A brief pre-millennium recovery in the long-depressed Handy size bulk shipping markets appears to have been snuffed out before it got going, brokers said.

A rush of available tonnage seeking charters ahead of the holiday period was to blame, brokers said.

Collapsing Panamax rates, after their recent recovery based on pre-Christmas fixing, were also depressing the Handy sector.

"For a couple of days this week things looked perkier. Rates moved up, but now they are in reverse," one Handy broker said.

The J E Hyde Handy index dropped by nine points on Nov. 18, and brokers said heavy falls were on the way.

Ships were being brought in early, particularly on the Continent, to find fixtures that would put them at sea with a cargo over the December 20-January 10 period, brokers said.

The number of available ships was depressing rates, and vessels fixed on subjects were repeatedly failing.

One broker talked of a 50,000 ton vessel being fixed and failed three times.

"On Tuesday (Nov. 16) we hoped the recovery could be sustainable for up to ten days, but now there is a feeling that if it continues going down it won't come back," another broker said.

However, brokers said there was a substantial differential between day rates and period charters.

In the East, 40,000 ton vessels were obtaining $8,500-$9,000 a day for four to six month time charters, compared with a fixture of $5,300 for a prompt Singapore to Boston back haul trip.

Day rates should be averaging $7,500 on the basis of $10,000 out to the East and about $6,000 back, they said. "The interest in short period charters at better rates suggests there is a feeling out there that better times may be ahead," a broker said.

Meanwhile, Panamax rates were falling back from the peaks of the last two weeks.

Round trip Pacific voyages could be below $10,000 a day by Monday, one broker said, from $10,500-$11,000 a week ago.

"There is a hole in the U.S. Gulf with just not enough cargo for committed ships," a broker said.

He predicted rates of $22.00 a ton, down from up to $23.00 a week ago.

The rapid falls could rebound, particularly if reported Iranian interest in French grain saw them buy up to 600,000 tons for delivery between December and mid-January. So far Iran was said to have purchased 300,000 tons.

"Panamax rates will be softer until December 10 and thereafter it's anyone's guess," a broker said. "But there could be one last thrust before the holiday period."

Sponsored Content

MSC Sets a New Standard for Time Off in 2025, Plus Earn a $44,345 Bonus as an Able Seaman!

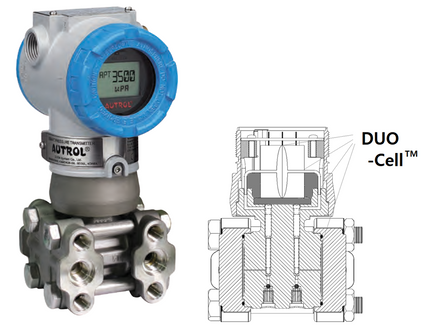

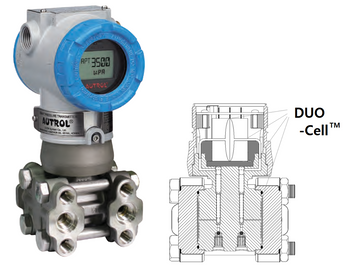

The Future of the Advanced Measurement Industry: A Vision of Precision, Safety, and Reliability

Subscribe for

Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week