Broadband Bandwidth Battles

As Satellite providers battle for market share, the onboard struggle to efficiently maximize bandwidth allocation is also being solved.

The requirement to monitoring critical equipment and at the same time satisfy the increasingly sophisticated demands of today’s seafarers all need to be balanced against the cost of bandwidth. The call for both ‘big data’ and the full range of crew connectivity and entertainment is upon the shipping industry. SatCom providers have responded in a big way, but the myriad choices available to shipowners and operators can be confusing, complicated and needlessly expensive.

Arguably, the biggest problem with selecting a maritime communications provider in today’s market is that no two providers do business in the same way. Some own the satellites and sell packages or bandwidth, some rent the bandwidth and sell hardware, some use a network of contract service and sales providers and still others do it all.

The new wrinkle in the process is the differences in which some send and receive data and information. Even as the advent of the Maritime Labor Convention (MLC) sends operators scrambling to find ways to keep their best people on their vessels, at the same time, performance and efficiency efforts have placed greater demand on the ability to move critical data quickly and cheaply between ship and shore. The marketplace says it can be done. Maritime Reporter & Engineering News, with the help of industry insiders, explains how.

Maritime Broadband’s Triple Play

Although Maritime Broadband isn’t the biggest or best known maritime communications provider, the engineering company’s VSAT communication systems for maritime use are quickly getting noticed in a market sector that tends to gravitate towards more familiar names that have been around a lot longer. The New York-based company’s flagship product, the C-Bird antenna, represents years of research and development in partnership with shipowners, says Maritime Broadband CEO Mary Ellen Kramer.

“Maritime Broadband has only been in business since 2008. Really, in truth, we’re nowhere near the top of the market share list. We’ve spent the majority of our time developing our solution and honing it. Our solution is a combination – you might call it a triple play, in essence – and we’re providing the hardware as well, so it is a turnkey package with a proprietary C Band antenna called C-bird. This comes with an internet subscription that can be taken at various levels of committed information rate.” The way that all of that is packaged – and the price point that it comes at – is, according to Kramer, what sets her firm apart.

As the task of providing crew entertainment and connectivity becomes a necessary line item cost in an increasingly competitive market for quality seafarers, the cost and logistics of delivering that data to the vessel has shipowners worried. Maritime Broadband addresses the quandary with its own menu of high quality broadcast television that includes, for example, such channels as CNN or MSNBC, and a 24-hour sports channel. What’s different from other providers is that the entertainment system comes in through the same antenna, but uses separate, high quality multi-cast bandwidth. In this case, subscriptions for the internet remain separate.

Separating Business & Pleasure

Maritime Broadband uses the same satellite provider (MTN) that provides multi-cast television to cruise ships. Kramer explains, “This is all broadcast television, meaning that it is live, so we’re not using IP bandwidth for the television. It’s high quality video that’s being sent to all subscribing ships via MTN’s network. It is simply a matter of whether the customer is a subscriber or not and we can turn it on, if so. One bandwidth is for internet traffic only and the other for broadcast television. It’s the same antenna. That’s a beautiful thing because the customer does not have to purchase a ‘receive only’ television antenna. Data and broadcast TV are coming through the same device using separate bandwidth.”

Each company has to make the decision of how to set up its business and to find out where their competitive edge lies. For Maritime Broadband, the competitive edge lies in the antenna itself. According to Kramer, companies can enjoy true global coverage using an affordable C-Band option for commercial ships from 70°N to 70°S, with unlimited data. According to Kramer, companies can enjoy true global coverage using an affordable C-Band option for commercial ships from 70°N to 70°S, with unlimited data. “That’s a magical combination for ships. There are a number of frequency bands in our maritime world and the most well known service is provided on L-band. Also a 70-to-70 model, it involves pay-by-use with subscription limitations. Ku band is the most frequently used bandwidth for maritime companies that want and need more bandwidth, but it’s only got a footprint that covers for the most part, the northern hemisphere.”

