Newbuild Contracts at Lowest Level in 20 Years -BIMCO

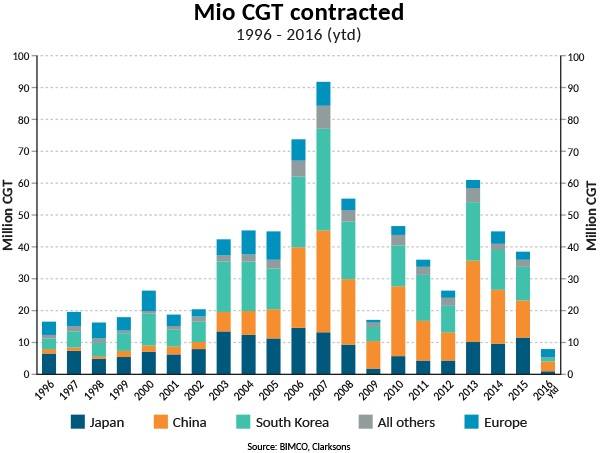

Shipyards have become the next victim of the deteriorating conditions in the dry bulk, container and offshore markets as 2016 looks to set the record for the lowest newbuilding contracts in more than 20 years, according to international shipping association Baltic and International Maritime Council (BIMCO).

After a decline from 2010 to 2012, shipbuilding had a rebound in 2013 and was expected to level out over the next few years. The reality was a slight decline in 2014 and 2015, but still high levels of contracting measured by compensated gross tonnage (CGT). Since then, shipyards have crashed, as the contracted CGT globally has reached its lowest level since on record.

“Since the high contracting in 2013, BIMCO expected the shipyards could come under pressure. This expectation became a reality at the start of 2016, with Q1 contracting the second lowest CGT in 20 years,” said Peter Sand Chief Shipping Analyst at BIMCO.

“A low level of contracting is exactly what the shipping industry needs in order to eventually restore the fundamental balance between supply and demand,” Sand continued.

Japanese and South Korean contracts down by 86 percent

The shipyards in Europe were the only ones to see an increase in contracting in the first eight months of 2016 compared to the same period in 2015. Europe contracted 2.52 million CGT, an increase of 45.3 percent compared to the previous year. Japan and South Korea have had the biggest decline in contracting, down by 86.7 percent and 86.5 percent respectively, compared to the same months the year before. China contracted 49 percent less CGT in that period.

Globally, the tanker and container segments are the main reasons for diminishing new orders by percentage as well as in CGT in 2016. Combined, they were responsible for 67.7 percent of the total contracted CGT in the first 8 months of 2015. This year, tanker contracts are down by 80.1 percent and container contracts are down 84.1 percent compared to the same eight months last year.

Alarming order cover due to overcapacity at the shipyards

The effect of declining contracts and continuing shipyard overcapacity has put pressure on the shipyards order cover. The order cover is the number of years it will take to deliver the scheduled order book, based on the capacity of the shipyards. Therefore, a low order cover can be a result of high capacity at the shipyards, as well as a decreasing order book.

Shipbuilding in South Korea is suffering the most, as they hold orders for less than two years of building. Europe continues the positive trend seen in contracted CGT, with increasing order cover. This shows that additional contracting orders are not being absorbed by new shipyards entering the market.

“There is a declining trend for Japan, China and South Korea and with such low levels of newbuilding contracts being placed, this will look even more severe next year. However, the order cover could have been even lower, if capacity had been taken out due to shipyards cutting down on operations or closing entirely,” Sand said.

Troubles for South Korean shipyards started in 2014

South Korea saw the order cover start to decrease from 2014 to 2015, whereas China and Japan saw the decline one and two years later respectively. This might be an indication of South Korean capacity being held artificially alive by government support. Government support is seen in many places in the shipping industry.

It’s positive to note that Europe’s order cover is still increasing and is currently 5.3 years. Europe is however only responsible for 9.3 percent of the global order book. The order book for Europe consists mainly of ferries, tugs and cruise ships.

As 67.9 percent of the Chinese order book and 58.4 percent of the Japanese order book are deliveries for either the container, dry bulk or offshore segments, there is a possibility for postponements and cancellations. The postponements can add a further headache to the shipyards’ liquidity, as the final payments in these cases may be delayed.