Ship Recycling Prices March Higher, Doubling in a Year

Far from the traditionally expected slowdown during the monsoon / summer months, sub-continent recycling markets fired on at pace once again this week, and a slowdown in the supply of tonnage of late is likely contributing to some overly aggressive offerings from hungry end buyers.

Steel plate prices in Bangladesh and Pakistan continue to firm, while India has cooled off and remains tentative on any fresh/incoming vessels, especially after a bullish last few weeks.

Notwithstanding, there certainly must be a ceiling on proceedings as prices have doubled over the last year, reaching the ongoing unprecedented and crazy levels in the high $500s/LDT that seem like they are set to breach $600/LDT any time soon.

Not since the heady days of 2008 have we seen such consistently firm levels on scrap prices, and it will be interesting to see how much longer this trend persists, with many analysts predicting that this ongoing ‘super-cycle’ may be set to end at some point before the end of the year and that could eventually turn tumultuous at that time, for ship owners and cash buyers alike.

Dry bulk and container rates continue to impress and as such, there are very few recycling candidates from these particular sectors on offer, especially as tankers and offshore units make up a majority of a rather limited supply at present.

Covid-19 continues to present significant problems across the sub-continent markets and Bangladesh has once again gone into a hard lockdown, with offices closed and residents told not to leave their houses, to try and prevent the spread of the dangerous Delta variant of the virus.

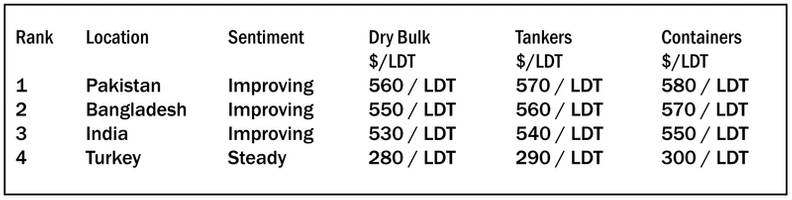

For week 27 of 2021, GMS demo rankings / pricing for the week are as below.

Source: GMS

Source: GMS