HSFO Sales Rebound After Pre-IMO 2020 Correction -BIMCO

In the first quarter of 2021 high-sulpfr fuel oil (HSFO) has been the only bunker fuel to experience year-on-year growth in Singapore, the world's largest bunkering hub. HSFO sales are up 47.2% from Q1 2020, reaching 3.1 million tonnes. This is however still less than a third of high-sulfur fuel sales in Q1 2019, before the IMO 2020 Sulphur Cap came into force.

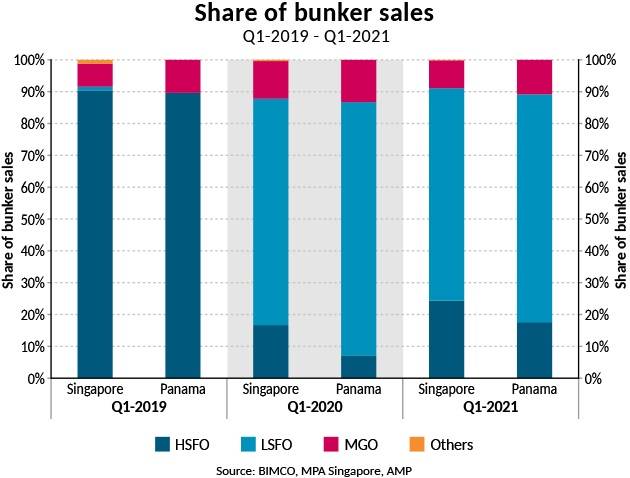

The 1 million tonne increase in HSFO sales exceeded the fall in low-sulfur fuel oil (LSFO) and marine gas oil (MGO) sales, though only marginally, with total bunker sales in Singapore up by 0.8% in Q1. Sales of MGO fell the most compared to a year earlier, down by 25.3% and accounting for just 8.7% of total bunker sales in Singapore in Q1. LSFO sales reached 8.6 million tonnes, a 5.4% drop from Q1 2020, bringing its share of total bunker sales to 66.7%, slightly down from the 71.1% share it claimed at the start of last year.

HSFO on the rise across the board

A similar development in the share of bunker fuel sales can be seen in other bunkering hubs. In Fujairah, HSFO accounted for 16.9% of total bunker sales in Q1 2021. Here, LSFO dominated with a 78.6% market share.

In Panama, where total bunker sales fell by 7.2% in the first three months of this year compared with 2020, LSFO accounted for 71.6% of total bunker sales (down from 79.5% in Q1 2020). HSFO’s share has also risen from Q1 2020, to a 17.6% share, up from 7.1% in 2020, but nowhere near the dominance it enjoyed in Q1 2019.

“After the quick adjustment to the global sulfur cap, the decline in HSFO’s share of total bunker sales has stopped. Although its share is much lower than any time prior to Q4 2019, the steadily rise in scrubber-fitted ships has supported demand for HSFO and will remain until new solutions and future fuels are widely introduced on the industry’s path to decarbonization,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“In addition to changing the share of fuel types being sold, the global sulfur cap has also resulted in larger bunkering hubs gaining an even larger market share, and recording growth in 2020 despite a drop in total bunker sales. This development was due to owners and charterers seeking to minimize risks by choosing the biggest bunker hubs in the face of uncertainty surrounding the new fuel types,” Sand says.

Rising high-sulfur fuel sales match rise in scrubber take-up

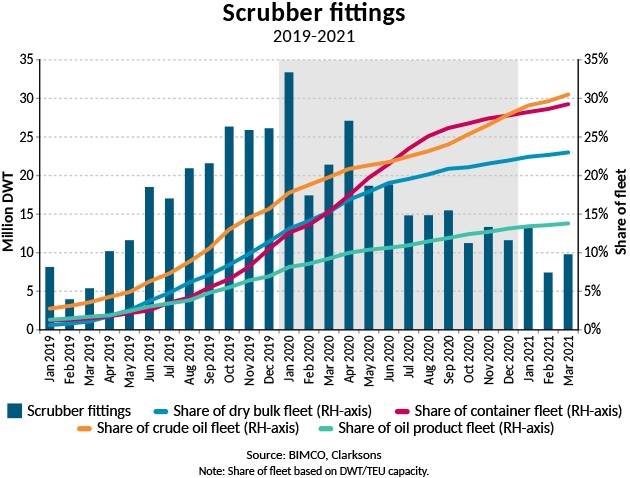

The number of scrubber-fitted ships doubled in the thirteen months after the global sulfur cap came into force, fueling a rise in high-sulfur fuel sales. There are currently 4,006 scrubber-fitted ships, up from 2,010 ships in January 2020.

Across the four major shipping segments an average of 24.1% of the fleet, when measured in DWT (and TEU for containers). The crude oil tanker fleet has the highest share, at 30.5%, while with only 13.8% of total capacity scrubber fitted the oil product tanker fleet has the lowest. At the start of 2020 the average share across these four fleets stood at just 12.9%.

The pace of scrubber fittings has slowed since its peak in January 2020, during which 259 ships with a total capacity of 33.4 million DWT either had a scrubber installed or were delivered with one already on board. In the first three months of this year 228 ships have joined the number of scrubber-fitted ships each month, totaling 30.5 million DWT in the first quarter.

Of the 228 ships fitted with scrubbers so far this year, two-thirds (153) were newbuilds being delivered with a scrubber already fitted, with only 75 ships being retrofitted. This is almost the exact opposite of the shares in 2020, when only 27.1% were newbuilds (479), while the rest (1,289) were retrofits of the total 1,768 ships to have a scrubber installed.

Will we see a second wave of scrubber installations?

Although the pace of scrubber installations has slowed, the economic case for a scrubber is still strong. After the ups and downs of 2020, the price spread between HSFO and LSFO has stabilized at an average of $100 per tonne in the major bunkering hubs.

In Singapore on 27 April, a metric ton of HSFO cost $388, leaving VLSFO $106 more expensive per metric ton. In comparison, on January 1, 2020 the price of HSFO was only $28 per metric ton lower than currently ($360 per tonne), but the spread was however three times higher as a metric ton of VLSFO cost $710 at the time.

Despite the ups and downs of the spread in 2020, when averaging the HSFO and VLSFO spread over the whole year, it stood at almost exactly $100 per metric ton (100.7).

“With the spread now stabilizing at a more normal level, a scrubber investment still represents a solid economic decision for owners, as higher earning—thanks to lower voyage costs—are enough to cover the initial cost as well as the running costs of the scrubber within a reasonable period,” says Sand.

“Low demand for certain oil products as a result of mobility restrictions has helped lower the price of LSFO. However, as demand for products such as jet fuel starts to recover, the HSFO-LSFO spread may well increase, solidifying the economic case for scrubbers.”

“A return to the high levels of scrubber installations that we saw at the end of 2019 and start of 2020 is however unlikely, as the majority of owners who wanted to retrofit their ships have now done so, and the majority of scrubbers being added to the fleet now come from newbuilds,” Sand says.