Contracting of Product Tankers Jumps

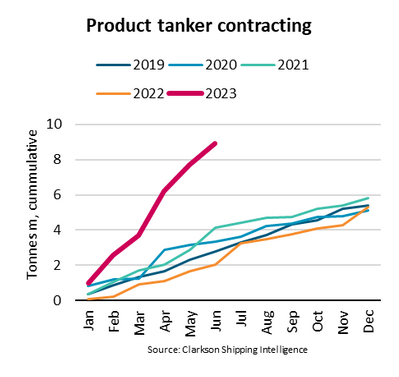

The product tanker orderbook to fleet ratio has surged from 5.4% in December 2022 to 9.3% in June 2023, driven by a remarkable 337% y/y rise in contracting during the first half of this year.

“A spike in freight rates and product tanker demand is likely behind the surge in contracting,” says Filipe Gouveia, Shipping Analyst at BIMCO.

By June 2023, product tanker contracting reached 8.9 million DWT. This means that more product tankers were already ordered in the first half of 2023 than during all of 2022.

While the contracting of MR and LR1 ships saw notable growth, it was the LR2 ships that displayed the most significant increase. So far this year, 5.6 million DWT of LR2 ships have been contracted, adding to an orderbook that is now equivalent to 21.6% of the current LR2 fleet. The contracting of ten LR1 ships this year should also be highlighted, as no ships in this segment had been contracted since 2018.

“The product tanker fleet has been gradually aging over the past ten years, and the average ship is now nearly 13 years old. The increase in contracting will help the sector address the increased market demand and could help rejuvenate the fleet,” says Gouveia.

The war in Ukraine, and in particular EU’s ban of Russian oil products, has caused an increase in product tanker demand, resulting in higher volume shipped and longer sailing distances. This has boosted freight rates and a rise in contracting new ships.

The ships contracted this year are scheduled to be delivered in 2025 and 2026. Until then supply growth should be limited and freight rates should be mainly affected by demand factors.

“The impressive pick-up in contracting this year could however begin to slow down in the medium term. The International Energy Agency estimates that oil demand could peak already in 2028, which would limit further fleet growth. As such, new contracting may focus on replacing the aging fleet and on reducing greenhouse gas emissions,” says Gouveia.