GMS: Ship Recycling Market Quiet and Stable

Following on from last week’s unexpected shock via the intentional depreciation in the value of the Bangladeshi Taka, it has been an altogether quieter week of sales and activity in the country, says cash buyer GMS.

Domestic ship recyclers are evaluating the potential costs and implications of further depreciations, given that the Taka slipped further into BDT 117 territory against the U.S. Dollar this week. “As Bangladesh’s outflow of foreign currency reserves increases once again, there remain growing concerns of further restrictions on an already limited number of L/C approvals in the country, in addition to a plate price that’s still in a coma, penalizing local buyers by pushing the cost of recycling ships in Bangladesh, into increasingly costlier and clearly worrisome times,” says GMS.

Meanwhile, the recent and impressively renewed aggression to acquire the one-off unit that has been proposed for a recycling sale, has seen the Indian market display an impressive performance at the bidding tables of late, resulting in several interesting acquisitions by Alang recyclers.

Further out west, despite all of the encouraging signs to continue on its recent trajectory, Pakistan’s struggles resume once again as the lack of motivation has seen Gadani recyclers continually missed out on their ‘swipe’ at ongoing fixtures.

Turkey remains silently on fire with nothing of note to report this week as well.

As global recycling economies endured a rare week of silent stability, the U.S. dollar has left most ship recycling nation currencies on an even-to-firmer footing this week, while local steel plate prices in Pakistan / Bangladesh bunk together in the same coffin and Indian plate prices jumped again by about USD 5/Ton this week. This has further boosted Alang sentiment as the nation concludes its fourth week of voting in the upcoming general election towards incumbent Minister Modi’s likely victory.

“There seem to be a few more vessels in the market (mostly for an HKC resale), and we should hopefully see a few more deals concluded in the week(s) ahead. Moreover, the condition of supply is hopefully set to improve come early July as further hiccups in freight rates are expected and supply is set to increase towards the end of Q3 / early Q4.”

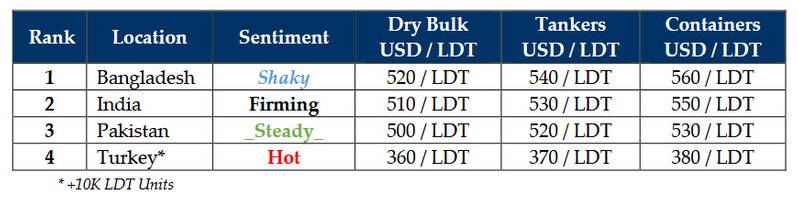

For week 20 of 2024, GMS demo rankings / pricings are: