Growth of US Inbound Containers Has Slowed

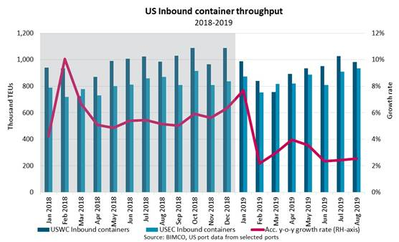

The accumulated growth rate for US inbound containers has almost been cut in off half from 5.1% in 2018 to 2.6% in August of 2019.

Towards the end of 2018, US retailers frontloaded consumer goods ahead of the planned tariff hike in January 2019. While another US tariff hike of 10% on Chinese goods worth USD 160 billion is planned for December 15, BIMCO does not expect the same frontloading to occur this time around, due to heightened uncertainty about the rumored trade deal.

According to communication by the US government, a US-China trade deal has been agreed upon in principle, but whether this deal will see the light of day in 2019 is very uncertain.

No matter the outcome, the trade war has already harmed the shipping industry.

Container shipping has not only felt the impact of the trade war but also the synchronized slowdown of the World’s economies.

The China Containerized Freight Index (CCFI), a freight rate index that tracks 10 Chinese ports, is down by 6% from January to October to an index level of 795 on October 1, 2019.

Carriers have tried to mitigate the poor demand by blanking sailings, but with little improvement in the market so far.

The containership fleet is expected to grow 3.6% for the full year of 2019 and with slowing demand growth, the fundamental balance is set to deteriorate in 2019 and into 2020.