Sea Containers Ltd., the transport group engaged in marine container leasing, manufacturing, depot

and logistics operations, railways operator, ferry operator and leisure

industry investor, issued a statement today about a major restructuring of

its ferries division and other matters.

Background The company's ferries business is composed of three units. The

largest is Silja Oy Ab, the Finnish based leading Baltic operator of cruise

ferries, ro-pax ships, fast ferries and cruise ships. The second is the

company's car-carrying fast ferries business with 9 ships operating in

European waters other than in the Baltic. The smallest unit is SeaStreak, the

New York based commuter ferry service operating between New Jersey ports and

Manhattan.

In 2005 the profits of Silja have declined significantly, due to a

combination of higher fuel costs which could not be recovered except on

services to Estonia, the unsuccessful m.v. Finnjet operation between Germany,

Estonia and Russia, reduced profits from duty free sales and overcapacity in

the Swedish market introduced by competitors. However, Silja still remains

the leading operator in its region with an excellent brand name and

reputation for quality, with its core business remaining profitable.

The company's car-carrying fast ferries incurred losses in 2005, due in

large measure to high fuel prices. The ships burn light fuel which has

doubled in price over the 2004-2005 period and it has been impossible to

recover the extra cost through fuel surcharges. Other factors have impacted

earnings. The ferry routes between France and England across the English

Channel have suffered from declining passenger and car volumes, excess

capacity and reduced profits from low tax merchandise sales. The company's

subsidiary, Hoverspeed, operates between Dover and Calais in the English

Channel.

SeaStreak, operators of services employing 7 foot-passenger only fast

ferries on three routes between New Jersey and Manhattan has also incurred a

loss in 2005 due largely to high fuel costs. Passenger fares are being

steadily increased to recover the extra cost but the market will only absorb

such increases to a certain level before switching to cars, buses and trains.

In light of the situation described above, the board of Sea Containers

met on November 2, 2005 and has decided to take measures that should

eliminate or greatly reduce the operating losses being incurred.

In the case of Silja Oy Ab, the company has decided to entertain offers

to buy the business. Societe Generale has been appointed to conduct a

controlled auction of Silja. In order to restore Silja's health, a number of

steps are being taken to improve operating results. These are:

1. The cruise ship m.v. Walrus will be sold preferably or if sale cannot

be achieved on satisfactory terms, it will be chartered out. The ship has

recently ended a long term charter and is having off-hire rectifications at

charterers' expense in Singapore.

2. The Swedish flag cruise ship, m.v. Silja Opera will be sold preferably

or if sale cannot be achieved on satisfactory terms, the ship will be

chartered out for operation outside the Baltic without high cost Scandinavian

manning. The ship will operate in the Baltic until February, 2006, relieving

the ships Silja Serenade and Silja Symphony which will be undergoing three

year surveys and docking at that time. Silja regrets the loss of the Silja

Opera which has established a good market following, but trade unions have

been slow to allow manning conditions which would enable the vessel to

continue to operate in the Baltic.

3. The m.v. Finnjet has left the Baltic and is currently on charter to

Louisiana State University Health Science Center through FEMA, based in Baton

Rouge, Louisiana. This vessel will not return to the Baltic. The vessel will

be offered for sale, or failing sale on satisfactory terms, it will be

chartered out. If chartered out, the ship's diesel engines may be increased

in power to allow 24 knots service speed which prospective long term

charterers have requested. The ship's hull was built for a 30 knot speed

using a combination of diesel engines and gas turbines but gas turbine

operation is prohibitively expensive in light of today's high costs for light

fuels.

4. The ro-ro ship m.v. Starwind has been sold for $5.4 million in the

fourth quarter, close to her book value.

5. Silja's three SuperSeaCat fast ferries will be reduced to two for

operation between Helsinki, Finland and Tallinn, Estonia. Financial

performance will be improved through better manning arrangements and other

operational measures. The third SuperSeaCat will be returned to Sea

Containers for deployment in the Mediterranean in 2006.

6. Silja's flagship service employing state of the art vessels Silja

Serenade and Silja Symphony, each with 2,852 beds, will be given a $12

million upgrade to freshen the product and increase their profitability. This

upgrade will be financed with asset sales or through mortgages on these

assets.

7. Silja's largest vessel, m.v. Europa, will continue to operate on the

Turku-Stockholm and Turku-Kappelskar routes together with m.v. Festival which

operates between Stockholm and Turku. Silja currently also operates two

roll-on, roll-off ships on the Turku-Stockholm route and these vessels are

capacity constrained.

