Great Lakes Iron Ore Trade Drop Below Five-Year Average in March

Shipments of iron ore on the Great Lakes were below one million tons in March, a decrease of 39.1% compared to 2024, reports the Lake Carriers’ Association. Loadings were also below the month’s five-year average by 19.4%.Year-to-date, the iron ore trade stands at nearly three million tons, a decrease of 31.9% compared to a year ago. Iron ore shipments are 15.2% below their five-year average for the first three months of the year.Since 1880, Lake Carriers’ has represented the U.S.-flag Great Lakes fleet…

Global Seaborne Iron Ore Trade will be Rocked by Guinea's Simandou Mine

The term gamechanger is often over used enough to be rendered meaningless, but the huge Simandou mine in the West African country of Guinea is going to be just that as its start up is set to rock the seaborne iron ore market.The first cargoes from the project may arrive by the end of this year and it's expected that it will ramp up to its full capacity of 120 million metric tons per annum fairly quickly.The four blocks of Simandou are impressive in their scale and infrastructure challenges…

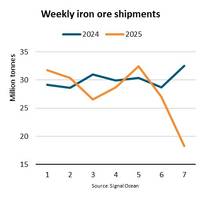

Iron Ore Shipments Fall 7%

Global iron ore shipments have fallen 7% y/y, during the first seven weeks of 2025, amid supply disruptions and weak Chinese import demand. Australian cargoes have fared the worst, down 10% y/y while shipments from Brazil have weakened by 5% y/y.“The comparatively stronger Brazilian shipments are boosting average sailing distances, but tonne mile demand is nonetheless estimated to have taken a 6% fall y/y,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.The weakness of iron ore shipments this year has intensified this past week in particular.

Cyclones Delay Rio Tinto Exports from Australia

Rio Tinto said on Tuesday it had begun clearing iron ore ships from two Western Australian ports as two tropical cyclones offshore swell seas and complicate its efforts to repair infrastructure damaged by a previous cyclone last month."Safety is our priority. As is procedure, we began sending ships from Cape Lambert Port at the weekend and Dampier Port last night, out to sea, to avoid high sea swells and wave conditions created by Tropical Cyclone Taliah and Tropical Cyclone Vince…

Great Lakes 2024 Iron Ore Trade Dips 2.5 PCT

Shipments of iron ore on the Great Lakes totaled 4.6 million tons in December, a decrease of 4.5 percent compared to a year ago. Shipments were just slightly above the 5-year average for the month.The year-end total for the iron ore trade stands at 49.8 million tons, a decrease of 2.5 percent compared to 2023.Compared to the trade’s 5-year average, 2024 iron ore loadings were up 3.8 percent.Since 1880, Lake Carriers’ has represented the U.S.-flag Great Lakes fleet, which today can move more than 90 million tons of cargos annually that are the foundation of American industry…

Broad Sector Declines puts Baltic Index at 17-month low

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, fell on Wednesday, hitting its lowest level in nearly 17 months, as rates dipped across all vessel segments.The index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 25 points to 1,028 points, hitting its lowest level since July 2023.The capesize index shed 71 points to 1,237 points, also hitting its lowest level since Sept. 2023. Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, decreased by $587 to $10,261.Iron ore futures prices slipped on Wednesday, as supply concerns eased and demand slowed marginally due to maintenance of more furnaces by steelmakers in top consumer China.

MSI: Iron Ore Market is Flashing Warning Signs

In its August HORIZON Dry Bulk month report, Maritime Strategies International states that against potential optimism from lower interest rates to come, price action in the iron ore market has been flashing warning signs. Prices have dropped about 10% since the start of the month and are now 30% lower than at the start of the year.With the freight market highly leveraged to iron ore flows (the largest dry bulk commodity), the response by suppliers will be critical. While it is…

ABS Opens Office in World’s Largest Iron Ore Export Town

ABS is expanding its footprint in Western Australia, establishing a physical presence in Port Hedland, a key trading zone for dry bulk minerals in the Eastern Hemisphere. The new site joins other ABS locations in Perth, Cairns, Brisbane, Sydney and Melbourne.Port Hedland, the world’s largest iron ore export port, is located within the Pilbara region in northwest Australia. The area is making substantial investments to support the energy transition to meet net-zero emissions goals.

