Otto Marine 1Q 2009 Results

Otto Marine Limited1, an offshore marine specialist, announced results for the first quarter of financial year ending 31 December 2009.

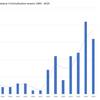

Revenue for the Group increased by 25.2% in 1Q2009 to S$71.7 million from S$57.3 million in the previous corresponding quarter due to an increase in the Group’s shipbuilding business, which saw a growth in the number of vessels constructed, particularly the larger and higher specification vessels. The revenue growth was partially offset by a decrease in revenue from the ship repair and conversion business as the Group shifted its focus away from ship repair and conversion to shipbuilding.

Gross profit rose 10.1% to S$15.0 million in 1Q2009 compared to S$13.6 million in 1Q2008 in line with the growth in revenue. Gross profit margin fell slightly from 23.8% in 1Q2008 to 20.9% in 1Q2009 mainly as a result of the drop in gross profit margin of the chartering business, which saw an increase in ship management costs.

Net profit for 1Q2009 was S$6.6 million compared with S$11.6 million in 1Q2008. The decrease was mainly due to foreign exchange losses of S$1.9 million in 1Q2009, compared to foreign 1 Otto Marine, and together with its subsidiaries, Otto Marine Limited exchange gains of S$1.6 million in the corresponding period last year, as well as a S$1.9 million decrease in interest income and a S$2.1 million reduction of the group’s share of profits in associates. The group’s cash position remains healthy with S$241 million in cash and cash equivalents as at 31 March 2009.

Lee Kok Wah, Group Managing Director of Otto Marine Limited said, “We are satisfied with our 1Q2009 performance despite the current tough economic environment. We will maintain our focus on the timely execution and completion of our order book, which will translate to sales proceeds that will help to boost our cash inflows and further strengthen our financial position. The expansion of our chartering fleet is another key focus area for us, and is in line with our business strategy of broadening our revenue base. In 1Q2009, we are pleased to have completed delivery of, and received full payment for 3 vessels, and we look forward to adding 10 vessels to our chartering fleet by the end of 2009.”

Otto Marine’s order book stands at S$752 million as at 31 March 2009, comprising 19 vessels which includes 12 AHTS (Anchor Handling Tugs Supply) vessels, four PSVs (Platform Supply Vessel), one utility vessel, one offshore construction vessel and 1 work barge with accommodation for 300 people.

Commenting on the Group’s prospects, Mr. Yaw Chee Siew, Executive Chairman of Otto Marine said, “We are cautiously confident that we will be able to ride through the current economic situation based on current global market conditions. Whilst the offshore marine sector, together with many industries, has been affected negatively by the adverse external market and economic conditions, we believe that these turbulent times may unveil opportunities that we may be able to take advantage of if they are aligned with our long-term strategies. We will continue to actively and cautiously review our long term strategies in this market place to deliver value to our shareholders.”

(www.ottomarine.com)