BIMCO Number of the Week: Capesize Bulk Carriers Extend Bull Run

Capesize dry bulk earnings break record on the back of strong 2021 start

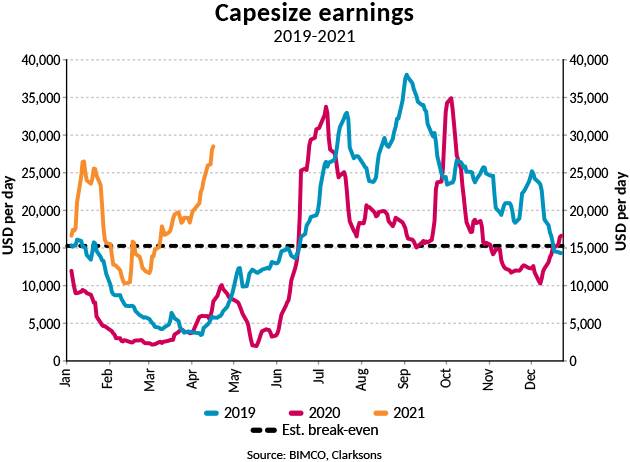

As daily earnings for the largest of the dry bulk ship types reached $28,520 on Friday, April 16, a 10-year-high was attained. However, whereas Fridays’ daily average time charter equivalent earnings (TCE) are seasonally strong, they are not special by their own merit.

Only when seen as a part of the overall elevated freight rate levels so far in 2021, currently at a daily year-to-date average of $18,133, does it qualify as a candidate for BIMCO’s Shipping Number Of the Week.

When comparing the 2021 year-to-date daily average capesize earnings to the averages of previous full years, it has already – not even four months into the year – exceeded that of 2019 ($18,025). This happened on Friday, and we must look all the way back to 2010 to find a higher level. In 2010, the daily average reached $33,298 as Chinese demand single-handedly ensured the recovery of the dry bulk market following the Global Financial Crisis.

“Now, the force of the Chinese dry bulk imports, powered by economic stimulus, is once again fuelling the economic recovery that was shattered by the COVID-19 pandemic in China and lifting the whole dry bulk shipping market,” said Peter Sand, BIMCO’s Chief Shipping Analyst.

“The impact of China’s economic stimulus has not only lifted the freight rates for capesize ships. In fact, you currently see earnings across all dry bulk sectors that have not been seen stronger since 2010,” Sand says.

Chinese imports of all commodities are growing strongly

Q1 iron ore imports are up by 7.9% (+20.7m MT) and soya bean imports are up by 19.0% (3.4m MT) compared to the same period last year.

Coal imports are up too, by 9.0% (8.9m MT), when comparing the most recent four months (Dec20-Mar21) with those of Dec19-Mar20. This four-month period is considered to focus on the trend, and not the stop-go nature of Chinese trade-war-impacted statistics, which specifically impact coal imports these days.

Brazilian exports in general, and to China specifically in Q1-2021, are up from last year, while still sitting below that of the first quarters of 2016-2019. Total Australian iron ore exports are back at the Jan-Feb 2019 level of 131m MT, while being up by 6.2% on last year.

Australian exports to China in Jan-Feb 2021 are down by 10.7m MT from Jan-Feb2019, while imports to Hong Kong and Singapore are up by 4.5m MT and 5.7m MT respectively, from a non-existing base of 2019 (source: Tradeviews). BIMCO expects that these volumes most likely will end up in China, bringing imports on par with the pre-pandemic level.

“Trade wars tend to develop inefficiencies in the market as well as questionable data. But at the end of the day, what matters is the daily freight rates. The global shipping market never lies, but it hardly ever gives you the full picture either,” Sand says.

(Source: BIMCO)