Big Money Needed to Develop US Offshore Wind Ports

Much has been written about potential bottlenecks in store for various parts of the U.S. offshore wind industry, from vessels to monopiles. A new report published by the Business Network for Offshore Wind (BNOW) outlines the need for significant investment in and development of port infrastructure to support the industry in its goal of 30 gigawatts (GW) of offshore wind power by 2030 and 110 GW by 2050.

The good news is that more than 35 new offshore wind port projects have gone into development or began commercial operations in the U.S. over the last five years—the majority of which are in the Northeast and Mid-Atlantic, according to BNOW’s report, “Building a National Network of Offshore Wind Ports: A $36B Plan for Domestic Clean Energy Infrastructure”.

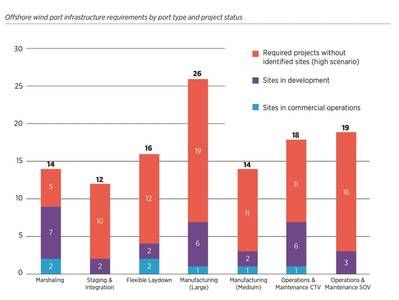

But that’s only the tip of the iceberg. The report’s authors estimate that the U.S. needs a total of 99 to 119 port development sites across the East Coast, West Coast and the Gulf of Mexico to meet its 2030 goal and lay the foundations for 2050. This means the U.S. is currently facing an offshore port infrastructure gap of 64 to 84 projects.

The industry needs a network of port facilities to efficiently manufacture, store, stage, install and maintain offshore wind turbines. Port types include marshaling ports, staging & integration ports, flexible laydown ports, manufacturing ports, operations & maintenance ports.

BNOW estimates that the total cost to address the nation’s offshore wind port infrastructure gap, assuming 2023 construction prices and no financing costs, is between $22.5 billion and $27.2 billion. This construction funding gap is approximately 3.4% to 6.2% of the total capital needed for project deployment through 2050.

After estimating the timing of projects over the next decade, and accounting for construction inflation, the upper bound of capital required to address the offshore wind port infrastructure gap escalates from $27.2 billion ($ 2023) to $36 billion ($ Year of Expenditure (YoE)). According to BNOW’s report, the financial costs associated with developing these projects is estimated to be an additional $7.2 billion ($ YoE) over 10 years.