8. Silja will be reducing its staff and offices in Finland, Sweden and

Germany, including up to 150 shoreside jobs at a cost of up to $10 million,

achieving annual savings of approx. $18 million.

Additionally, an action plan for improved internal cost efficiencies is

being implemented to achieve further annual savings of $10 million by the end

of 2007.

9. A restructuring charge of $70 million in connection with the plans

outlined above will be recognized in the fourth quarter of 2005. It is

expected that underlying debt or more will be achieved on asset sales. The

cash component of the restructuring charge will be $10 million or less.

In summary, Silja is being reduced to its core business of 8 vessels

operating on three routes. Silja's EBITDA for 2004 was $70 million and for

2005 after absorbing $22 million of extra fuel costs it expects to achieve

EBITDA of $39 million (excluding restructuring costs). EBITDA is expected to

improve in 2006 and 2007, assuming fuel remains at today's costs and

excluding restructuring charges. It is not possible to predict the sale price

for Silja.

Car-carrying fast ferries The company owns or part-owns 9 such ships. One

SuperSeaCat is on long term profitable charter. Two of the vessels are

operated in the Adriatic in a 50/50 partnership with the Mediterranean

Shipping Company group. It is planned to put a fourth vessel owned by Sea

Containers into the partnership from 2006. The company also operates fast

ferry services in the Cyclades Islands in Greece in 50/50 partnership with

the Eugenides Group. It is planned to introduce a second vessel into this

trade in 2006.

Sea Containers is no longer able to support Hoverspeed's losses on the

English Channel so it will not operate the Dover-Calais route in 2006 or

thereafter. Hoverspeed has commenced consultation with staff as required by

labor law, which will result in a significant number of redundancies. A

restructuring charge of $15 million will be established to cover the closure

of Hoverspeed's Dover-Calais services.

Two of the company's car-carrying fast ferries are older than the other

ships and were built to a different construction code than applies to newer

vessels. These two vessels are currently laid up awaiting charter or sale.

Some countries (but not major ones like the U.K., France and Italy) will not

permit vessels built to the older code to operate to their ports, thus

reducing the company's range of deployment possibilities. The company has

determined, therefore, to reduce the carrying value of the two vessels built

to the earlier code by $19 million in total and to sell the ships in due

course. Two sister ships built to the latest construction code are employed

in joint ventures in the Mediterranean where they will remain, however, the

board has determined to write them down by $15 million to estimated current

market value.

Despite the re-deployment or sale of car carrying fast ferries it is

unlikely that this business will cover its full costs in 2006 unless either

fuel prices decline or fuel surcharges can be collected to cover the high

fuel costs. However, this deployment is expected to improve significantly the

operating results from the car carrying fast ferry fleet in 2006. The company

will no longer operate any of these ships itself but instead will charter

them out to joint ventures or other operators.

SeaStreak The company has decided to entertain offers to buy this

business. In the meantime an action plan is being implemented to increase

prices to recover the extra fuel costs, to close the South Amboy to Manhattan

service and take a related charge of $2 million and to have the owners

charter-out or lay up the two older vessels engaged in this service.

SeaStreak time charters the vessels from local owners as required by the

Jones Act.

Sponsored Content

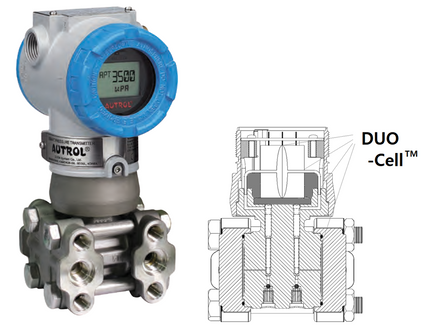

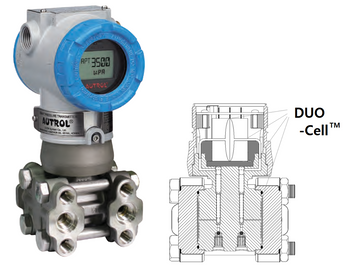

The Future of the Advanced Measurement Industry: A Vision of Precision, Safety, and Reliability

August 2025

Read the Magazine

Read the Magazine

Read the Magazine

Read the Magazine

This issue sponsored by:

Corn Belt Ports: Connecting America’s Heartland to Global Markets

Subscribe for

Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week