Container Service Reliability Falls Again

London, UK, 9th May 2011 –Container service reliability declined for the second quarter in a row during the first quarter of 2011, according to Drewry Maritime Research’s latest Schedule Reliability Insight report.

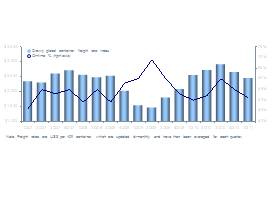

The proportion of the 2,972 vessel calls arriving on time at selected ports around the world during January-March fell back to 51%, down from 55% in the fourth quarter of 2010. The 1Q11 reliability performance was only a percentage point improvement on the on-time score recorded in the same period of 2010.

Despite showing the biggest decrease, the transpacific trade remained the most reliable of the three major East-West routes. Reliability in the transpacific went from 64% in 4Q11 to 55% in 1Q11. In comparison, Asia/Europe/Med services dropped one point to 49%, while transatlantic services went from 55% to 52%.

The decline in service reliability during the first quarter of 2011 mirrors the sharp fall in freight rates that lines have had to endure. The synchronisation of freight rates with reliability is something that has been evident since the first quarter of last year (see Figure 1.1 attached).

“Drewry cannot speculate whether carriers are consciously rewarding or punishing their customers with varying service quality dependent on prices, but it can be assumed that low rates reduce the incentive to deliver above-average service reliability,” said Simon Heaney, editor of Schedule Reliability Insight.

“Compounding the problem, escalating fuel prices mean that carriers are probably less inclined right now to speed up if the ship falls behind schedule.”

Heaney added that the first quarter was punctuated with numerous service changes and additions. The tinkering of service networks does little to aid reliability in the short term.

Not for the first time, the report revealed a sizable gap between the best- and worst-performing lines. Focusing on the Top 20 carriers (as ranked by vessel teu capacity) that provide the bulk of the vessels tracked, the on-time difference between the leading carriers and the lowest-ranked carriers was in the region of 30 percentage points (see Table 1.1 attached).

Having led the major carriers in 10 of the previous 11 quarters, Maersk Line ceded top spot this time around to CSAV. The Chilean carrier managed to improve its on-time percentage sharply to 69.1%, up from 45.5% in 4Q10. Maersk’s on-time average slipped from 70.2% to 66.4%, although this was still good enough for third place in the Top 20 rankings. Splitting those two was APL, which finished the quarter with an on-time average of 67.6%, little changed from 67.7% previously.

The lowest-ranked Top 20 carriers were CSCL (40.1%), UASC (39.8%) and Hanjin (38.8%).

Only seven of the Top 20 container lines were able to equal or beat the 51% on-time industry average and only four bettered their scores from the previous quarter. The most improved carriers were CSAV (up by 23.6 percentage points), Hamburg Süd (+11.0), MSC (+6.6) and Evergreen (+0.8). Those that suffered the biggest declines were UASC (down by 17.2 percentage points), OOCL (-13.1) and Hyundai Merchant Marine (-11.6).

Drewry has been monitoring container service reliability since the end of 2005. Historically, industry averages have ranged between 50-60% with a high of 68% (2Q09) and low of 46%

(1Q07).

Source: www.drewry.co.uk