VesselsValue’s new Small Dry module provides values for MPPs (and heavy-lift), single and tweendeckers, small handys and general cargo vessels. On the heels of its November 2015 launch, VesselsValue delves deeper into the sector’s nuances, premiums and discounts.

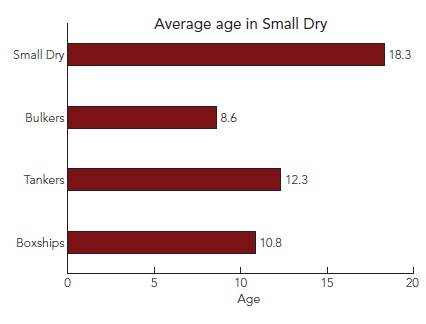

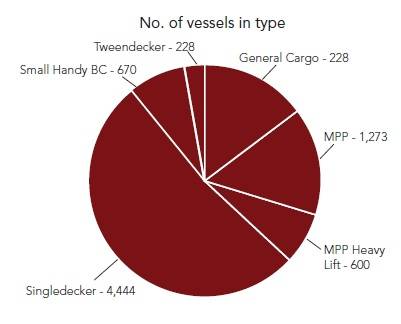

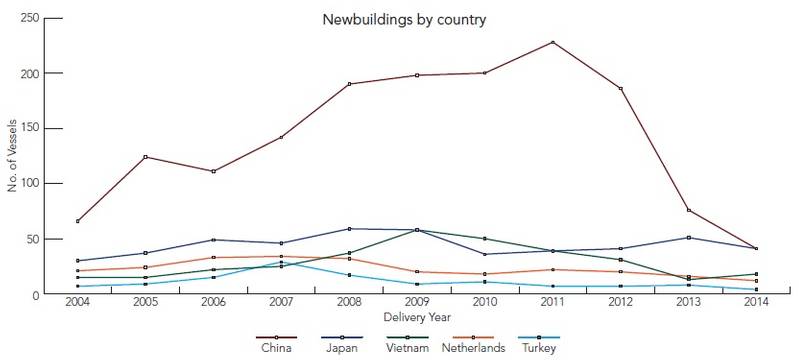

The small dry sector is relatively old and experiences a much lower rate of fleet renewal than perhaps bulkers or tankers. On VesselsValue the average age of a small dry vessel is 18.3 years compared to that of bulkers (8.6 years), tankers (12.3 years) or containers (10.8 years). Fleet renewal has floundered in recent years; newbuild deliveries peaked in 2008 at 401 vessels being delivered. Almost 50 percent of these were constructed in Chinese yards, the output being five times that of its nearest competitor, Japan. Yet fast forward six years and only 132 small dry vessels were delivered. In the sector newer vessels tend to lend themselves to a greater level of specialization with the average age in the MPP Heavy-lift sector sitting at 8.4 years. Tweendeckers, on the other hand, have a much higher average age of 22.9 years. These are an example of vessels that have become increasingly defunct due to improved port infrastructures, increased parcel size and ship design.

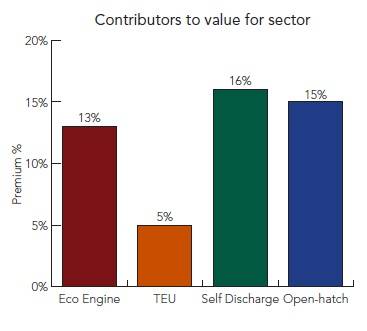

So what premium or discount does a vessel receive for its defining features? The latest fashion/fad of shipping has been the Eco engine. VesselsValue values around 8,500 small dry vessels of which approximately 30 are fitted with an Eco engine. The gross majority of these are heavy-lift MPPs with a few small handys also. So for such a small minority, one would expect a significant premium; we give on average a premium of 13 percent. The small dry sector is well known for its flexibility and post containerization there was increasing demand for these vessels to carry containers. This now represents a significant proportion of small dry trade. Around 40 percent of the fleet carry TEU and the average premium these vessels will receive over non-container carrying vessels is circa 5 percent.

Other features that will be particularly attractive in the small dry sector are the ability to self-discharge and the open-hatch design. Self-discharging vessels are supremely suited to the small dry trade, operating in small ports with less infrastructure. Vessels will attract a premium of around 16 percent on average if furnished with self-discharging equipment. The open-hatch design also lends itself to small dry vessels given the nature of the general cargoes being transported. Only singledeckers and small handys are known as having open-hatch design; for a singledecker this receives a premium of 8 percent, rising to 14 percent for small handys.

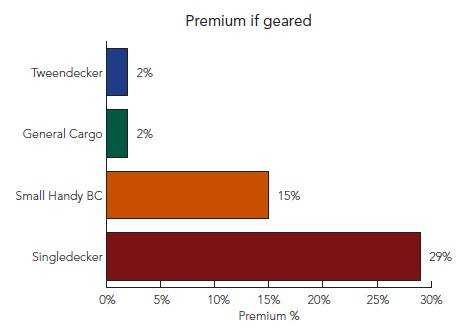

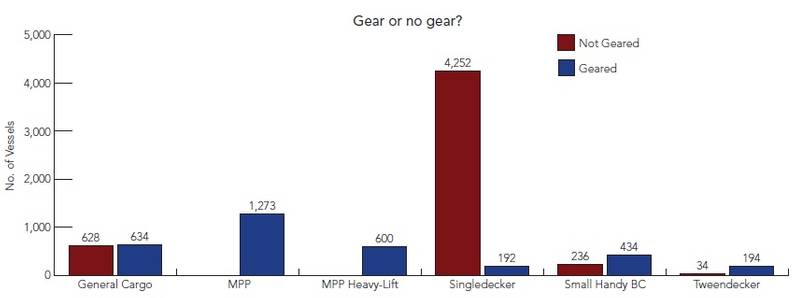

The most significant defining feature that contributes towards value is the vessel’s gearing or lack thereof. Again, similar to self-dischargers, gearing is particularly important for the small port trade that small dry vessels invariably find themselves operating in. MPPs and Heavy-lift vessels by definition are all geared. General cargo vessels are split approximately 50/50 and only 4 percent of the singledecker sector is geared. How much more is a vessel worth with gearing than without? Of the 4 percent of singledecker vessels fitted with lifting equipment, they are on average 29 percent dearer than their gearless equivalent.