The cost of operating cargo ships rose marginally in 2017 following two consecutive years of falls, but ship owners should prepare for higher costs led by a spike in insurance premiums, according to the latest Ship Operating Costs Annual Review and Forecast 2017/18 report published by global shipping consultancy Drewry.

After two years of marked decline, average vessel operating costs stabilized in 2017 as pressure on owners was lifted by a nascent recovery across most cargo shipping markets. Trends in ship operating costs are heavily linked to developments in the wider shipping market, external cost pressures notwithstanding.

But the recovery has not been uniform across all sectors, and risks remain. Despite a brighter economic outlook, the industry is still weighed down by excess capacity, poor profitability and high levels of debt and many owners are struggling to survive. Poor financial returns have kept the pressure on costs and we expect this to remain the case for the foreseeable future.

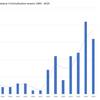

Drewry estimates that the average daily operating cost across the 44 different ship types and sizes covered in the report rose 0.9 percent in 2017, following a 7.5 percent fall over the previous two years (see graph below). Costs rose for most cargo sectors, with the exception of container shipping which achieved a third consecutive year of cost reductions.

The depressed state of shipping markets has forced operators to focus on cost reduction as a means of survival. In the past few years big savings have been achieved in stores and spares, while many owners have been forced to slash repair and maintenance spending, keeping any work to an absolute minimum. Meanwhile, falling asset values and excess capital for hull insurance have depressed insurance premiums. Finally, owners’ largest cost head, manning, has changed little in recent years as wage increases have been kept to a minimum.

“However, there are limits to how long cost cutting can be sustained,” said Drewry’s director of research products Martin Dixon. “This is evident from the uptick in spending on stores & spares as well as repairs and maintenance in 2017. Meanwhile, the recovery in crude oil prices from the lows of 2015 has forced up the cost of lubricants.”

These factors have helped to stabilize overall ship operating costs, while the early signs of a recovery in many cargo markets have given owners some breathing space.

Looking ahead, pressure to restrain costs will continue as many sectors remain overtonnaged and any recovery will rely on fragile fundamentals. Hence, Drewry expect costs under the immediate control of owners, such as manning, spares, repairs & maintenance and management & administration, to be tightly managed.

“But some cost elements are harder to control as they are driven by influences outside an owner’s control,” added Dixon. “Large losses being booked by reinsurers for a series of natural disasters this year will have the effect of driving up hull & machinery as well as P&I premiums in future years.”

However, given the more benign outlook for the remaining cost heads, overall ship operating cost inflation is expected to remain moderate over the next few years.