Kramer says that C Band has long been the choice of cruise ships, ferries, oil and gas, the military because it is reliable and not subject to ‘rain fade.’ She adds, “C-Band is hardy band and is used for many mission-critical applications. We’ve gone and made it available for commercial shipping with our proprietary antenna.” Beyond that, she points to pricing. “Many customers will be faced with paying over $1,100 per month for 250mb per month of data come January 1. Amortizing our equipment over 36 months, plus our lowest-speed service with unlimited data, customers will pay $1,400 per month. We think it is a matter of industry education. Once people know what we can provide and at what price, it becomes a no-brainer.”

Ship’s personnel can assemble c-bird during a regular port call in just four hours using tools already on board. Kramer explains further, “The beauty of it is that our equipment gets installed by the crew in a regular port call – they don’t have to pull down the other antenna, they just put ours up alongside it. In the rare occasions that our C-Bird might not be available, the customer may always revert to their L-band option.”

Pricing for the entertainment package is separate, on top of existing service and would be $100 per month for the news station, going up to $500 monthly for 24/7 news and sports. And Kramer says, “The ship’s business and crew internet, are on separate networks. Priority first is to voice, then official business of the vessel, and the balance – whatever was not being used – would be allocated for the crew. The crew has an account that they log into.”

Maritime Broadband’s C-bird

We asked the Maritime Broadband CEO if it wouldn’t make more sense to go with another service for everything else and Maritime Broadband only for entertainment. Kramer responds, “It wouldn’t make sense to go for one, without the triple play.” Kramer clearly hopes she can grow the firm’s innovative antenna and pricing plans into a bigger market. Today, Maritime Broadband, she says, enjoys its biggest penetration in both the Baltic tanker and global bulk markets. To that end she says, “There is a lot of consolidation in our industry – we’ll see where it shakes out. In any case, we are providing value here because the tramp nature of these markets makes global coverage critical, especially for the bulk market. We have no idea where our ships are going next and sometimes, neither do they.”

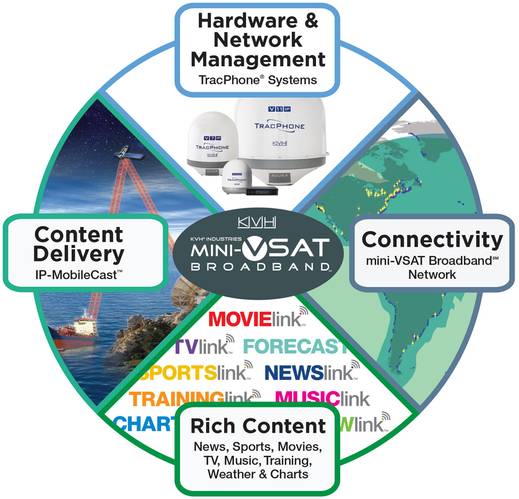

KVH & IP-MobileCast

The news that KVH Industries was increasing capacity on key South American beams probably came as no surprise to industry analysts, who have watched the firm’s market share increase to more than 4,000 units in the field on its mini VSAT network. In fact, KVH’s mini-VSAT Broadband network is the dominant player in the global maritime VSAT market, with twice the market share of its closest competitor, according to a 2014 industry report by Euroconsult. Nevertheless, KVH and its SVP Marketing and Strategic Planning, Jim Dodez, are hardly satisfied with sitting back on their laurels.

The new KVH IP-MobileCast is the latest and most visible product of that effort. Intended for both entertainment and operations, the service is predictably making its biggest splash on the crew’s side of the ledger. At the heart of it is KVH’s ability to deliver fast broadband service, with Internet download speeds up to 4 Mbps. And, through the use of what Dodez calls ‘multicasting,’ high quality licensed content is being moved over a broadband pipe – inexpensively and quickly.

