'24 in Review: Container Vessel's Steams Ahead, LNG Lags

The last 12 months has seen values rise to near-record levels across several sectors of the shipping industry, fuelled by the post-covid shipping boom and a strong newbuild market.

The report states that the newbuild market experienced continued growth, with a notable rise in orders, particularly in the Post/Panamax and Capesize sectors. Chinese dominance in both ordering and shipyard production remains a defining trend, further consolidating their position in the bulker industry.

- Container Sector's Rise

The report states that increased sailing distances from a prolonged Red Sea crisis became the main driver of demand in 2024 that culminated in global twenty foot equivalent unit-miles (TEU-miles) gaining around16% year-on-year, supported by around 6% growth in global trade. As a result, one-year time charter (TC) rates for container vessels rose across all sectors and at the end of the year, Post Panamax earnings hit US$73,330/day, more than double the levels seen at the same time last year and up by an impressive ~111% year-on-year.

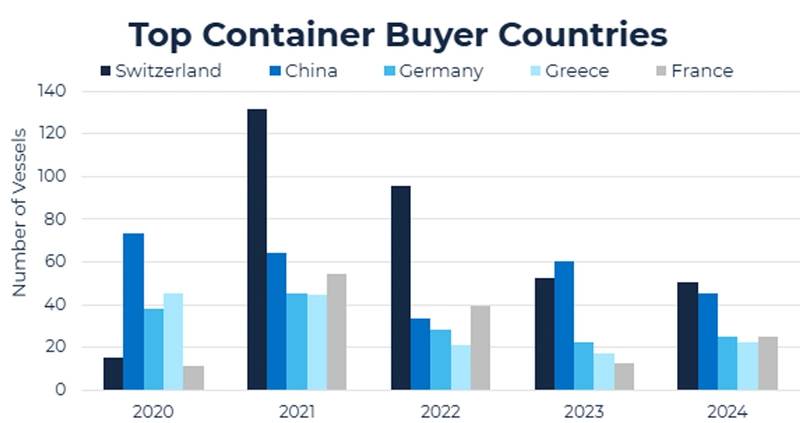

“The container market experienced remarkable growth over the past year, driven by increased demand, rising earnings, and a robust asset value resurgence across all sectors,” Rebecca Galanopoulos, Senior Content Analyst says. “This is also reflected in new ship orders which were up by around 76% year-on-year based on 321 deals including options, compared to 182 orders in 2023.”

Source: VesselsValue, a Veson Nautical solution

Source: VesselsValue, a Veson Nautical solution

- Minerals Exports Drives Bulker Sector

The report also states that values for bulkers strengthened for most of the year, rising across all age sectors and sub types, when compared to 2023 levels. The most impressive gains were seen in the Capesize sector, where values for 15-year-old vessels of 180,000 DWT increased by around 26.1% year-on-year. This was led by firm earnings for bulkers, driven by strong imports of iron ore, bauxite and coal to China, combined with the rerouting of vessels from the Red Sea around the Cape of Good Hope.

The longer distance required for this increased ton mile demand, and this has had a significant impact on earnings this year. However, although bulker values remain at very high levels compared to the historical average, levels have corrected lower in the final quarter of the year, due to somewhat weaker sentiment.

- Tanker MarketTails Off to Close '24

The report adds that the tanker market kicked off the year with a dynamic start with both rates and values in a strong position, supported by the increased ton mile demand that has occurred because of the sanctions on Russian oil and more recently, vessels travelling around the Cape of Good hope in order to avoid conflict in the Red Sea. However, by the end of the year, earnings had corrected lower and second-hand sales slowed because of very high prices and weak demand from China combined with uncertainty over the recent US elections and what the incoming President Trump may hold in store for the oil trade.

- LNG is a Laggard

The report adds that earnings in the liquefied natural gas (LNG) carrier sector have been soft in 2024 on the back of delayed projects, increased vessel supply and high inventories. Large LNG one-year TC began the year around US$70,000/day but at the beginning of December it stood around US$26,000/day, making the 2024 average of around US$55,000/day, which is 52% below 2023 average. The typical peak season for LNG vessels have been absent this year as 62 vessels have been delivered and demand has struggled to keep up the pace.

“Looking at asset values for fixed age LNG vessels [Veson Nautical] sees firm value developments for all sizes and ages despite a softening in earnings,” Jarl Milford, Maritime Analyst at Veson Nautical says. “Overall newbuilding ordering activity for LNG vessels has increased year-on-year in addition to second-hand transactions and there has also been increased sales and purchase (S&P) activity for LNG vessels.”

Milford adds that the bullish conditions being witnessed in the container market in terms of newbuild orders is contributing to higher asset prices for other markets.

Source: Veson Nautical’s ‘2024 End- Of-Year-Report’.