IMO2020: Market Uncertainty Brings More Fuel Oil Price Volatility

The oil market has recently been shaken up by geopolitical events, but volatility in the price difference between low and high sulphur fuel cannot be explained by that alone – the uncertainty is the chaos factor.

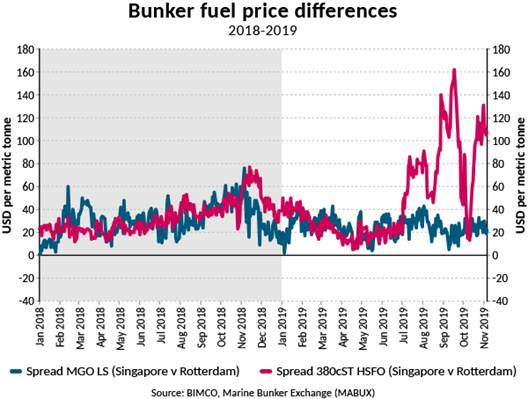

The uncertainty of the upcoming IMO 2020 Sulphur cap regulation (IMO2020) is having a big impact on the bunker market. Whereas, the price for Marine Gas Oil Low Sulphur (MGO LS) has largely remained stable, the price for High Sulphur Fuel oil (HSFO) has been become increasingly more volatile in recent months. The HSFO-MGO LS price spread has, in some ports, widened to levels exceeding the actual price for HSFO.

IMO2020 adding a disruptive interference in the market

The oil market has remained on edge in recent months with plenty of market volatility to go around. The bunker fuel oil market is normally directly correlated to the developments in the crude oil market, but recently, IMO2020 has added a seemingly disruptive interference with the pricing of bunker fuel on top of it.

As people in shipping are painfully aware, in less than two months, shipowners are no longer allowed to burn fuel oil with sulphur emissions above 0.5%, unless a scrubber is working on board. This presents a massive challenge for the industry, where the vast majority of ships are operating on 3.5% HSFO.

“The bunker price spread illustrates the tumultuous ride that the bunker market has endured in the last couple of months and similarly, the spread illuminates why the market is filled with uncertainty about the future. From October 1 to November 1, the spread for HSFO-MGO LS in Rotterdam spread widened 21%, from USD 229 to USD 277 per metric tonne,” says BIMCO’s Chief Shipping Analyst, Peter Sand.

MGO LS is, as all other bunker fuels, exposed to underlying oil market shocks, but has exhibited less volatility and fluctuated around the same price range in 2019. Conversely, price volatility of HSFO has increased in recent months with significantly greater fluctuations in price.

BIMCO members can dive into the fluctuations further using the bunker pricing tool available on the BIMCO website at the market reports section. It shows the bunker fuel prices in 32 ports around the world, based on daily information supplied by MABUX. The service is available to BIMCO members only.

Lightning struck the market repeatedly

A quick review of the market can shed some light over recent developments. Seemingly, a lightning struck the HSFO market towards the end of June. Over the course of 14 days.

“Geopolitical events, such as the attack in Saudi Arabia, certainly impose shocks on the bunker oil market, but recent movements in the HSFO-MGO LS spread cannot solely be laid at the feet of geopolitics. Seemingly, the uncertainty of the IMO2020 regulation is disrupting the normal market conditions to a certain extent. Anecdotal evidence suggests that, in some ports, greater efforts have been made to store MGO LS on bunker barges, tightening the market for HSFO.” says Peter Sand.

Varying availability

Availability of fuels will vary greatly in between ports and greatly influence bunker prices. Some ports, such as Singapore, are increasingly focused on storing MGO LS.

Bunkering in the western hemisphere

At the Panama Canal, one of the main bunkering hubs in Central America, a similar development has taken place. MGO LS prices have remained relatively stable.

As fundamentals are off, setting up scenarios will help

The massive uncertainty in the market is clearly interfering with the usual pricing mechanisms. BIMCO reckons, that it is no longer fundamentals driving the market, but rather a market.

Shipowners are ready, are bunker suppliers?

Conflicting narratives are circulating in the market, as IMO2020 draws close.