BIMCO’s Sand to Offer Boxship Insight in Athens

BIMCO’s Chief Shipping Analyst, Peter Sand, will be speaking and providing the audience with unique insights on the container market at the European Shipping Seminar on November 27, 2019 in Athens, Greece.

The European Shipping Seminar, hosted by S&P Global Platts, will discuss the various topics relating to the commercial shipping markets and take a deep dive into how the shipping industry will navigate its way through the uncertain environment of the IMO 2020 Sulphur Cap.

Container shipping outlook

BIMCO has persistently stressed that trade wars and protectionism are negative for shipping. The US and China are still engaging in a tit-for-tat trade war casting a grim shadow over the global macroeconomic development and the liner shipping industry.

The macroeconomic uncertainty is showing on a global scale with the International Monetary Fund (IMF) adjusting their GDP growth projections downwards. Cracks are starting to appear in the surface of the US economy with the growth rate slowing down. Across the pond, recession alarms are starting to sound in the Euro area with the German economy on the brink of a technical recession.

Container shipping is a servant to the consumption of the advanced economies and a slowdown in GDP growth of these economies will lead to lower container shipping demand in the foreseeable future.

BIMCO looks to intra-Asian container trade volumes as an indicator of what to expect on the longer-haul trades and with an estimated volume growth rate of 0.2% for the first eight months of the year, a bright mid-term future is not to be expected on the longer trade lanes.

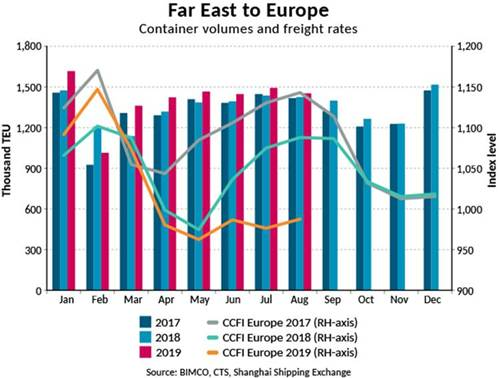

Chief Shipping Analyst Peter Sand says: “Major container carriers have blanked sailings, hoping to lift freight rates, but without any significant improvement. Although, to everyone’s surprise, the Far East-Europe trade lane is up 4.6% in accumulated volumes year-on-year, indicating that tariffed goods headed for the US might be transhipped through Europe to circumvent the American tariff wall.”

BIMCO expects a containership fleet growth rate of +3.5% for 2019, but with comparatively low demand growth, the fundamental balance is set for a deterioration.

Liner companies are no strangers to the volatility of bunker fuel oil, as Bunker Adjustment Factors (BAF) have always been an integral part in liner contracts, although with mixed results. With 84 days to the implementation of the IMO 2020 Sulphur Cap, the negotiation skills of liner companies will surely be tested, as many seek to pass on the added fuel costs related to the disruptive regulation.

BIMCO has emphasized that companies have the greatest chance of passing on costs in the best possible market balance. However, the current containership freight rates are indicating that the negotiation positions of liner companies are weak. It is hard to imagine a scenario where a non-transparent BAF, amounting to something like one sixth of the actual freight rate, can be neatly implemented.