Record Exports from Australia’s Pilbara Ports

The Pilbara region of Australia has achieved a record 758.3 million tonnes of exports passing through its ports in the 2023-24 financial year.This marks the fifth consecutive year of record-breaking throughput for Pilbara Ports.The Port of Port Hedland contributed significantly to this achievement with a throughput of 573.6 million tonnes.The commodities exported through Pilbara Ports in 2023-24 were valued at an estimated A$173.2 billion.Pilbara Ports play a crucial role in facilitating Australia’s iron ore trade…

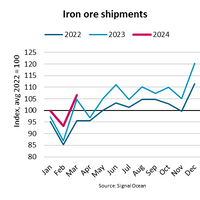

Iron Ore Shipments Up 3.8% Despite Weak Chinese Demand

In the first quarter of 2024, global iron ore shipments rose 3.8% y/y on expectation of strong Chinese steel production which, however, failed to materialise. Iron ore supply has grown faster than Chinese demand which could lead to weaker shipments ahead, says Filipe Gouveia, Shipping Analyst at BIMCO.During the start of the year, Brazilian iron ore shipments typically slow down due to mining disruptions caused by heavy rainfall. However, this year conditions were better and Vale…

Study Highlights Ammonia Bunkering Potential of Australia’s Pilbara

A feasibility study has highlighted the potential for using clean ammonia to refuel ships, particularly iron ore carriers, visiting the Pilbara region of Western Australia.The study, commissioned by Yara Clean Ammonia (Yara) and Pilbara Ports, was undertaken by Lloyd's Register, and looked at key areas including the estimated demand and likely availability of ammonia as a replacement shipping fuel. The potential risks and regulatory requirements for ammonia bunkering at the ports…

China Demand Drives 7% Jump in Minor Ore Exports

“Driven by continued growth in minor ore demand in China, global seaborne minor ore exports rose 7% y/y in the first seven months of 2023, vastly outpacing the 2% y/y growth in overall dry bulk exports,” says Filipe Gouveia, Shipping Analyst at BIMCO.Accounting for 51% of seaborne minor ore exports, bauxite exports also led year to date growth with a 9% y/y increase. Bauxite is refined into alumina, the primary ingredient in aluminium production.Chinese aluminium production has rapidly increased since the start of the Ukraine war.

Cyclone Ilsa Hits Australia's Northwest, Misses Iron Ore Export Hub

A tropical cyclone smashed into Australia's northwest coast as a category 5 storm, setting new wind speed records, but has largely spared populated regions including the world's largest iron ore export hub at Port Hedland, authorities said on Friday. Cyclone Ilsa made landfall early Friday morning with the highest intensity rating on a 1-to 5 scale and then moved inland as emergency crews urged several remote communities along the storm's path to seek shelter and remain indoors."Port Hedland ... escaped the brunt of the cyclone at this stage.

Iron Ore Price Soars, Fueled by hopes for China'sQ3 Rebound

Iron ore futures soared on Monday, extending a rally spurred by hopes of an economic rebound for top steel producer and consumer China in the third quarter, and support for the country's troubled property sector.The most-traded iron ore, for September delivery, on China's Dalian Commodity Exchange DCIOcv1 ended daytime trade 7.1% higher at 711 yuan ($105.27) a ton, after earlier hitting 723.50 yuan, its strongest level since July 14.Iron ore's front-month August contract on the Singapore Exchange SZZFQ2 was up 2.2% at $105.40 a tonne…

Benchmark Dalian Iron Ore Futures Plunge

Chinese iron ore futures dived more than 8% late on Friday after the country's regulators and industry association issued warnings against recent unusual price moves of the key steelmaking ingredient.Earlier on Friday, the National Development and Reform Commission (NDRC), which is the country's state planner, said it and the market regulator would dispatch investigation teams to the commodity exchange and key ports to look into iron ore inventories and trading in the spot and futures market.The NDRC…

China Steel Hopes Drives Iron Ore Demand

Dalian iron ore rose on Friday and advanced nearly 6% this week as traders returned from New Year holidays feeling optimistic about potential demand recovery in top steel producer China.Iron ore's most-active May contract on China's Dalian Commodity Exchange ended daytime trading 1.4% higher at 719 yuan ($112.78) a tonne, rising for a fourth straight session and touching 725.50 yuan earlier in the day, its highest since Oct. 27.On the Singapore Exchange, the steelmaking ingredient's most-traded contract expiring by end-February climbed as much as 0.7% to $128.25 a tonne…

BIMCO: Iron Ore Spot Rates Spike 163%

As the average length of the journey increases, partly due to port congestions in China, soaking up capacity and pushing up spot rates, shipowners will likely be enjoying high freight rates until the end of the year.Iron ore spot freight rates from Western Australia, to Qingdao, China have jumped 163% to USD 21.82 per tonne on 28 September 2021 compared with the same time last year. For a very large ore carrying Capesize ship transporting 200,000 tonnes of iron ore, this represents an increase in freight revenue from USD 1.66 million…

Chinese Iron Ore Imports Fall to 14-month Low in July - BIMCO

Chinese iron ore imports fell to 88.5 million tons in July, the lowest level since May 2020. The fall in July means that accumulated imports are lower than in the first seven months of 2020. Imports this year have totaled 649 million, a 1.5% decline from January to July 2020. In July, imports were down 21.4% from the same month in 2020 when they reached a record high of 112.7m tonnes.Steel production declines following government restrictionsIn addition to the July drop in iron…

China Goes from Driver to Brake for Crude Oil, Iron Ore and Copper

China has switched from driving global demand for major commodities to being a drag on growth, with July's customs data confirming the weakening trend for imports of crude oil, iron ore and copper.The exception to the trend was coal, but the sharp gain in July's imports of the polluting fuel are more a result of China having to go the seaborne market because of domestic policies that curbed local output.China, the world's biggest importer of crude oil, brought in 41.24 million tonnes in July, equivalent to 9.71 million barrels per day (bpd), according to official customs data released on Aug.

Iron Ore Futures Fall as Chinese Demand Softens

Chinese iron ore futures fell below a key 1,000 yuan per tonne level on Thursday, falling more than 5% to their lowest in more than two months as domestic consumption remains sluggish on steel production controls.The most active iron ore futures on the Dalian Commodity Exchange, for September delivery, plunged as much as 5.6% to 999 yuan ($154.54) per tonne, their lowest since May 27. They were down 4.6% to 1,009 yuan a tonne as of 0322 GMT."Domestic consumption (for iron ore) is weakening significantly...

Iron Ore: China Demand Powers Fortescue Shipments to Record

Australia's Fortescue Metals Group Ltd on Thursday narrowly beat its full-year estimate for iron ore shipments after a record fourth quarter, as strong demand from top consumer China offset the impact of bad weather.The world's fourth-largest iron ore miner fared better than rivals Rio Tinto and BHP, whose June quarter output dropped because of weather disruptions in Western Australia.Despite those disruptions, surging prices of the steelmaking ingredient and robust demand from China are expected to drive bumper earnings at miners…

Iron Ore Stumbles as Rising Supply Runs into China Steel Discipline

Iron ore prices have suffered their worst week for nearly 18 months amid signs that the two factors needed for a sustained correction may be coming into play - Chinese steel producer discipline and a recovery in supply of ore.The main Chinese domestic iron ore benchmark, the Dalian Commodity Exchange contract, dropped around 10% in the week to July 23, the worst weekly performance since February last year.The contract ended the week at 1,126 yuan ($173.77) a tonne, and has now slid about 17% from its record high in May.Benchmark spot 62% iron ore for delivery to north China , as assessed by co

Chinese Regulators Eye Irregularities in Spot Iron Ore Trading

China's state planner, the National Development and Reform Commission (NDRC), said on Monday it and the market regulator are jointly looking into the iron ore spot market and have pledged to crack down on hoarding and speculation.The move comes after NDRC said on Thursday that new rules on the management of price indexes for commodities and services will be effective Aug. 1 and will standardise price index compilation and transparency of information.During a visit to the Beijing Iron Ore Trading Center Corporation (COREX)…