2022 & Beyond: Will the Container Carrier Debacle Ever End?

When the global supply chain runs smoothly, it’s like a well-choreographed dance. Everything comes together elegantly and effortlessly. But when someone misses a step, the show can quickly turn into a disaster. And that’s what’s currently unfolding before our eyes, headline after headline.

Those of us in the supply chain industry know it takes a Herculean effort to keep the wheels of commerce turning without so much as a squeak or rattle. And it’s going to take just that to get what Reuters cleverly coined as "Containergeddon" back on track.

To help shed some light on what it will take to get supply chains back to full health, we must first examine the potential roadblocks ahead. The following market insights outline the factors that will impact efforts over the next 5-10 years.

Where we are today

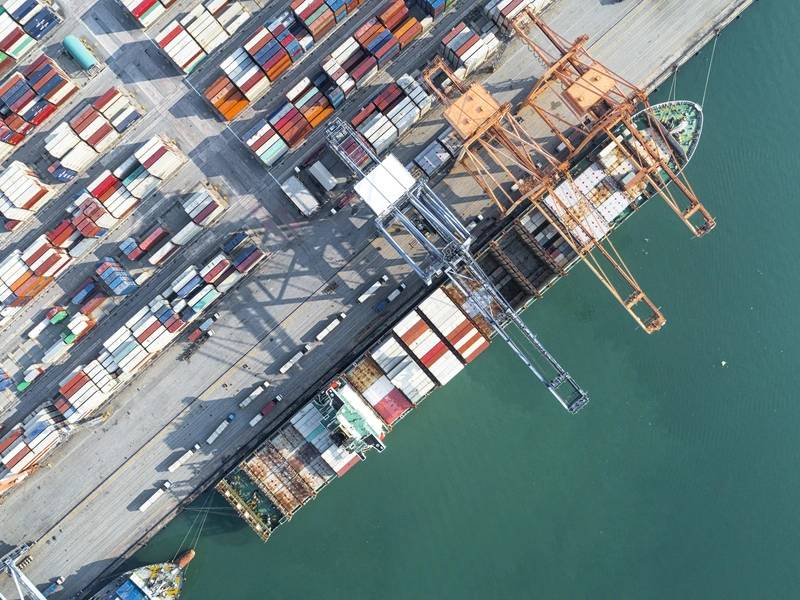

Examining where things currently stand within the global supply chain makes clear that COVID-related disruptions combined with strong demand and other factors have resulted in port congestion, maxed-out capacity, and an overall imbalance in the shipping and receiving of goods. This has all resulted in some of the highest shipping rates on record.

Short-term market indices have documented a 900%+ rate increase over the past year alone. In November2021, the Xeneta Shipping Index (XSI) for the contract market revealed a monthly increase of 16.3% month-over-month. This represented the largest month-on-month jump since July and took the benchmark to 121.2% higher than the equivalent period of 2020 and the end of last year.

Shippers are willing to pay more to secure deliveries and get ahead of the key Christmas trading period with shortages of goods still looming. Others are finding more creative ways to battle the inflating costs, Maersk recently announced that it’s rerouting services to multiple small ports, while other carriers are turning to more blanked sailing. Coca-Cola is shipping 60,000 MT of product in bulk tankers instead of containers.

In addition to consumers experiencing product shortages and higher prices, the supply chain’s current state also has unintended consequences. A container ship was responsible for causing a recent oil spill that has polluted more than 24 miles of the California coastline. The more backlogged the ports become and the longer ships have to wait to dock, the greater the risk of error and adverse incident.

More than ever, shippers need to remedy the short, medium and long-term factors affecting the container market to create a healthier supply chain.

What to expect next: short term outlook (2021-2025)

Unfortunately, there is little hope that container rates will drop back to pre-pandemic levels, and surcharges will continue as well. In addition, schedule reliability will only become more questionable as supply chain problems worsen. We’ll also continue to see images of backlogged vessels waiting near port.

However, that’s only half of the story; the truth is far more complex. We’re in the midst of the perfect storm, created by a combination of a worldwide driver shortage, equipment shortage, pandemic-related port congestion issues, container carriers’ disregard for signed contracts and an influx of exports from Asia into the US. And another storm cloud is that big carriers are buying up port facilities and freight forwarders, enabling them to have a firmer grip on rates and services.

Smaller carriers are moving cargo from China into the EU and US West Coast to circumvent some of this. However, they are running into the same port issues as the big carriers, so cargo isn’t moving inland any quicker. And discussions of nearshoring show promise, but these are long-term decisions that take time to implement. As such, relocating to Mexico or Eastern Europe will not relieve the supply chain crisis any time soon.

Beyond the short term: mid-term outlook (2025-2030)

Massive new build programs might launch in time, but the supply chain problems will remain. If anything, additional cargo sitting outside the US, Northern European, or main Chinese ports will only add to the paralysis, as budget and approval for port expansions get backlogged in government red tape. Driver and port worker shortages will only worsen as the populations in North America, the UK, and the EU continues to age out.

Consumer and retail pressure will also push carriers to take climate change seriously. The future fuel debate will likely be resolved (methanol and LNG), but the cost of such fuel and its effect on rates has yet to be determined.

As port congestion worsens and the big carriers increase their hold on rates and services, agile-minded companies will turn to multi-sourcing strategies to build more stability into their supply chains. Central and South America, Eastern Europe and Africa will be considered as alternative areas to source from. Nearshoring will also rise as another alternative for keeping the flow of cargo stable during challenging times.

The next decade: long term outlook (2030 and beyond)

The higher wages needed to continue attracting drivers and dock workers will cause shipping rates to climb. From a policy perspective, US lawmakers could target profitable carriers with fines and fees in response to public outrage to the never-ending supply chain debacle. It’s not uncommon for the government to levy hefty fines on corporations the public deems as bad actors. One only needs to look at the penalties imposed on American tech giants for a recent example.

Under intense scrutiny from policymakers, retailers and consumers, pressure will mount for carriers to meet the International Maritime Organization (IMO) emission standards; via LNG, methanol, or both. But regardless of which fuel becomes the new standard, the new builds will still be forced to deliver into ports that lack sufficient workers, infrastructure and equipment. However, companies that have executed their multi-sourcing and nearshoring strategies might regain control of their supply chain by bypassing still-choked ports.

Although the above scenarios are based on the assumption that rates will continue to climb, proactive measures by carriers to help course-correct global supply chain woes will go a long way in preventing future blowback. Today, investments in remedies will help prevent the inevitable repercussions of shortsighted planning, including nearshoring, increased government regulations, and intense public scrutiny.