BIMCO: Tanker Market Hangover Continues

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?

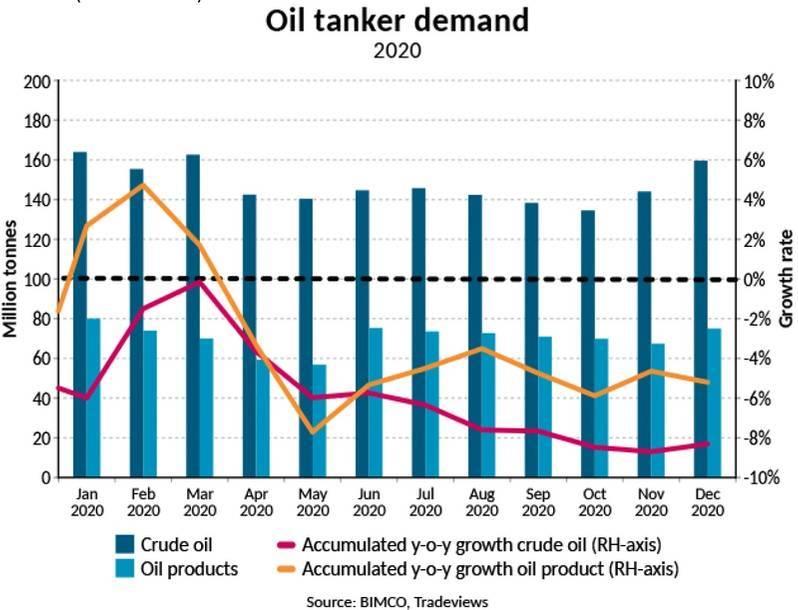

In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions. The US Energy Information Administration (EIA) estimates that global oil demand fell by 8.9% in 2020, from 101.2m barrels per day to 92.2m bpd. Though the drop in oil tanker shipping is slightly below this, demand for crude oil tanker shipping fell by 8.3% while oil product demand was down 5.2%. Measured in tonne miles, the fall in demand is slightly larger for both sectors: crude oil down by 9.2% and oil products by 6.3%.

The larger drops in tonne miles are in part due to Asia’s dominance and its importance when considering tonne miles, which in 2020 accounted for 63.6% of global crude oil imports and 36.8% of oil products. Asian imports of these fell by 60.9m tonnes (-5.1%) and 32.4m tonnes (-9.4%) respectively. In volume terms, the second largest falls in crude oil imports came from Europe and North America, where crude oil imports fell by 51.0m tonnes and 41.6m tonnes respectively. Outside Asia the largest drops in oil product imports came from North America (-8.8m tonnes) and Oceania (-6.7m tonnes).

“After the oil market boom, a bust was inevitable for oil tanker shipping as travel and economic activity was restricted, but the scale of the shock was unknown. Looking back, the overall damage to tanker shipping has not been as bad as the damage done to global oil demand,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“However, the stability of crude oil imports over the course of 2020 hide the realities that unfolded behind the scenes. As the oil price war broke out in March, the market was rushed with cargoes, leading to the peak in freight rates, a spike visible when looking at export data. However, the rush of cargoes caused severe delays due to logistical challenges, and the crude oil was therefore only discharged gradually, flattening out import data,” Sand says.

Timing crucial in determining oil tankers profitability in 2020

Though not exceeding the reported spike in crude oil tanker earnings in October 2019 (USD 307,888 per day on 11 October), the high earnings in March and April 2020 lasted longer, and many more ships were fixed. Average earnings for a VLCC between mid-March and the end of April was $171,753 per day. High exports from OPEC+, in particular Saudi Arabia and Russia, meant a sudden rush in demand for tankers in March, followed by a de-facto shortage of tonnage during April in particular, as ships faced extended waiting times to discharge their cargoes as ports were overwhelmed.

Since then, lower exports due to the pandemic, frontloading in March through May and ships coming out of floating storage have meant that earnings have been depressed for many months. With global oil demand only projected to return slowly, profitability is not just round the corner for tanker shipping.

