Ship Recycling Market Surges

After a dire summer that saw over USD 100/LDT wiped off vessel recycling prices in Indian sub-continent ship recycling markets (and even Turkey to an extent), nearly all of the markets have enjoyed an upward resurgence entering the fourth quarter of the year.

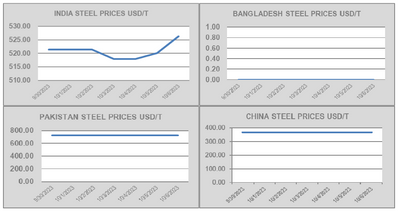

India has been the primary beneficiary of this recent resurgence with some stunning (container) purchases, some even approaching the USD 600/LDT mark once again, reports cash buyer GMS. As China too entered a holiday period, Indian local steel plate prices were the only ones to have traded this week and even gain marginal ground, all while the Indian Rupee remained relatively steady against the US Dollar. Demand from Alang buyers also remains rampant pursuant to a successful G20 summit and the announcement of various infrastructure projects.

“It is therefore unsurprising to see most of the tonnage head towards Alang, which remains the market of the moment with the top payers / players / performers and has been the most reliable destination for transacting lines of credit of all sub-continent markets,” says GMS.

“Pakistan has certainly come back into the picture of late and several end buyers have even managed to secure line of credit approvals to purchase five - six (mostly Panamax sized) bulkers. With those vessels successfully beached, Gadani subsequently endured a slight dip and cooling of local demand as bank restrictions resumed. However, as line of credit approvals seemingly start to filter through once again, we can expect sales to take place into Pakistan before the year is out.”

Bangladesh has been disappointing, as prices tumbled uncontrollably during the summer / monsoon months and the Chattogram market is yet to fully recover. “Indeed, line of credit approvals are struggling once again as steel plate prices remain stranded well behind their competitors, to the extent that the BSBRA has had to temporarily halt the sale of inventory from local yards to domestic steel mills, in order to prevent underselling at these loss-making levels.”

Overall, the supply of tonnage has primarily been container ships over the last month, but as dry bulk vessels continue to trade at less than impressive rates, GMS has seen a steady introduction of vintage handy and Panamax bulkers, with capes seeming set to come as well.

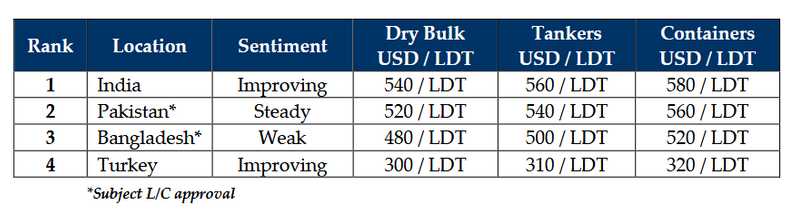

For week 40 of 2023, GMS demo rankings / pricing for the week are: