Fitch Ratings: Demand Risks Weigh on Global Shipping Sector Outlook

The global shipping sector outlook remains negative reflecting the demand-side risks of protectionism and slower economic growth, Fitch Ratings says. Higher fuel costs and sulphur regulation will also put pressure on shippers.

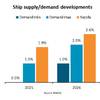

Partly offsetting an unfavourable environment are emerging signs of better capacity management by shipping companies, which is key to a sustainable balance and freight rates that support consistent profitability. We expect better fundamentals in container and dry bulk, while capacity growth will weigh on tankers.

The key risk to shipping is an escalation of protectionist measures that would damage global trade and GDP growth. Free global trade is vital for shipping development - about 80% of world trade in goods is carried by ships.

More stringent fuel regulations regarding sulphur content could significantly increase operating costs and capex requirements in all shipping segments. This may negatively affect financials unless shippers pass these costs to customers. However, the product tanker market may benefit from these regulations as seaborne trade of low sulphur fuel is likely to increase as a result.

We expect healthy, albeit slower volume growth, in 2019 in container shipping. But supply and demand should be more balanced as fewer new vessels come onto the market. This should provide support to freight rates. Container shipping has become more consolidated with top five players accounting for 63% of the market in 2018 compared to only 31% in 2000, which is beginning to help with coordinated capacity deployment.

We expect freight rates in dry bulk to remain flat on average in 2019 based on balanced volumes and net fleet growth of about 3%. Any escalation of global trade conflicts, especially between the US and China, could affect cargo flows, especially for grains and minor bulk. However, we see the risk of a material reduction of overall demand and rates to be low. This is because commodity trade flows are likely to shift, rather than stop. For example, Chinese tariffs on US grain imports caused an increase in South American exports to China, while US soybeans have been directed to European and Middle Eastern markets.

Potential overcapacity weighs on the tanker sector. We forecast net tanker capacity to grow at about 3%, up from about 1.5% in 2018. The sector may face downside risks from oil demand and supply. US Energy Information Administration (EIA) forecasts global oil consumption in 2019 to rise 1.4%, down slightly from a 1.5% increase in 2018. The impact of US sanctions on Iranian crude oil exports as well as OPEC's decision on production volumes in December meeting are likely to affect oil supply and, as a result, demand for tankers.