Ship Recycling Market Faces Tonnage Shortage

Global ship recycling markets are now being exclusively driven by the relentless and futile shortage of tonnage that is expected to continue until Spring (at the very least), says cash buyer GMS.

“The much-anticipated rebound in global recycling volumes that so many in our industry had been waiting (hoping) for before the turn of the year, has unfortunately failed to materialize.”

Markets in Turkey and India remain well off the competitive pace, so Pakistan and Bangladesh remain are leading the market despite the continued drop in supply of vessels. This can be attributed to the unseasonable boom in freight rates on the back of unexpected 2024 geopolitical concerns.

The increasingly positive outlook in Bangladesh and Pakistan results from the easing of financial hurdles and line of credit (L/C) restrictions - that were previously imposed by the respective governments and spanned over two quarters towards the end of 2023. This had practically shuttered the entire Gadani ship recycling sector.

“Elections are due in India next month and with those in Pakistan and Bangladesh having only recently concluded (about six weeks ago), much of the ongoing political uncertainty and unrest that dominated the sub-continent ship recycling nations over recent years should hopefully be settled (or at least until the next election cycle),” says GMS.

In Turkey, economic / fundamental woes remain rampant as the Lira continues to plummet week after week.

Overall, the expected supply of container ships for recycling (perhaps the slowest of all sectors) has yet to materialize, all while owners continue to operate their aging box carriers and exploit trade routes currently afflicted by the ongoing Red Sea conflict, and enjoying the trickledown effects of this (overheated?) charter market, says GMS.

“Sub-continent recycling prices have also remained stable of late, hovering around the USD 500/LDT mark, as there seems less danger of a surprise slide (or even surge) in levels in the near future, given current fundamentals in each market.”

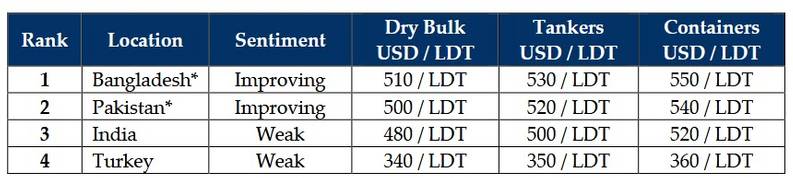

For week 8 of 2024, GMS demo rankings / pricing are: