Argentina’s Grain Exports Could Jump 40%

“Argentina is on track to boost grain exports by 40% in 2024, recovering from last year’s drought which afflicted crops, but still below the 2019-2022 average. Climate patterns and government policy are shaping the outlook,” says Filipe Gouveia, Shipping Analyst at BIMCO.

El Niño has brought improved weather conditions for Argentina’s grain crops. The wheat harvest is nearly complete and estimated to be 20% larger than a year ago. Meanwhile, the favorable conditions continue to support the growing maize and soybean crops. Though exports should increase across the board, maize is expected to see the biggest boost. A 71% increase in maize exports is expected, equivalent to an additional 17 million tonnes in 2024.

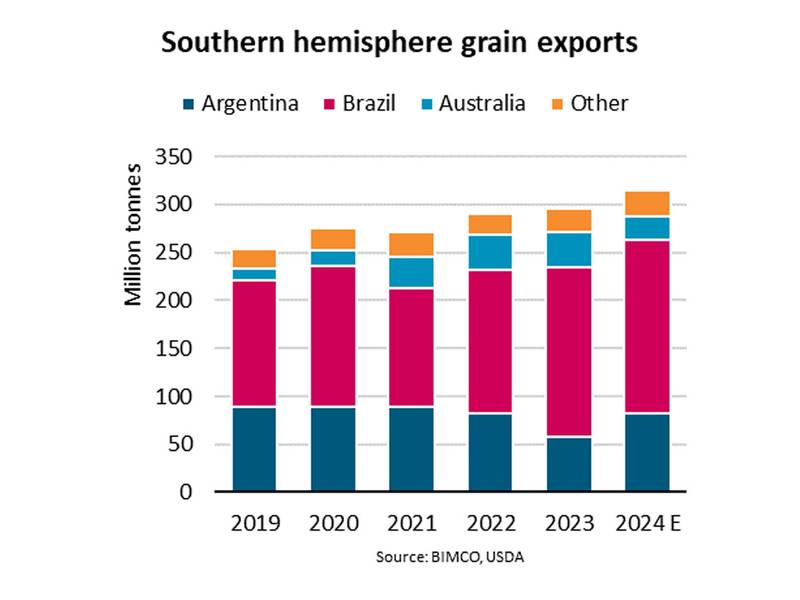

“In 2024, grain exports from the southern hemisphere could increase by 5-6%, driven by Argentina’s large harvests. This, paired with the above average sailing distances for Argentinian grain shipments, would support demand for ships in the panamax and supramax segments,” says Gouveia.

While El Niño has been favorable for Argentina, it has led to a weaker wheat harvest in Australia and mixed conditions in Brazil. In Brazil, the forecasts for maize and soybean harvests have been gradually revised downwards. Nonetheless, if conditions do not deteriorate further, Brazilian grain exports should remain stable in 2024 due to high soybean and maize inventories.

The National Oceanic and Atmospheric Administration estimates there is a 60% chance that El Niño will end during April-June 2024.

Under neutral conditions, weather conditions in Argentina are less favorable to grain harvests. As such, yields could be lower during next year’s harvests.

Argentina’s new president Javier Milei intends to increase export tariffs for maize and wheat from 12% to 15%. This is part of a set of emergency measures for the Argentinian economy to be discussed during the first quarter of 2024. Since most of this year’s grain has already been planted, this measure is unlikely to have a significant short-term effect on supply.

“In the medium term, higher tariffs could lead to lower grain exports as farmers might allocate less planting area to these crops. However, if approved, many expect this measure to be temporary and that Milei will pursue export friendly policies in the long run. In turn, this would allow Argentina’s grain exports to rebound to levels seen during 2019-2022,” says Gouveia.

Related News