Oil product tanker earnings have followed a similar patter to their crude oil counterparts, with a jump in March and April, followed by low rates. In fact, daily earnings for Handysize tankers falling to just a few hundred dollars a day in October and November. With travel and demand for oil products still restricted, likely only to open up slowly, BIMCO does not expect a swift recovery in this area either.

The boom and bust of the oil price war

Holding the first two graphs in this analysis against each other, the strength of earnings in the second quarter appears to have come out of nowhere. Looking at the details however, provide a better explanation. Saudi Arabian exports in particular reflect the ups and downs of earnings in 2020.

In the second quarter, exports were up by 5.1% (4.5m tonnes) from Q2 2019, though volumes to some destinations were considerably higher. Exports to North America and the EU were up by 42.9% and 32.2% respectively, while those to the Far East were up by 5.3%. Despite the smaller percentage increase, due to Asia’s considerable market share, the increase in exports in volume terms to the Far East was not far behind those to North America and Europe. The largest drop was seen in exports to the Indian subcontinent, which fell by 2.0m tonnes (-18.8%). Combined, the rest of the world saw a drop of 2.9m tonnes.

Higher exports to Far East and North America in particular contributed to higher tonne miles which rose by 11.6% compared to Q2 2019.

However, once things had settled down, Q3 brought losses across the board, with total exports down by 15.1%.Those to Europe and North America were particularly hard hit with drops of 41.8% and 39.2% respectively (-3.5m tonnes and -3.8m tonnes). In volume terms, the fall in exports to Asia was similar, down 3.2m tonnes, though as volumes here are higher, this represents a smaller percentage drop (-6.7%).

Mixed bag for oil product tankers

Just like demand for oil products was affected differently by the pandemic and following restrictions, so was demand for oil product tanker shipping. By far the largest drop comes from fuel oil imports, which saw a 21.1%% drop (37.0m tonnes). In 2020, fuel oil accounted for 16.4% of total oil product tanker demand, down from 19.7% in 2019, which was the largest change in share. Gas oil retained its dominant position with a 32.3% share, falling by just 0.2% in 2020.

Other than fuel oil, the largest drops in demand for product tanker shipping came from jet fuel and kerosene, which fell by 10.6m tonnes and 4.0m tonnes respectively. Combined, the two had a market share of 6.4% in 2020, down from 7.7% in 2019. Of the major oil products, gasoline was the only one to grow in 2020, up by 1.8%, or 3.8m tonnes.

The diverging paths of oil products, which is likely to continue as demand for some products (such as gasoline) recover faster than others (such as jet fuel), will continue to affect product tanker shipping, as trading patterns are shuffled and traditional routes disrupted.

For profitability, another OPEC+ breakdown is needed

Global oil demand is expected to only recover slowly, with the EIA currently forecasting that on a quarterly basis, it will not return to Q4 2019 levels until Q3 2022. OPEC will contine to cut millions of barrels per day of production, and demand for tanker shipping is unlikely to experience another positive shock. This will leave earnings below breakeven levels unless the OPEC+ alliance breaks down again and once more finds itself pumping and exporting at will.

Furthermore, the lower oil price makes it harder for US crude oil producers relative to those in OPEC+ as the former have much higher production costs, meaning lower production and lower exports from North America. This is harming tonne mile demand in particular with regards to Far East imports. In 2019, total US crude oil exports grew by 52.5% in 2020 (source: US Census Bureau), giving them a substantially higher share of total global crude exports. However, with US production and thereby also exports, unlikely to maintain this pace of expansion, tanker shipping can no longer rely on the US to boost its tonne mile demand.

“Oil tankers are looking at a slow, uneven and unsteady recovery, as travel restrictions are once again tightened around the world, thanks to new virus mutations, even as vaccines are arriving left, right and center. In the longer term, the change in oil trade patterns is likely to have a negative effect, as the strong growth in US exports is unlikely to return as long as crude oil prices remain in their current range,” Sand says.

(Source: BIMCO)