Average Container Prices and Leasing Rates Decline in China

Average container prices have declined to more than half from the last year in August as China picks up containerized trade volumes more recently, according to an analysis published by Container xChange, a technology marketplace and operating platform for container logistic companies. The analysis is a part of the monthly container logistics report published by Container xChange titled ‘Where Are All The Containers’.

The decline in average container prices and leasing rates offer good opportunities for shippers and freight forwarding companies to plan cargo as the supply chain braces for the peak season, typically from July to September.

Trade in China was impacted in the first half of the year, but the containerized trade seems to have picked up since July (2022) according to the analysis put together by Container xChange. “Shippers are once again hoping that the exports will restore in full swing as the industry prepares for the peak season. Amidst this, there are more reasons for shippers to rejoice as the average container prices and one-way leasing rates Ex China shows a downward trend at a time when shipping is historically at its peak in the country. The average container prices are more than halved as compared to the last year, in August. Clearly, this brings cheers to the shippers and forwarders hoping to ship cargo containers out of China.” said Christian Roeloffs, Co-founder and CEO, Container xChange

Shanghai Container Availability index (CAx) indicates that the CAx is 0.58 in week 33 as compared to 0.52 in 2021, 0.32 in 2020 and 2019 (pre-pandemic). This high CAx value could potentially mean that there are more containers in China as compared to the last three years with reduced prices, making it easier for shippers and freight forwarders to plan trips from China.

“This is the peak shipping season, and the industry expects heavy outflow of containers from China to fulfil orders from demand centers. This year, we haven't witnessed two key trends that are a norm during this time in previous years – a rise in leasing rates and container prices in China and a decline in CAx values,” added Roeloffs.

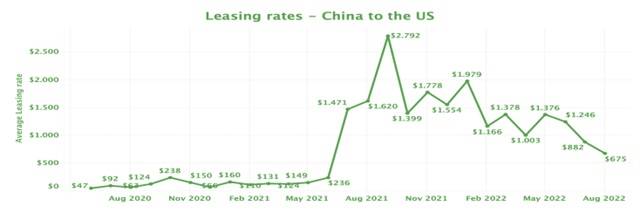

17% decline in one-way leasing pick-up rates of containers from China to the US from June to July

One-way leasing rates for standard containers, were in the range of $100-$300 before June 2021(see graph above). The rates picked up from July 2021 skyrocketing at $1470 in the month of July 2021 and peaking by September to reach $2792. The leasing rates then started to decline. This year in May, the leasing rates stood at $1277, plummeting to $1095 in June and further to $906 in the month of July.

One-way leasing rates for standard containers, were in the range of $100-$300 before June 2021(see graph above). The rates picked up from July 2021 skyrocketing at $1470 in the month of July 2021 and peaking by September to reach $2792. The leasing rates then started to decline. This year in May, the leasing rates stood at $1277, plummeting to $1095 in June and further to $906 in the month of July.

On the China to Germany stretch, these one-way pick-up rates for leasing containers plummeted from $3394 in January 2022, further to $2428 in April and now to $1995 in the month of July.

China to Canada one-way leasing rates decline at the highest rate at 49 percent as compared to China to any other country

The data shows a significant drop in the average per unit rates for 40HCs from China to Europe and North American countries. Canada is leading the fall with a 49.4% drop in the leasing rates between June and July. Right behind Canada is the US with a 32.5% drop in the average pick-up or PU (Pick Up) rates. For countries in Europe, the average one-way PU charges from China dropped by 16% in the UK, 13% in Germany, 18.4% in France, and 17.3% in Belgium.

In Qingdao and Shanghai, CAx remained over 0.5, in July, and continued increasing. The continued high CAx scores align with the decreased container rental fees and indicate a comparatively slowed down movement of boxes at these ports. Ningbo’s CAx scores were lower than 0.5 July indicating that more containers are leaving the port. And, that there’s probably more demand for export containers than full imports at the port and a likely delays cargo acceptance.

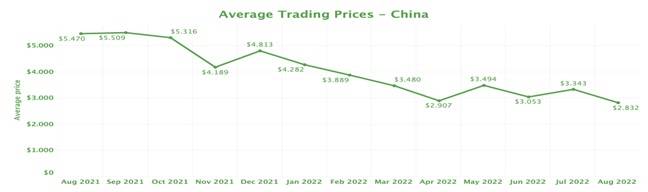

Average Trading prices in China halved year on year in August this year

From around $5500 for a cargo-worthy standard container size in September 2021, and further declining from there to reach $3494 in May 2022, the current average trading price has plummeted to $2679 so far in August 2022. Last year in August, this average trading price was $5470. More than halved from last year same month.

Download the full report here.