenfold. The entire enterprise is now involved in cost reductions, whereas before it was focused in Engineering and Planning.

3. Considering Total Ownership Costs

The three tenets of NASSCO shipbuilding are: (1) get the design process down; (2) know how you are going to build the ship (i.e. facility considerations); and (3) get the design and planning done prior to the start of construction, with all construction material available prior to start of construction.

NASSCO realized that the costs associated with producing naval and commercial vessels can be greatly improved by the efficiencies of the shipbuilder. It is estimated that 85% of the total ownership cost for a ship over its lifetime is formed at the earliest design phases. Currently, NASSCO and the U.S. Navy have established a partnership in which to openly discuss reducing costs at the acquisition phase. In our commercial shipbuilding activities, NASSCO works closely with our customers throughout each step of the design and construction phase to ensure that further cost saving considerations will be realized over the total life of the ship. NASSCO envisions that these discussions will be expanded on the TOTE contract, given that this shipbuilding program is a first-of-its-kind in the field of LNG propulsion.

TOTE Today

On January 1, 2012, American Shipping Group underwent a dramatic transformation. The company, formerly known as ASG, became TOTE, Inc., and experienced a complete structural and cosmetic makeover. TOTE, Inc. organized its five independently managed businesses in to three groups:

- Maritime,

- Logistics, and

- Ship Management

Choosing to adopt the TOTE name was an easy decision for the organization. “We felt the “America...” name was somewhat limiting with our goal of expanding our logistics services beyond the USA. Totem Ocean Trailer Express (TOTE) has a very strong brand in the trade it services. It is highly respected so it was an easy decision to utilize that strong brand for the overall parent company branding,” said TOTE, Inc. President & CEO Anthony Chiarello.

Totem Ocean Trailer Express was founded in 1975 and offers twice-weekly cargo ship operations between the Port of Tacoma, Washington and the Port of Anchorage, Alaska. The company represents the foundation a much larger Seattle-based operation, Saltchuk Resources. Saltchuk was founded in 1982 with the acquisition of Totem Ocean Trailer Express from Sun Ships. Since then, Saltchuk has grown its portfolio to over 20 independent companies, organized in to six operating groups, TOTE, Inc. being one of them.

(As Published in the January 2013 edition of Maritime Reporter - www.marinelink.com)