BIMCO: Trade Restrictions Continue to Drive Tanker Demand Higher

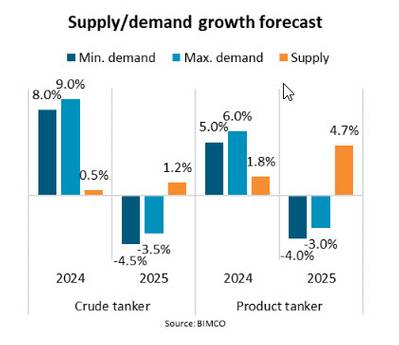

Crude tanker demand is forecast to outpace supply in 2024 but grow slower than supply in 2025 as ships may return to the Suez Canal and sailing distances shorten, according to BIMCO’s May issue of its Tanker Shipping Market Overview & Outlook.

Driven by increasing sailing distances, product tanker demand is also expected to grow faster than supply in 2024 but slower in 2025. A tightening supply/demand balance should result in increases in rates and prices in both markets in 2024 but could weaken in 2025.

The longer sailing distance caused by Red Sea rerouting is estimated to drive 75-80% of demand growth in 2024.

The IMF estimates that the global economy will grow 3.2% in 2024 and 3.2% in 2025. Growth is slowing in key countries such as the US, China and India.

The IEA estimates that crude supply will grow 0.3 mbpd in 2024 and 1.5 mbpd in 2025. Mainly US, Brazil and Guyana will increase supply. The IEA also expects an oil demand increase of 1.1 mbpd in 2024 and 1.2 mbpd in 2025. Demand continues to grow mainly in Asia while demand in OECD countries has stagnated.

The crude tanker fleet is estimated to grow 0.5% in 2024 and 1.2% in 2025 as the order book remains small. Product tanker fleet growth is expected to be 1.8% in 2024 but increase to 4.7% in 2025 as deliveries of ships contracted in 2023 begin.

“We expect sailing speed and congestion levels to remain static. The assumed shorter sailing distances in 2025 and weaker supply/demand balance could reduce speeds in 2025,” says Niels Rasmussen, BIMCO’s Chief Shipping Analyst.