Asia Dry Bulk-Capesize Rates to Hold Steady

Floor may have been reached on Western Australia-China rates; dry cargo demand could fall 5.4 pct in first quarter.

Freight rates for large capesize dry cargo vessels on key Asian routes are likely to hold around the current levels next week on ample tonnage supply even as chartering activity is likely to increase following the end of the Chinese New Year holidays.

"Some people think rates may have hit a floor in the Pacific," a Singapore-based capesize broker said on Thursday.

"At the moment there is no sign of a revival in rates. It really depends on the volume of cargo that comes out next week," the broker added.

Both the Atlantic and Pacific basins are well stocked with capesize vessels waiting for employment, the broker said.

"Rates in the Pacific are pretty flat with the last charter fixed at $4.90 per tonne. Nothing has been fixed for a while from Brazil," the broker said.

Freight rates on the route from Brazil to China are just below $8,000 per day, down 13 percent week-on-week, Norwegian ship broker Fearnley said in a note on Wednesday.

"The outlook for February/March Brazil loaders is not great," due to the large number of empty ships sailing towards Brazil," Fearnley added.

Charter rates on the Western Australia-to-China route for standard 180,000 deadweight tonne (DWT) capesize vessel are around $6,500 per day, down 20 percent from last week, Fearnley said.

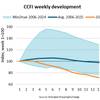

Dry cargo demand in the first quarter could contract by up to 5.4 percent in the first quarter compared with the fourth quarter 2016, said Peter Sand, chief shipping analyst with industry lobby group BIMCO quoting figures from ship broker SSY.

That will coincide with a flurry of new vessel deliveries with 5.3 million DWT delivered in January and 10.9 million DWT in Q1-2017, Sand said in a dry cargo report on Tuesday.

"For the coming months January-April, BIMCO expects vessel supply to outstrip demand and a level of loss-making freight rates will follow in its wake," Sand added.

Charter rates from Western Australia to China fell to $4.95 per tonne on Wednesday, the lowest since Oct. 27, from $5.19 per tonne last week.

Freight rates for the route from Brazil to China slipped to $12 per tonne on Wednesday against $12.45 per tonne the same day last week.

Charter rates for smaller panamax vessels for a north Pacific round-trip voyage eased to $5,600 per day on Wednesday from $5,625 per day a week earlier on lower cargo demand.

Rates in the Far East for supramax vessels were affected by slow chartering activity levels with charterers paying $4,000-$5,000 per day for ships to carry coal from Indonesia to China, brokers said.

The Baltic Exchange's main sea freight index fell to 786 on Wednesday, from 862 last week.

By Keith Wallis