Times are Bleak for Ship Recyclers

As oil and even the overall Baltic Exchange’s main sea index fell further this week (about 1.6%), the increasing supply in tonnage is regrettably being met by further disappointment as ship recycling prices fell across the board and have remained subdued through the week, reports cash buyer GMS.

Any sales that are being concluded are at numbers now dropping towards the mid USD 400s/LDT, with some facing even lower indications due to their poorer overall condition. Post-monsoon too has unsurprisingly bought little respite to ease the instability in the markets that many had been hoping would’ve been a lot more stable, says GMS. The markets have now lost well over USD 100/LDT on levels since the peaks seen over the year, where a container ship was sold above the highly coveted USD 600/LDT mark into Bangladesh.

“Cheap Chinese product also continues to stifle steel industries in both Pakistan and India despite restrictive tariffs being set into place. Moreover, as Pakistan’s economy continues to crumble amidst IMF loan hurdles, dithering foreign currency reserves, and reports of mismanagement of funds, both India and (especially) Pakistan are unable to prevent the continued dumping of underpriced Chinese billets into their respective markets.”

The pending outcome of the U.S. elections has already seen mixed performance from the U.S. dollar across ship recycling nation currencies. Consequently, end buyers remain logically reticent to commit at these present lower levels even now, rightly fearing inevitable market instabilities as plates continue to dance around.

“It is therefore a bleak outlook across all ship recycling markets at present, and with supply only expected to increase going into the new year on the back of freight markets (particularly dry bulk) cooling off, all will be wondering where recycling prices find their bottom and what prices will result in all parties getting back to the bidding tables again.”

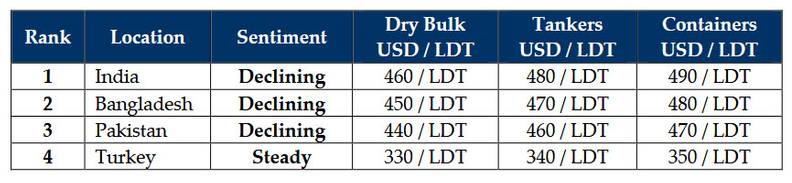

GMS demo rankings / pricing for week 44 of 2024 are: