Japan's Power Plan to Rattle Australian Coal, LNG exporters

Japan has been largely forgotten as a source of demand for energy commodities, overshadowed by the rapid rise of China, but the country's new electricity generation targets will shake the market up.

For many years Japan has been viewed as a largely steady source of demand for liquefied natural gas (LNG) and thermal coal used in power generation, with small variations in the volumes imported on a year-by-year basis.

But this comfortable situation for commodity producers supplying the world's third-biggest economy may end if the draft of Japan's latest energy policy is put into effect.

Japan aims to boost the use of renewable energy to 36-38% of the electricity mix by 2030, double the level of 18% achieved in the fiscal year to March 2020, according to a government report released on July 20.

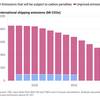

The jump in renewable energy means that LNG and coal will have to surrender market share, with coal planned to drop to 19% of generation from about 32% in recent years, and LNG dipping to a planned 20% from around 37%.

Nuclear energy is targeted to provide 20-22% of electricity in 2030, which would by a sharp rise on the 6% it provided in the 2019 fiscal year, when many of the country's reactors were still offline for extended safety checks implemented in the wake of the 2011 Fukushima disaster.

New fuels like hydrogen and ammonia are only expected to make up 1% of power generation by 2030, up from effectively zero currently.

The draft plan is certainly ambitious on renewable energy, very bullish on nuclear and surprisingly non-committal on new fuel sources.

It will likely be a stretch to achieve the targets, with massive investment needed in renewables such as wind and solar, most likely with battery storage as well.

The Japanese public may also baulk at the nuclear component, which will require restarting most, if not all the remaining reactors, with nine currently operating and some 24 still offline. Credit: Parilov / Adobe StockAUSTRALIA HIT

Credit: Parilov / Adobe StockAUSTRALIA HIT

Notwithstanding the challenges involved in implementing the draft plan, the main impact would be felt by LNG and coal exporters, especially those in Australia.

Australia supplies about two-thirds of Japan's thermal coal requirements, with imports of 70.7 million tonnes in 2020, out of a total of 105.2 million, according to official data.

Japanese utilities have long favoured Australian thermal coal for its higher energy value and lower impurities compared to other grades available on the seaborne market.

If Japan does meet its target of reducing coal from the 32% share of power generation in the 2019 fiscal year to just 19% by 2030, this implies a reduction of total annual imports to around 62.6 million tonnes, assuming total power generation remains at current levels.

This would mean Japan would be buying about 42 million tonnes less by 2030, and it would be logical to assume that Australian miners would take the biggest blow.

Japan is currently the world's biggest LNG buyer, and if it does drop the use of the super-chilled fuel to 20% of power generation by 2030 from 2019's 37%, it implies annual imports should decline from 74.5 million tonnes in 2020 to about 40.3 million by 2030.

Australia, which vies with Qatar as the world's biggest LNG producer, is again Japan's top supplier, although it's not quite as dominant a position as it is with thermal coal.

Australia supplied 29.1 million tonnes of LNG to Japan in 2020, or about 39%, beating out Malaysia's share of about 14% and Qatar's 11.7%.

There is also the likelihood that LNG not being sent to Japan will find other willing buyers in Asia, with several countries including China keen to expand their use of natural gas.

Nonetheless, the loss of around 35 million tonnes of demand will likely give pause to LNG producers eyeing new projects or expansion plans.

(Editing by Kim Coghill)