The multipurpose shipping market, including the breakbulk and project cargo sectors, has struggled over the last few years, but conditions are ripe for recovery, according to a recent report from shipping consultancy Drewry.

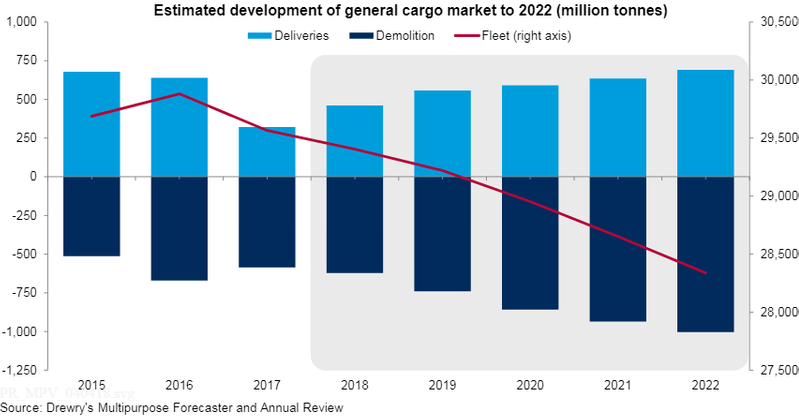

A strong start to 2018 in the multipurpose shipping segment is expected to continue as the sector’s recovery advances further on increasing demand, contracting vessel supply and shrinking threats from competing sectors, Drewry reported in the latest edition of its Multipurpose Forecaster and Annual Review. In addition, dry cargo demand is growing, with a number of drivers reporting improving conditions, while the multipurpose fleet is contracting as older, smaller, less heavy lift capable tonnage is weeded out.

“This year has started with renewed optimism and it is Drewry’s belief that the market has finally turned that corner,” said Drewry’s lead analyst for the multipurpose sector Susan Oatway. “Rate rises are never stratospheric in this sector, but we believe a steady growth of around 2-3 percent per year is possible over the forecast period.”

However, there are still concerns over the market’s medium-term outlook, especially when considering the diversity of drivers that supports this sector. Tariffs on U.S. steel imports, the looming marine fuel sulphur cap and a shrinking simple multipurpose fleet are among causes for concern.

Drewry expects the impact of tariffs on U.S. steel imports will be limited. The 45 million metric tons of steel imported into the U.S. on a yearly basis represents just 8 percent of the global trade. And many countries have now been exempted from tariffs, including the two largest U.S. suppliers, Canada and Mexico. Furthermore, under certain scenarios, alternative trading patterns could lead to an increase in ton-mile demand.

There is to be no push back on the International Maritime Organization (IMO) deadline to implement a 0.5 percent sulphur cap on marine fuel from 2020, so owners are looking at three costly measures for compliance. They can either install scrubbers, use expensive low-sulphur fuel or switch to vessels fueled by liquefied natural gas (LNG). For the older, simpler vessel this could be the impetus needed to send overage vessels for demolition since almost 10 percent of the fleet is over 30 years old, Drewry said.

The simple multipurpose fleet – those vessels with lift below 100 tons – has already started to contract at a rate that is affecting the whole fleet. However, Drewry believes that the future is with the project carrier sector, i.e. those vessels with lift greater than 100 metric tons.

“Some 80 percent of all newbuildings over the last five years have heavylift capability, and at least 70 percent of the orderbook has this capability. The project carrier fleet is growing, but it will be some time before it reverses the decline in the overall multipurpose fleet,” added Oatway.