Dodez explains the concept, saying, “We’ve done a phenomenal amount of work since we first came up with this concept. The actual concept of multicasting content to our customer base has been around since the beginning of our mini VSAT broadband network. But we had to set it up correctly – get the global coverage and technology in place. This involved moving it from the content owner to our hubs, encoding it and setting up multicasting technology in a way that ensures the exact file gets to vessel, because if just digital rights file is incorrect, it won’t work correctly. And then, we put the whole thing together into a user interface so that a crewmember can look at it with an iPad or similar device.”

Along the way, KVH made two key acquisitions. First, Headland Media, which is now the UK-based KVH Media group, specializes in obtaining commercially licensed content – which it has to be on board commercial vessels. Dodez adds, “MLC and port state inspectors are going to be checking for these kinds of things.” The second acquisition was Videotel, a provider of on board training solutions. That’s because, according to Dodez, training will be an important part of its package. “Yes, you want to entertain them, you want to provide connectivity, provide communications. But, also provide training resources that they need.”

MultiCasting in Action

Instead of sending one movie individually, KVH sends one movie to everyone within the satellite footprint at the same time. The old way might entail a request for a movie that takes up as much as 6gb of data. Sending that file a dozen times, says Dodez, is incredibly inefficient. He adds, “You can imagine 100 fleets multiplied by 20 people, and what that would entail in terms of bandwidth. So, we send that 6gb file once to all vessels. They all receive it and it is stored on the media server.”

Only those vessels subscribing to the service will be able to unlock the digital rights however. The same applies to e-Charts and training materials. The server knows which data is relevant to the vessel, and discards the rest.

The broadcasts are sent continuously – sending, according to Dodez, as much as two terabytes per month. Beyond this, he says, “That’s the difference between our service and others – we’re sending a lot of live content continuously. So, in times when you are not in peak demand for your bandwidth, you have a lot of capacity available on your satellite network. We send data all the time when our network is under-utilized and we prioritize it so we’re not competing with the connectivity, but we have a huge amount of capacity that we’re able to deliver content on. The MLC – making the crew happy part – it doesn’t interfere with ship’s business.”

It’s not all fun and games at KVH, however. Agreements with Transas and Jeppesen for the delivery of electronic charts and AWT for weather and advanced voyage planning round out the high speed, data rich KVH menu. “We’re trying to meet the operations and crew morale needs of the vessel. We have some clever technology that allows us to efficiently deliver large amounts of content.”

Not surprisingly, KVH will retain the Videotel brand. With a user base of about 11,000 customers, Dodez thinks that KVH will take them to the next step, delivering their content efficiently via multicasting.

Cost: The Bottom Line

The Multicasting entertainment service is sold in three packages, starting at $300 per month. Dodez insists, “The beauty of it is that you take a tremendous strain off your communication solution. And when the crew is using this content, they’re not going out on the internet and trying to get it somewhere else.

Operators can look at how much is actually being used and cut back if they need to. And, they can customize their services to the point where they actually might be paying less than they were in the first places without the entertainment content.”

At KVH, There are two ways to go: those operators already having connectivity for operations might go with the KVH multicasting solution for the crew to separate and relieve pressure off the operational networks. But, as operators begin to cut back on crew access because of the impact that it has of ship’s business, a standalone KVH entertainment solution may just be the ticket. On the other hand, signing up for the total solution will do the exact same thing. That’s because, says Dodez, “We never tax the system with the content. So far, most of our entertainment customers are existing customers who use our standard offerings. We’re doing very well in the offshore markets.”

Divide & Conquer

Both KVH and Maritime Broadband have set out to provide MLC pleasing content for crews, in an efficient and economical fashion, but without impinging on the core business of the ship. Both bring a new twist to a market which is rapidly evolving from one which originally provided simple voice communications for ship’s business, into one which can facilitate training, address crew moral issues and have plenty of bandwidth left for ship’s business and everything else.

Solving the on board broadband bandwidth problem therefore has become the challenge for users and providers alike. And, the race is on.

(As published in the February 2015 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)