Ship Recycling: Vessel Offerings Have Declined

Action in the Middle East, including a repeat Houthi attack on container vessel Groton in the Red Sea, has increased volatility in the region, and the already slim pickings of tonnage for recycling only got worse through August, reports cash buyer GMS.

“The desperate question unraveling in everyone’s mind is whether this is expected to be the case through 2024 / early 2025? Interestingly, even though we have seen sub-continent ship recycling nations take independent measures to curtail the devastating state of economic affairs, one that has mercifully seen inflation decline, it is regretful to witness how “war” in the Middle East would cast a wider dragnet of global economic misery and make it that much worse for those States where the fighting is unfolding.”

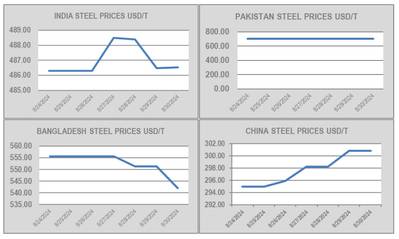

Meanwhile, vessel offerings have declined by about USD 60/LDT (and growing) since the peaks witnessed earlier in the year, as dry units are now seeing levels firmly below USD 500/LDT across sub-continent destinations, particularly on smaller LDT, laid up, Far-Eastern built, owned, and operated units.

While there has been an overall dearth of large LDT vessels, this has likely been a relief to the Bangladeshi and Pakistani markets where L/C and banking limits for a growing number of recyclers has been getting stretched.

India has only seen a depressive movement since the announcement of its recent budget. “On the one hand, Alang recyclers remain frustrated that the freshly formed coalition government has deprioritized domestic infrastructure projects, and on the other, the ongoing import of cheap Chinese steel continues to afflict the recycling industry.” It has led to an undercutting of prices on local inventories. As such, recyclers in Alang and Gadani remain beset by the import of cheap Chinese steel and remain in wait-and-watch mode before offering afresh on tonnage again, logically fearing further falls ahead.

“As a tumultuous time infects ship recycling nations, the focus should not be on buying ships, but rather, on initiating some form of global peace in the hopes of a better tomorrow.”

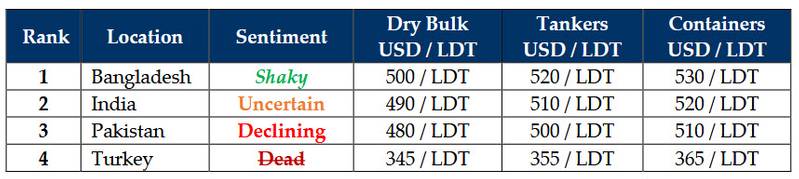

For week 35 of 2024, GMS demo rankings / pricings are: