BIMCO: Ship Demolition Prices Spike, Tankers Lead the Way

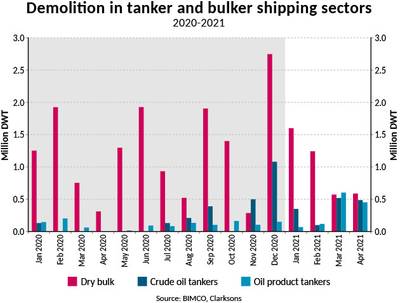

In the first four months of 2021, the amount of oil product tanker capacity that has been sent for demolition has already reached the total amount of demolished capacity in each of 2019 and 2020 due to unfavourable freight rates. If that pace continues for the rest of the year, an 11-year record is set to be broken.

This according to a report out today from BIMCO, which shows that so far this year, 10 crude oil and 38 oil product tankers have left the active trading fleet and the development in crude oil tanker demolition and that of oil product tankers continues to head in different directions. Crude oil cargo carrying capacity of just 1.45 million (m) DWT has left the market since the start of the year compared to 1.25m DWT of oil product tankers.

After the initial two months saw a total of just 11 oil tankers being sold for demolition, March and April both had oil tanker capacity of 1m DWT being retired.

The rise in demolition sales of oil product tankers is noteworthy although it comes from a very low base, whereas the amount of demolished crude oil tanker capacity fails to impress.

- Same-same but Different

Ships are demolished when earnings are low and higher earnings are not in sight in the near-term future. But why do we only begin to see a pickup in demolished volumes now when profits peaked one year ago and have been in doldrums since September 2020?

“Oil tanker owners made a lot of money during the boom-periods of 2019 and 2020. No one is short on cash and find themselves actively seeking asset liquidations,” saidPeter Sand, BIMCO’s Chief Shipping Analyst. “Just as every crisis holds recognizable elements from previous one – they are never the same. Every one of them contains something unique. This time around it seems to be demolition of oil product tankers that stand out."

During the years of 2019 and 2020, 1.2m DWT of oil product tanker capacity was all that was demolished per annum. In 2021 however, the same amount of tonnage has been sold to cash buyers within just four months for subsequent breaking.

“Demolition of oil product tankers is heading for an 11-year high if the current pace continues for the rest of the year,” said Sand.

It would then amount to 2.1% of the active oil product tanker fleet. For crude oil tanker sector to reach that level, 10m DWT will have to be broken up.

- Pace in the Crude Oil Tanker Sector

Despite the pick-up in demolition for crude oil tankers in March and April too, the sheer level – when compared to the size of the fleet - is much lower than that of oil product tankers. Currently 2021 volumes sit at 60% of what was demolished in 2020 (2.4m DWT).

With low earnings in the spot market most likely to stick around for longer than anyone hopes for, demolished crude oil tanker capacity during 2021 will no doubt exceed that of 2020 and 2019 (2.2m DWT). But it is unlikely to reach the 18.5m DWT that faced the blowtorch in 2018 as earnings were multi-decade low.

“If the spot market continues to bleed for another year with no real improvement in earnings, demolition will accelerate in 2022. Having said that, any dead-cat bounce which only temporarily eases the pain will limit demolition activity as die-hard optimism starts to re-emerge and inevitable slows demolition interest,” Sand says.

Finally, the devil is in the detail, some may say crude oil tanker demolition volumes is somewhat higher than what is included in the above chart. But for the freight market, what matters is only the actively trading VLCCs, and not the FSOs (Floating Storage Offloading units) or other structures permanent deployed in different ways.

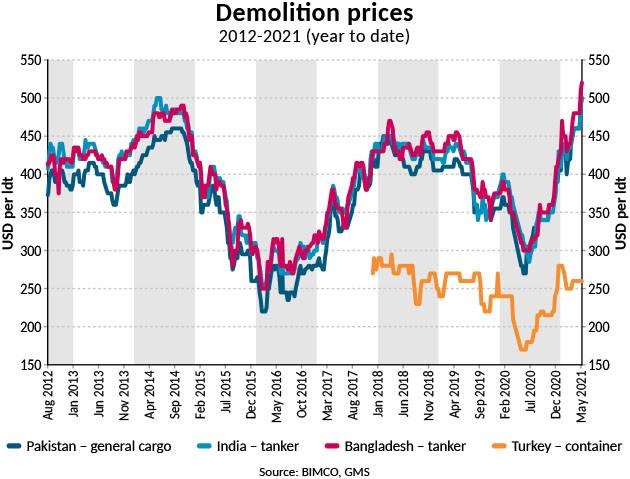

- Breaking in Bangladesh: Top Dollar Paid

The average tanker demolition steel price paid in Bangladesh reached an all-time high on 7 May 2021 of $520 per LDT (Light Displacement Tonnage). With reports of much higher as well as significantly lower scrap steel prices agreed too for ‘demo-ready’ tankers.

Why is that? Ships are different, and a tanker - small as it may be – which has stainless steel tanks onboard, like ‘Laris’ 13,843 DWT (ex-name TMS Polaris), may be priced at $845 per LDT when sold to a bullish buyer in India (source: GMS).

Demolition prices are often very ship specific, depending on the steel content and quality as well as the condition of it and the – ‘as-is’ location of the sale, ‘as is’ is the jargon for a crewless ship which is sold for demolition, waiting for a crew to be ‘re-staffed’ for its final journey. Due to the rising cases of COVID--19 in India, as well as other main ship breaking nations such as Pakistan and Bangladesh, crews for ‘as is’ sales from these countries have been restricted from many ports world-wide. This makes crew change even more difficult that it already is.

- A Dearth of Scrap Metal

The lack of scrap metal has pushed the demolition prices higher across the board. Nevertheless, no owner sells a ship because of high demolition prices, he sells when the freight markets have been horrific for long enough, and only for demolition if the second-hand value is lower.

Still, receiving $21 million for a 22-year-old VLCC that was purchased for $70 million must bolster the books somewhat, as the asset is fully depreciated.

Bulker owners expected a “normal” market but have adjusted to “extraordinary”

Finally, demolition of dry bulk capacity has been the exact opposite of tankers. Going into the year, bulker owners did not expect the extraordinary market that the first four months of the year has turned out to be.

Realizing that, the demolition interest naturally cooled rapidly. The average age of bulkers leaving in 2020 and 2021 is 28-29 years, illustrating that owner are pleased with current market condition and no one is selling young ships for demolition.

Source: BIMCO