Sub-Continent Recyclers Hope for Better 2024

As we enter the last week of 2023, sub-continent markets struggle on, says cash buyer GMS, going the final furlong to round out what has been an overall disappointing year for pricing and volumes.

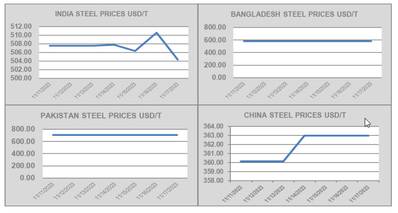

Prices have collapsed from over $600/LDT to below $500/LDT over certain stages this year, seeing around $150/LDT wiped from residual values in a shock for owners and cash buyers alike.

“Now that currencies and steel prices seem to have stabilized across the board for the time being, many will be hoping for a more bullish 2024, particularly as the supply of tonnage is set to increase – from both the dry bulk and container sectors.”

Ready and available financing will remain the chief component in how far markets are able to push on in the new year, and there is some hope that incoming IMF loans and settled elections will bring greater desire from buyers and for banks to loan again.

International prices have gained good ground over the last quarter of the year, says GMS, but markets in India have yet to keep pace – instead actually losing around 7-8% in value in the last month alone.

Regulatory aspects are certain to cause disruption in 2024, with the new UAE ship recycling directive coming into effect and the EU finally willing to consider adding Indian yards to their approved recycling list.

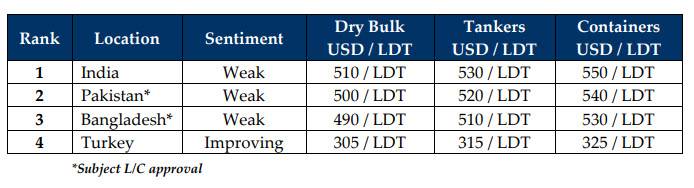

For week 51 of 2023, GMS demo rankings / pricing is: